The director of the South Korean Financial Supervisory Service has announced that the government will support “normal” transactions of cryptocurrencies. Acknowledging that most crypto exchanges are having problems obtaining virtual accounts, he promises to encourage banks to work with them.

Also read: Indians Look to Buy Bitcoin Overseas as Regulations Tighten

Supporting ‘Normal’ Crypto Transactions

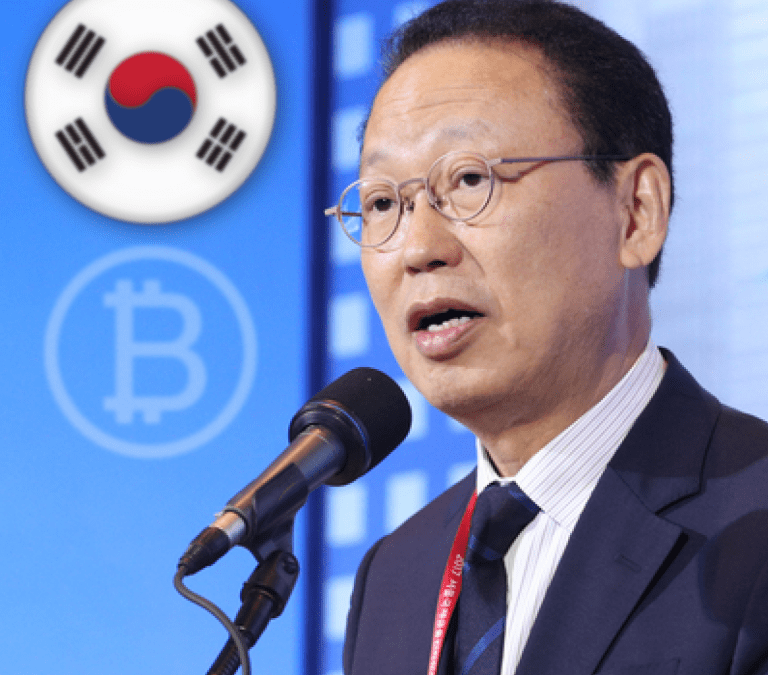

The director of South Korea’s Financial Supervisory Service (FSS), Choi Heung-sik, said at a press conference on Tuesday, as reported by Yonhap:

The government will support ‘normal transactions’ of cryptocurrencies.

The Korea Times further quoted him elaborating, “The whole world is in the process of reconsidering to find a framework for virtual currency, and that we should make it a normal transaction instead of strengthening regulations.”

Choi’s latest announcement contrasts his earlier stance when he called for strict regulations, stating that “bitcoin will lose its bubble later. You can bet.” Shocked by the regulator’s statement, a South Korean citizen filed a petition with the Blue House, calling for the dismissal of Choi as the director of the FSS. The petition, which ended on January 27, had 40,149 signatures. According to the rule of the Blue House, a petition needs 200,000 signers for the government to answer.

Helping Small and Medium-Sized Exchanges

Prior to his Tuesday announcement, Choi held a meeting with the Korean Blockchain Association and representatives from local cryptocurrency exchanges, including the chairman of the Association’s self-regulatory committee, Yonhap described.

It has been three weeks since the regulators enforced the real-name system at exchanges and ended the use of virtual accounts that allowed for anonymous cryptocurrency trading.

It has been three weeks since the regulators enforced the real-name system at exchanges and ended the use of virtual accounts that allowed for anonymous cryptocurrency trading.

However, since the implementation of the new system, banks have only been issuing new virtual accounts for the country’s top four exchanges: Upbit, Bithumb, Coinone, and Korbit. They are reluctant to issue virtual accounts for small and medium-sized crypto exchanges.

Frustrated with the inability to obtain virtual accounts, twelve small and medium-sized exchanges reportedly sent a letter to the Blockchain Association on Monday, calling for a meeting to discuss how to deal with this problem, Biz Net Times reported. An official of a small and medium-sized exchange was quoted saying:

When I joined the Association in the first place, I understood that if I adhered to the guidelines, I could get virtual accounts at the bank.

At the end of last month, 25 crypto exchanges had joined the Association for this purpose. Unable to obtain virtual accounts, these exchanges have had to either stop fiat deposit services or keep using corporate accounts for crypto transactions – a practice the Korean regulators clamp down on to avoid money laundering.

Banks Encouraged to Work with Crypto Exchanges

The government has repeatedly said that banks have “sufficient systems [and] could freely open a virtual currency real name account,” Yonhap conveyed.

Major Korean banks Shinhan, Nonghyup, and the Industrial Bank of Korea are already doing business with four cryptocurrency exchanges, Choi noted, adding that “they should do more,” Money Today reported. He further emphasized that three other banks, including KB Kookmin Bank and KEB Hana Bank, have also set up a real-name trading system. However, they are not yet issuing accounts for crypto exchanges.

Acknowledging the problem small and medium-sized exchanges are facing, Choi emphasized, “I will encourage KB Kookmin Bank and KEB Hana Bank to deal with virtual currency handling businesses.” He was further quoted by Yonhap saying:

The government will ‘encourage’ banks to make transactions with cryptocurrency exchanges.

What do you think of the Korean regulator’s announcement? Let us know in the comments section below.

Images courtesy of Shutterstock, Money Today, and Yonhap.

Need to calculate your bitcoin holdings? Check our tools section.

The post South Korean Regulator Supports ‘Normal’ Cryptocurrency Transactions appeared first on Bitcoin News.