The South Korean National Pension Fund has been indirectly investing billions of won in cryptocurrency exchanges such as Upbit, Bithumb, and Korbit. This was revealed amid the country’s regulators continually releasing regulatory measures for cryptocurrencies.

Also read: South Korean Officials Caught Trading On Insider Knowledge of Crypto Regulations

Investments In Crypto Exchanges

Amid South Korean regulators pushing to regulate the country’s cryptocurrency market and the Ministry of Justice drafting a bill to ban crypto trading, local media report that the country’s National Pension Service (NPS) has been indirectly investing in cryptocurrency exchanges.

Amid South Korean regulators pushing to regulate the country’s cryptocurrency market and the Ministry of Justice drafting a bill to ban crypto trading, local media report that the country’s National Pension Service (NPS) has been indirectly investing in cryptocurrency exchanges.

South Korea’s NPS is the world’s third-largest pension fund. It was established in 1987 to “help secure the retirement benefits of Korean citizens with income security, thereby promoting national welfare in the case of retirement, disability or death,” its website states.

Lee Chan-yeol, an NPS officer, was quoted by News1 on Thursday:

The National Pension Fund invested 2.6 billion won in four cryptocurrency exchanges through two venture capital funds.

The first fund invests in the operators of Upbit and Coinplug, Newsis detailed. The second fund invests in the operators of Korbit and Bithumb.

Government’s Warning

The Korean government has also been discouraging small and medium-sized funds from investing in companies operating cryptocurrency exchanges. According to Yonhap, there are approximately 700 medium-sized funds registered in the country, but only 28 of them invest in cryptocurrency exchange operators. These funds are operated by 16 venture capital firms.

The Korean government has also been discouraging small and medium-sized funds from investing in companies operating cryptocurrency exchanges. According to Yonhap, there are approximately 700 medium-sized funds registered in the country, but only 28 of them invest in cryptocurrency exchange operators. These funds are operated by 16 venture capital firms.

The Ministry of Strategy and Finance issued an official notice last week confirming that “The investment amount of 41.2 billion won [~USD$38.7] million is the total amount invested by the 16 venture investment firms in the virtual currency market.” The ministry then warned that “It is inappropriate for the 16 investment ventures to invest in the 28 venture funds.”

The Korean National Pension Fund

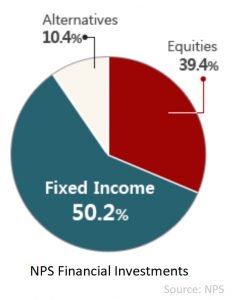

The NPS website states that the entire National Pension Fund “is valued at approximately KRW 618 trillion as of the end of October 2017.”

The NPS website states that the entire National Pension Fund “is valued at approximately KRW 618 trillion as of the end of October 2017.”

According to an NPS officer, many institutions invest in the same funds the Pension Fund invests in and fund managers have “an exclusive right to make investment decisions,” not the NPS.

Recently, the regulators released their cryptocurrency measures as well as anti-money laundering guidelines. They are in the process of overseeing banks converting from the current virtual account system into a real-name system which is expected to be implemented on January 30.

What do you think of the Korean National Pension Service indirectly investing in cryptocurrency exchanges? Let us know in the comments section below.

Images courtesy of Shutterstock and the NPS.

Need to calculate your bitcoin holdings? Check our tools section.

The post South Korean National Pension Fund Indirectly Invests In Crypto Exchanges appeared first on Bitcoin News.