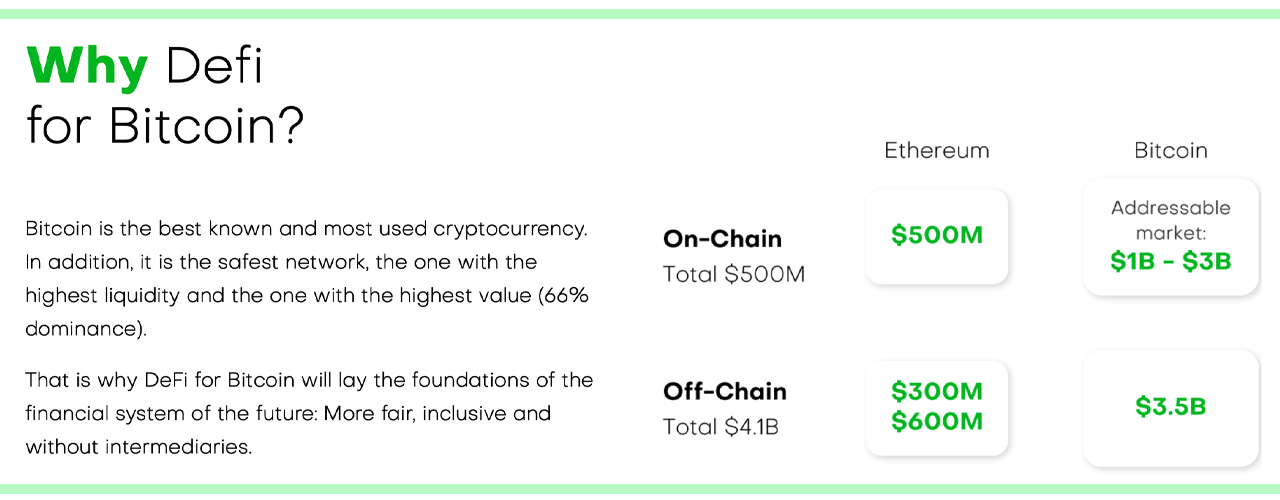

During the last year, Ethereum has dominated the decentralized finance (defi) ecosystem but a number of other blockchain projects plan to join the fray. The second layer, smart contract protocol RSK aims to bring the defi demand to the Bitcoin blockchain and there’s already a few RSK-based defi projects in the wild.

In the world of defi, users leverage applications that delegate traditional finance concepts like issuing assets, lending, borrowing, trading, and earning interest in a noncustodial manner. Crypto proponents have certainly noticed the creative and sometimes highly experimental defi projects hosted on the Ethereum blockchain.

2020 has also undoubtedly highlighted the defi trend’s successes and interesting blunders. With all the money flowing into these projects, there’s no doubt that other blockchains want a piece of the defi pie and RSK is attempting to grab the reins.

RSK is an open source platform that allows for smart contracts secured by the Bitcoin (BTC) network. The process is achieved by merge-mining as the RSK network is mined by BTC miners representing 52 exahash (EH/s) of hashrate.

While visiting RSK’s developers page, the website advertises “defi for bitcoin” and highlights a number of developing projects. For instance, RSK allows for stablecoins, and the projects Money on Chain and RIF both allow for collateralized tokens.

Lending, borrowing, and liquidity concepts from the RSK network are leveraged by trading platforms like Huobi, Liquid, and Coinswitch. RSK introduced its token bridge on February 6, 2020, and the protocol allows for cross-chain interoperability between RSK and Ethereum.

Similar to Uniswap, the RSK developers recently announced the decentralized exchange (dex) Rskswap. Essentially, Rskswap users can leverage the automated market maker (AMM) to swap ERC20 tokens and provide liquidity. “Any ERC20 token can be listed on Rskswap,” the platform’s creators state.

“No permission is required. Each token has its own smart contract and liquidity pool. If there is none, it can be created easily. Once a token has its own exchange smart contract and liquidity pool, anyone can trade the token or contribute to the liquidity pool while earning a liquidity provider fee of 0.3%,” the Rskswap announcement detailed.

The platform Rskswap is clearly a fork of the Uniswap protocol, and the website explains this on the Rskswap home page.

RSK also has tokenized bitcoin (BTC) called RBTC and the RSK explorer notes there are 338 RBTC ($3.6 million) locked into the system to-date. RBTC can be leveraged on defi apps like the Rskswap platform and serve as collateral for loans and pegging schemes like the RIF Dollar.

A number of bitcoiners are excited to see what RSK will bring to the bitcoin-fuelled defi space and the sophisticated use cases RSK smart contracts will offer. RSK smart contracts are also being leveraged by the California Energy Commission used in a carbon-credit trading pilot.

What do you think about RSK’s attempt to bring defi to the Bitcoin network? Let us know what you think in the comments section below.

The post Smart Contract Protocol RSK Attempts to Bring Defi to the Bitcoin Network appeared first on Bitcoin News.