Tether Holdings, the firm that issues tether (USDT), has plans to launch an offshore Chinese yuan stablecoin called CNHT. Tether’s digital dollar presence within the crypto economy has been massive in recent months, seeing significant demand from China. Bitfinex shareholder Zhao Dong has explained in a recent interview that Tether is also preparing to launch stablecoins backed by bulk commodities like gold, rubber, and crude oil.

Also read: ERC20 Tether Transactions Flip Their Omni Equivalent

Tether Dominance in the East and Plans for a Digital Yuan Called CNHT

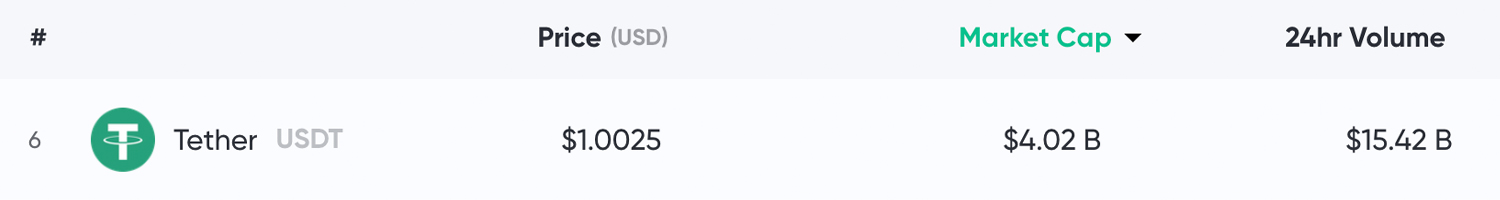

Bitfinex shareholder and over-the-counter (OTC) trader Zhao Dong has revealed that Tether is planning to launch a cryptocurrency backed by the Chinese renminbi. Tether has captured a market capitalization of over $4 billion to date. When the project first launched in beta in November 2014, the company said the flagship tether tokens would eventually represent three currencies: “UStether (US+) for United States dollars, Eurotether (EU+) for euros and Yentether (JP+) for Japanese yen.”

A great example of tether’s prevalence can be seen this week as most of the top 10 cryptocurrencies have dropped below their 200-day averages. Today, tether accounts for more than 75% of all BTC trades, 49% of ETH swaps, 40% for XRP, and 57% of all BCH trades. In July, cryptocurrency reporter Anna Baydakova discussed the demand for tether (USDT) with Chinese importers in Russia. According to Baydakova, the importers claim to be purchasing $30 million a day of tethers and between the Russian and Chinese border, USDT is the king of cryptos. The report detailed that prior to 2018, BTC was used by the importers, but since then they have switched over to utilizing the stablecoin.

“According to several Moscow OTC traders, it has at least one real-world use case – as the go-to remittance service for local Chinese importers,” Baydakova wrote at the end of July.

Not too long after Baydakova’s report on August 21, Zhao Dong discussed the possibility of a Tether product that represented an offshore yuan called CNHT. The prominent Bitfinex investor revealed the plan on the Chinese messenger and social media platform Wechat. Zhao Dong also claimed that when the stablecoin launches, his OTC business Renrenbit will support the newly minted CNHT. “Personally, I think the offshore yuan stablecoin could boost the circulation of offshore renminbi and internationalize it. Regulators may be happy to see it proceed and succeed,” he said on Wechat. Zhao Dong also told the publication Chainnews the same information in regard to Tether launching a digital renminbi.

Tether’s Multi-Chain Operation

The news follows the recent migration of tethers from Omni Layer to the Ethereum chain. Over the last week, ERC20-based tether transactions flipped their Omni equivalent and last month tether users paid $260,000 in ETH gas to push the ERC20 versions. On Thursday, there were 100,000 ERC20 tether transactions compared to the 39,000 Omni tether transactions. The Chinese yuan-backed tethers won’t be the company’s first time issuing another fiat stablecoin after the USD version. In August 2016, the firm started issuing euro-based tethers via Omni called EURT. At the time, the euro versions were traded on Omnidex against USDT and on other exchanges like Openledger and Coinsbank. Just like USDT’s current migration from Omni to Ethereum, Tether Holdings moved the EURT project to the Ethereum chain in January 2018. “Following the widespread success of our Bitcoin-based USD tether, issued via the Omni Layer Protocol, we have launched and issued both US Dollars and Euros as Ethereum-based Tether, compatible with the ERC20 standard,” the website tether.to explained.

