Authorities in Poland have clarified the taxation of revenues received from cryptocurrency exchange transactions. The Ministry of Finance has recently published a 2019 tax form that has a dedicated section where taxpayers are expected to declare separately proceeds from crypto trading.

Also read: Mario Draghi Leaves European Central Bank Without Ever Raising Interest Rates

Polish Taxpayers to Declare Crypto-Related Income

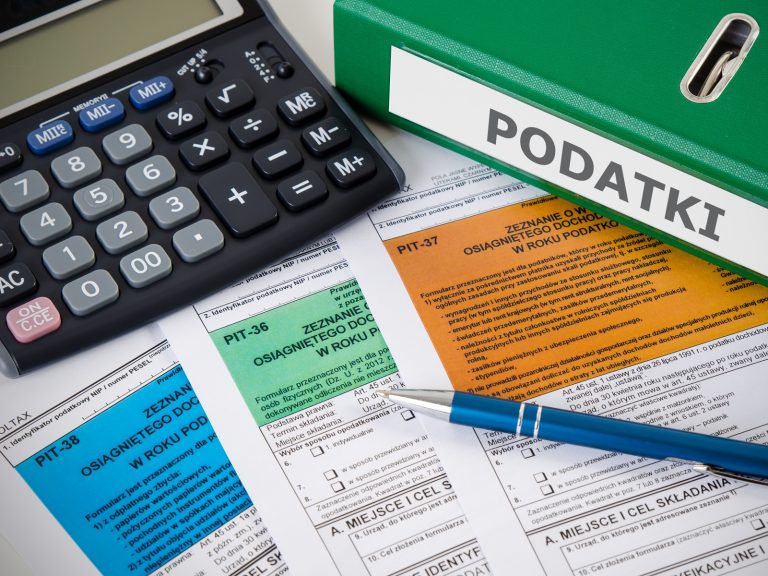

Ministerstwo Finansów unveiled this month the new PIT-38 (personal income tax) form which will simplify the reporting and settlement of taxes related to cryptocurrencies. The form will be used by private individuals residing in Poland. The country’s finance ministry claims it will make crypto taxation easier and more transparent.

The updated form allows Polish taxpayers to enter proceeds from the sale of virtual currencies and provide data about the costs of acquiring digital coins and tokens. Investment costs from consecutive years can be added until they are fully deducted. However, no deduction should be claimed from other sources of income such as the sale of shares.

To properly report their profit from cryptocurrency trading, Poles need to obtain and provide financial statements from the digital asset exchanges they have used to purchase and sell the coins, Polish news outlet Kryptowaluty detailed.

Efforts to Regulate Crypto Taxation in Poland

The executive power in Warsaw has been taking steps to regulate the taxation of proceeds received from cryptocurrency trading since last year. The framework that has been developed and implemented since the beginning of 2019 covers personal as well as corporate income tax.

In the first case, profits from digital asset trading should be taxed as income from cash capital. If the trading is private, the revenue is classified as income from property rights and taxed according to the regular progressive scale with rates between 18% and 32%. If the profit comes from a business activity, the income may be subject to a 19% flat rate.

Revenues from trading conducted by corporate entities are regarded as capital gains. The base rate paid by larger companies is again 19%. Smaller corporate taxpayers enjoy a preferential rate which was 15% in 2018.

Since January 2019, however, entities reporting revenues of up to €1.2 million within a tax year and startups established this year will pay only 9% income tax if they meet certain conditions. The “small taxpayer” threshold will be increased to €2 million in January 2020.

The new tax regime for crypto trading does not concern entities registered and operating as providers of cryptocurrency exchange services. That includes crypto-to-crypto trading platforms as well as those exchanging decentralized digital money such as bitcoin cash (BCH) with traditional fiat currency like the Polish zloty.

What’s your opinion about the tax rates for crypto trading income in Poland? Tell us in the comments section below.

Images courtesy of Shutterstock.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.

The post Tax Form to Report Revenues From Cryptocurrency Trading Issued in Poland appeared first on Bitcoin News.