Tax regulations implemented even before dedicated legislation has been adopted have hit Brazilian cryptocurrency exchanges. Digital asset brokers failing to comply with the new reporting requirements face fines and the stricter rules are hurting smaller platforms, which are shutting down due to dwindling trading volumes.

Also read: Tax Agents ‘Confiscate’ Bitcoin From Criminal but Keep the Coins in His Wallet

Exchanges Struggle With Compliance Costs and Diminishing Returns

One of the affected exchanges, Acesso Bitcoin, points to the current situation created by the new regulations as the main reason for its decision to quit. “After the Federal Revenue Service introduced these rules we noticed a significant decrease in the traded volume,” said cofounder Pedro Nunes, quoted by the crypto news outlet Portal do Bitcoin. “We also feel that the market has cooled off for smaller exchanges,” he added.

Porto Alegre-headquartered Acesso Bitcoin recently advised clients on how to proceed with withdrawing their funds. Anyone who keeps bitcoin core (BTC) with the exchange should transfer the coins to a private wallet or another exchange. Customers who have balances in Brazilian real (BRL) can withdraw the money at any time in accordance with the terms and conditions that were applicable when the platform operated normally.

Latoex, formerly known as the São Paulo-based platform E-juno, is another cryptocurrency exchange that’s shutting down due to difficulties meeting the tax authority’s new requirements. Last week, the closure was confirmed by Diego Velasques, chief executive officer of Latoex Capital, the investment arm of the exchange which separated from the crypto trading platform in December.

Latoex (Latin America Token Exchange) is now looking to sell its assets to other companies and return remaining funds to its clients. The asset manager is also trying to reverse a suspension order issued by CVM, Brazil’s Securities and Exchange Commission, which threatened to impose a 100,000 Brazilian rial ($23,000) fine in case the group does not comply with its decision.

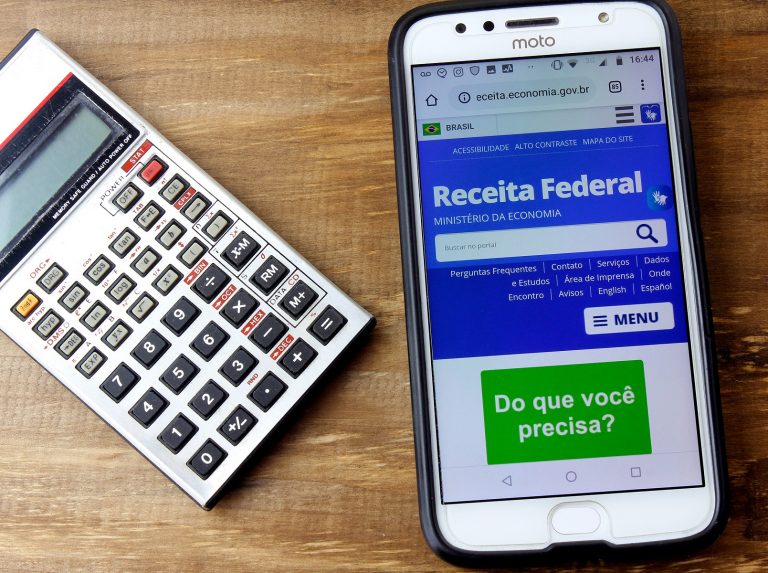

Brazil is yet to adopt legislation tailored to regulate the crypto space. In the absence of a dedicated law, interactions in the industry are now largely governed by Normative Instruction 1888 issued by Secretaria da Receita Federal do Brasil (RFB), the Department of Federal Revenue. The substatutory act was published in May and entered into force on Aug. 1, 2019.

According to the instruction, all transactions carried out through Brazilian crypto exchanges must be reported to the RFB, regardless of the amount traded. Noncompliant brokers and companies that present inaccurate information will be fined. Failure to file a monthly declaration would cost them between 500 and 1,500 rial ($350) per violation. But even without fines, compliance requires additional investments as the whole sector is trying to adapt to the new regulations.

Three Crypto Bills Stuck in the National Congress

Multiple proposals to comprehensively regulate the crypto industry and place it under the oversight of the Central Bank of Brazil have been filed in both houses of the country’s National Congress. The main draft so far, Bill 2303/2015 which was introduced to the Chamber of Deputies almost five years ago, was archived in 2018 and later placed back on the agenda in March 2019. A special commission has been appointed to analyze it and make revisions, if necessary.

Two other bills, PL 3825/2019 and PL 3949/2019, are currently under review in the Senate. Both aim to establish general rules for the cryptocurrency market with particular focus on implementing regulations for digital asset brokers and investor protection measures. No specific time frame has been set for the enactment of either of these pieces of legislation which are still subject to deliberation.

The new challenges for crypto companies in Brazil mirror some regulatory developments European businesses have to deal with. Stricter due diligence requirements were introduced in the EU with the bloc’s Fifth Anti-Money Laundering Directive (AMLD5) that member-states had to transpose into national law by Jan. 10, 2020. Several crypto startups have already closed down or relocated to other jurisdictions in order to preserve their business models and keep their customer base. The European Commission is still working on a comprehensive proposal to regulate crypto-related activities in the union.

What are your expectations about the future of crypto businesses in Brazil? Share your thoughts on the subject in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Images courtesy of Shutterstock, Acesso Bitcoin.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.

The post Tax Rules Hit Brazilian Crypto Exchanges, Forcing Trading Platforms Acesso Bitcoin and Latoex Out of Business appeared first on Bitcoin News.