The reason for the change over to the ERC20 standard was attributed to “much lower network transaction fees and much faster confirmation times (15-30 seconds) compared with tether on Omni.” As far as USD-backed tethers are concerned, there’s roughly 2.5 billion USDT on the Omni network and 1.5 billion USDT that use the Ethereum network. Additionally, between the EOS and Tron networks, there’s $350 million USDT circulating on both chains. Tether has also revealed USDT will be hosted on the Algorand platform and rumor has it tethers will also be used on Blockstream’s Liquid protocol. Today there’s approximately 4,008,269,411 USDT in existence and $15.42 billion in global trade volume. Tethers are currently the most traded cryptocurrency by volume worldwide.

Bulk Commodity Tethers and the PBOC Digital Renminbi

The expansion of Tether migrating coins from Omni to Ethereum, the continued issuance of tethers, and the current demand for the stablecoin is all happening while the New York Attorney General (NYAG) investigates the company. The NYAG office accused Tether and Bitfinex of losing millions of dollars worth of commingled corporate and customer funds. Ifinex, the two firms’ parent company, has called the allegations “misleading” and “inaccurate.” The crypto-based company also attempted to get the case discharged on the grounds of jurisdictional overreach, but so far Ifinex hasn’t been successful. Besides fiat-based tethers, the company is discussing the possibility of minting coins backed by bulk commodities according to a Bitkan interview with Zhao Dong. Tethers could be backed by commodities like gold, crude oil, and rubber the Bitfinex investor and Renrenbit founder said.

In the midst of Zhao Dong revealing the concept of bulk commodity backed tethers and an offshore digital renminbi, a senior official at the People’s Bank of China (PBOC) disclosed that the country’s state-backed cryptocurrency was “close to being out.” The PBOC coin could pose a problem for Tether if the Chinese government whimsically decides to ban the use of any fiat-backed tethers. Tethers may meet the same fate BTC saw in 2017, when the central bank and financial regulators put a stop to exchanges trading BTC against the yuan. Deputy director of the PBOC Mu Changchun told the press that the state-operated crypto was coming soon and said the offering would be a two-tier system. The first system the cryptocurrency will use will be tied to the central bank and the subset of smaller financial institutions below the PBOC. The second tier will be comprised of a system that distributes the digital yuan to the retail market. Rumor has it the PBOC crypto might be called “Globalcoin” and the Chinese digital fiat has a lot of similarities to Facebook’s Calibra project.

Because of the PBOC’s efforts, some digital currency proponents believe Tether’s creation of CNHT is not a good idea and could upset Chinese regulators. Founding partner at Primitive Crypto Dovey Wan said: “I don’t see enough demand for CNHT and alike, as local Chinese will still trade USDT with CNY, if it’s CNH it will be the same as USD — Not sure what’s the material upside of having CNHT for Tether, plus pissing off the Chinese regulator.” The founder of cryptocurrency trading platform Lbank had the same opinion. “This is a useless stupid effort — There’s no such demand from local traders, neither demand from overseas. It only enables trade between the Chinese yuan and U.S. dollar in the digital realm, while its issuer is not a Chinese firm,” Lbank’s He Wei commented.

What do you think about Tether issuing offshore digital yuan called CNHT? What do you think about the possibility of Tether minting tokens that represent bulk commodities like gold and crude oil? Let us know what you think about this subject in the comments section below.

Image credits: Shutterstock, Pixabay, markets.Bitcoin.com, Tether.to, and Wiki Commons.

You can now easily buy Bitcoin with a credit card. Visit our Purchase Bitcoin page where you can buy BCH and BTC securely, and keep your coins secure by storing them in our free Bitcoin mobile wallet.

The post Tether Plans to Mint Digital Yuan and Commodity Coins, Says Bitfinex Shareholder appeared first on Bitcoin News.