Barely a week passes when Tether isn’t in the news. For a so-called stable coin, Tether and its acolyte Bitfinex are at the center of a lot of instability within the cryptoverse. After it emerged over the weekend that Tether had kissed goodbye to its auditor, critics of the opaque company began to wonder whether they would ever be granted a glance at the company’s books. Months of promises have ended with a whimper now that auditor Friedman LLP has exited stage left.

Also read: Vouching Bitfinex and Tether’s Bank Accounts Hold Nearly $3 Billion USD

Tether, Friedman, and the Audit That Never Was

The Tether story is like a children’s classic that’s been retold so many times as to obfuscate many seeds of truth. What is beyond dispute is that tethers – tokens with a fixed $1 value – are widely used as a means of surrogate fiat currency by millions of crypto traders and several major exchanges. Most people have no problem with this arrangement, nor do they dispute that Tether, and Bitfinex – the exchange whose owners hold a controlling stake in the company – is profitable.

With Coinbase recording $1 billion of revenue a year, Binance raking in $300 million and Coincheck instantly compensating victims of the $400 million NEM hack in Japanese yen, exchanges aren’t short of money. It is the secretive way in which Tether operates that has given grounds for concern. Last year, after lingering rumors that the company didn’t possess the USD to cover the USDTs it was merrily issuing, Tether reluctantly agreed to conduct a public audit. Traders waited for the report to be issued, but as delays mounted up, commenters ventured that the audit would never be published. It appears they were right.

All Talk, No Action

Friedman LLP has confirmed via a statement that its relationship with Tether has come to an end, but gave few specifics as to the reason behind the parting of ways, preferring to trot out platitudes about remaining “committed to the process”. The biggest fear would be for it to transpire that Tether lacks the USD to cover the USDT tokens it is readily issuing; as many as $500 million a week of them have been introduced to the crypto markets this year. But even if it emerged that Tether/Bitfinex had the assets but was issuing tethers without rhyme or reason, it would still be a red flag.

In theory, issuing batches of tethers in accordance with fiat currency deposits into a Tether bank account ought to be a straightforward. Conducting an audit of that process should also be a simple undertaking. The audit was announced back in May 2017 with talk of Friedman LLP conducting “a comprehensive balance sheet audit”.

“Given the excruciatingly detailed procedures Friedman was undertaking for the relatively simple balance sheet of Tether, it became clear that an audit would be unattainable in a reasonable time frame,” proffered Friedman on Saturday. The complexity of this task is widely disputed, not least by Tether’s most vocal critic.

Weighing Up the Need for a Balance Sheet

Most people aren’t as single-minded as prominent Tether critic Bitfinexed; they just want to know that everything’s in order and then they can go back to trading crypto with confidence that the rug’s not about to be swept from under their feet. It’s hard to tell what a Tether collapse or cessation of service would do to the markets, but it wouldn’t be pretty and the slump could last months. In the vacuum created by Tether’s awkward silence, stablecoin alternative Trusttoken has been touting itself as the natural successor.

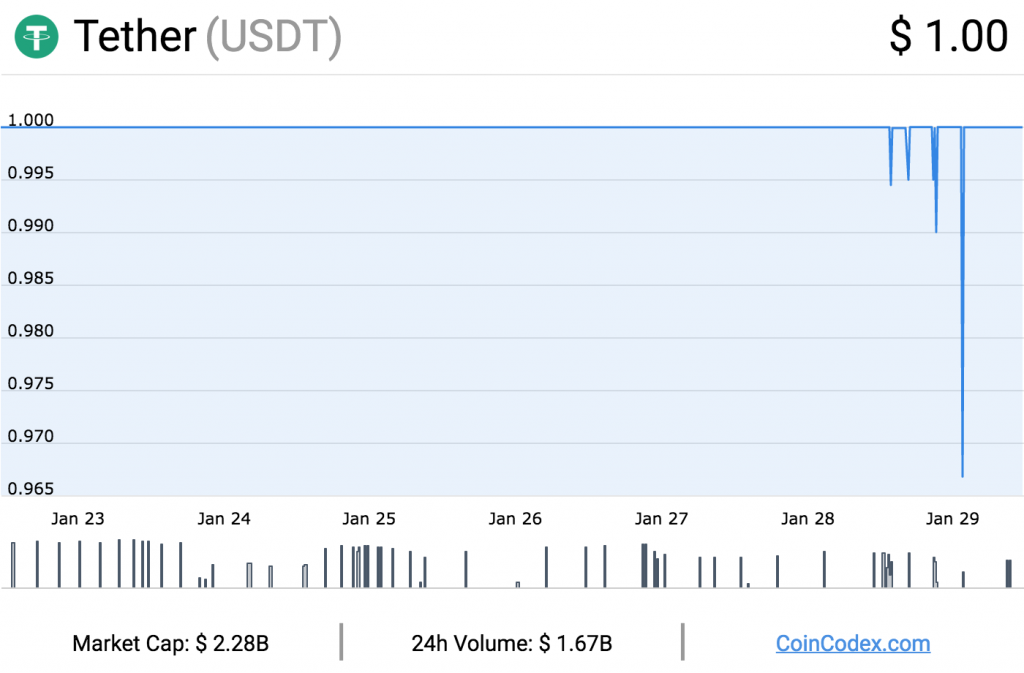

Some crypto-economists believe that the very concept of a stablecoin is unworkable and is destined to failure, whether due to government regulation or inability to maintain a stable price. Tether, for example, wobbles by around 2%, with buy orders for the token exceeding $1 during major bitcoin slumps, and dipping below $1 this weekend as the Friedman news broke. Whether Tether competitors can overcome these objectives remains to be seen. Given the uncertainty the Tether imbroglio has sown, any successive stablecoin will need to take great pains to ensure that its books are audited and transparency comes as standard.

Do you think Tether’s failure to provide an audit is cause for concern? Let us know in the comments section below.

Images courtesy of Shutterstock, and Coincodex.

Need to know the price of bitcoin? Check this chart.

The post Tether Severs Ties With Its Auditor, Leaving Its Accounts Shrouded in Mystery appeared first on Bitcoin News.