South Korea’s top financial regulators have jointly announced their plans to deal with digital currencies such as bitcoin and ether. Specific measures were outlined such as requiring banks to perform due diligence on bitcoin exchanges and strengthening user verification procedures.

Also read: South Korea Legalizes Bitcoin International Transfers, Challenging Traditional Banks

Attempt to Regulate Digital Currency

The South Korean Financial Services Commission (FSC), announced on September 3 how they would deal with digital currencies such as bitcoin and ether, according to local publications.

Korea is “joining Japan, China and other Asian nations in trying to regulate cryptocurrencies,” reported Yonhap, adding that digital currencies are currently not recognized as financial products and their exchanges are largely unregulated.

Korea is “joining Japan, China and other Asian nations in trying to regulate cryptocurrencies,” reported Yonhap, adding that digital currencies are currently not recognized as financial products and their exchanges are largely unregulated.

Noting that the recent transaction volume and volatility of digital currencies are “excessive,” the FSC conveyed that “it will step up monitoring and carry out probes into money laundering, unauthorized financing and other illicit transactions of digital currencies,” the news outlet detailed. The state regulator was then quoted saying:

There is a need for the government to cope with the virtual currencies to prevent them from being used as tools for crimes and simple speculative investment.

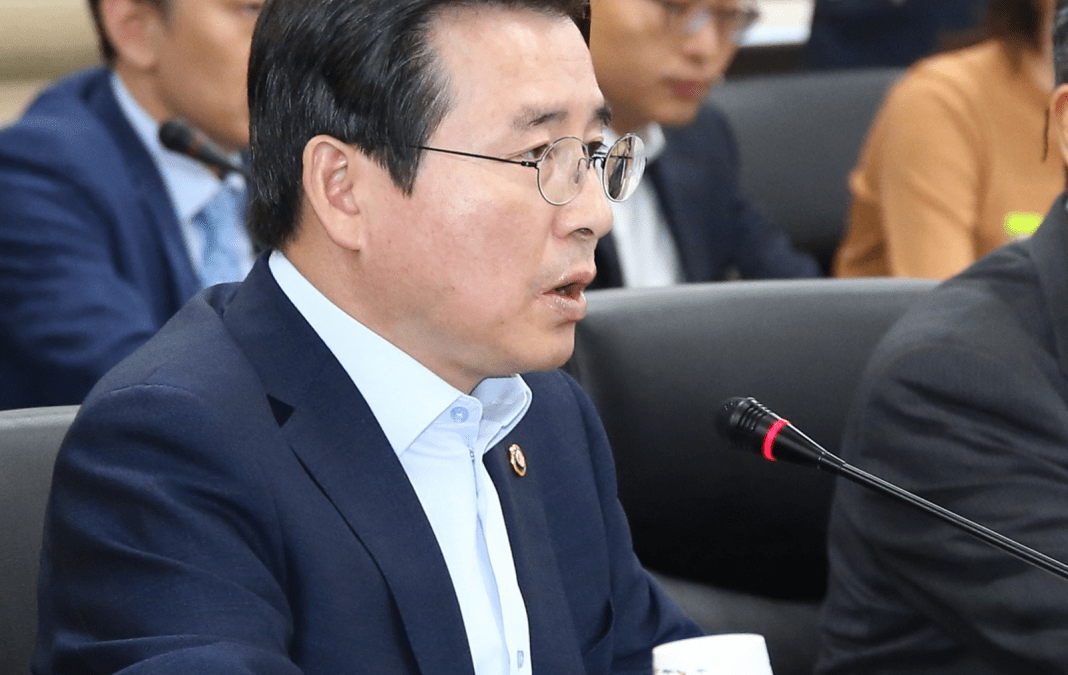

Sunday’s announcement followed a joint task force meeting chaired by FSC secretary-general Kim Yong-beom. “At this point, digital currencies cannot be considered money and currency not financial products,” Business Korea reported him saying.

The meeting was attended by officials from the FSC, the Ministry of Strategy and Finance, the Fair Trade Commission, the Ministry of Justice, the Korea Communications Commission, the National Tax Service, the National Police Agency, the Bank of Korea, the Financial Supervisory Service and the Korea Internet & Security Agency, according to iNews24.

Specific Measures

One of the measures discussed is to strengthen identity verification procedures. “Banks will be required to strictly check the personal information of people who work at digital currency exchanges,” Yonhap reported the FSC explaining. “If there are suspicious transactions in such bank accounts, lenders will be required to report the transactions to authorities.”

Banks that deal with digital currency exchanges will conduct due diligence to ensure that the exchanges have effective internal control procedures such as the identification of users. The banks will consider suspending their accounts if they cannot provide reliable information, elaborated iNews24.

Banks that deal with digital currency exchanges will conduct due diligence to ensure that the exchanges have effective internal control procedures such as the identification of users. The banks will consider suspending their accounts if they cannot provide reliable information, elaborated iNews24.

Remittance businesses using digital currency are also affected. News.Bitcoin.com recently reported on the Korean government legalizing foreign exchange transfers using cryptocurrency for small sums. In Sunday’s announcement, the FSC detailed that these small remittance operators “will report their daily transfer records to the Bank of Korea,” Yonhap clarified.

Digital Currency Market & ICOs

Meanwhile, the country’s largest bitcoin exchange Bithumb reported that its daily trading volume on August 18 exceeded 2.6 trillion won (approximately $2.3 billion). This was more than the trading value of Kosdaq market, which was 2.43 trillion won the day before, according to Hankyoreh daily newspaper. Kosdaq is the Korean counterpart of Nasdaq. “It was one-off, but enough to shock the financial market,” the publication detailed.

The FSC’s announcement came one month after lawmaker Park Yong-jin submitted a proposed amendment to the Electronic Financial Transaction Act to provide a regulatory framework for digital currency such as bitcoin.

The FSC’s announcement came one month after lawmaker Park Yong-jin submitted a proposed amendment to the Electronic Financial Transaction Act to provide a regulatory framework for digital currency such as bitcoin.

In addition, the FSC revealed that “they will punish Initial Coin Offering (ICO) that raises funds in the form of stock issuance using digital currencies permitted in some countries, including Switzerland, for violating the capital market act,” Business Korea elaborated.

What do you think of the Korean government’s attempt to regulate bitcoin? Let us know in the comments section below.

Images courtesy of Shutterstock and Yonhap

Need to calculate your bitcoin holdings? Check our tools section.