So you’ve created a Coinbase account, bought your first fraction of a bitcoin and followed up with half a litecoin. You’re now ready to become a cryptocurrency trader. You fire the lot over to an exchange where the first coin you purchase shoots up by 10% before you sell, smug in the knowledge that you’ve made it. Thanks to an inspired strategy of “Buy low, sell high”, you’re going all the way: the blue tick Twitter account, the audience of newbs hanging on your every call and the obligatory meme car in the driveway. It was all shaping up so well, until you went and committed one of the following rookie mistakes…

Also read: Russian Reports Say Crypto Entrepreneur Pavel Lerner Kidnapped in Kiev

Trading’s Deadliest Sins

The following advice will be sneered at by more seasoned traders, but hand on heart, who can say they have never committed any of the following? The mark of a great trader lies in their ability to learn from their rookie mistakes. To become great, first you must become humble, and there’s nothing more humbling than buying a pumped cryptocurrency at the top, bragging about the sick gains you’re about to make and then getting rekt.

Chasing P&Ds

Watching a vertical green candle shoot skyward is one of the most pleasurable sights a trader can see – provided you bought at the bottom. If you don’t have a horse in the race, however, the envy can be overwhelming. It’s all too easy to FOMO hard and pile in with everything you’ve got. Occasionally it’ll pay off; more often than not it’ll leave you in a fetal position on the floor.

A cryptocurrency suddenly rocketing in price isn’t always a sign of a pump and dump scheme in place; positive news or promotion by a major influencer can also cause it to soar. It’s important to understand why a coin is rapidly rising though before you buy in. Otherwise you risk getting rekt. Many novice cryptocurrency traders experiment with pump and dump groups that promise instant profits with zero effort. After getting burnt once or twice, most are shrewd enough to learn their lesson and pursue smarter trading strategies.

Buying Into Illiquid Markets

For your coin to go up in price, it needs to have someone else willing to buy it. The trouble with many emerging altcoins and many small exchanges is that they have extremely small order books. You may be convinced that Sprouts (SPRTS) is the future of cryptocurrency, but unless enough other traders share that sentiment, you risk being lumped with a coin that no one is willing to buy, or at least not at the price you’re seeking.

There’s nothing wrong with buying a coin whose fundamentals you admire as a long-term hodl. In the short-term, however, these ‘undiscovered gems’ are susceptible to a lack of liquidity. Impatient traders, bored of waiting for the coin to rise, may be forced to sell for substantially less than they had hoped.

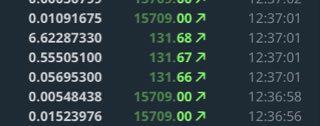

Setting the Wrong Price

Hands up if you’ve ever misread a zero when setting up a trade, set your sell order 10x too low and had your coins gleefully snapped up? When you’re dealing with altcoins that are priced in fractions of a bitcoin, it’s an easy mistake to make: you think you’re setting a sell order for 0.0000457 BTC only to discover that you actually placed it at 0.00000457. Most exchanges will fill your order for the highest bid on the orderbook at the time, sparing your blushes. Some sites, however, such as Etherdelta, aren’t so accommodating. Always double-check the buy or sell price you’re setting before you hit the execute button.

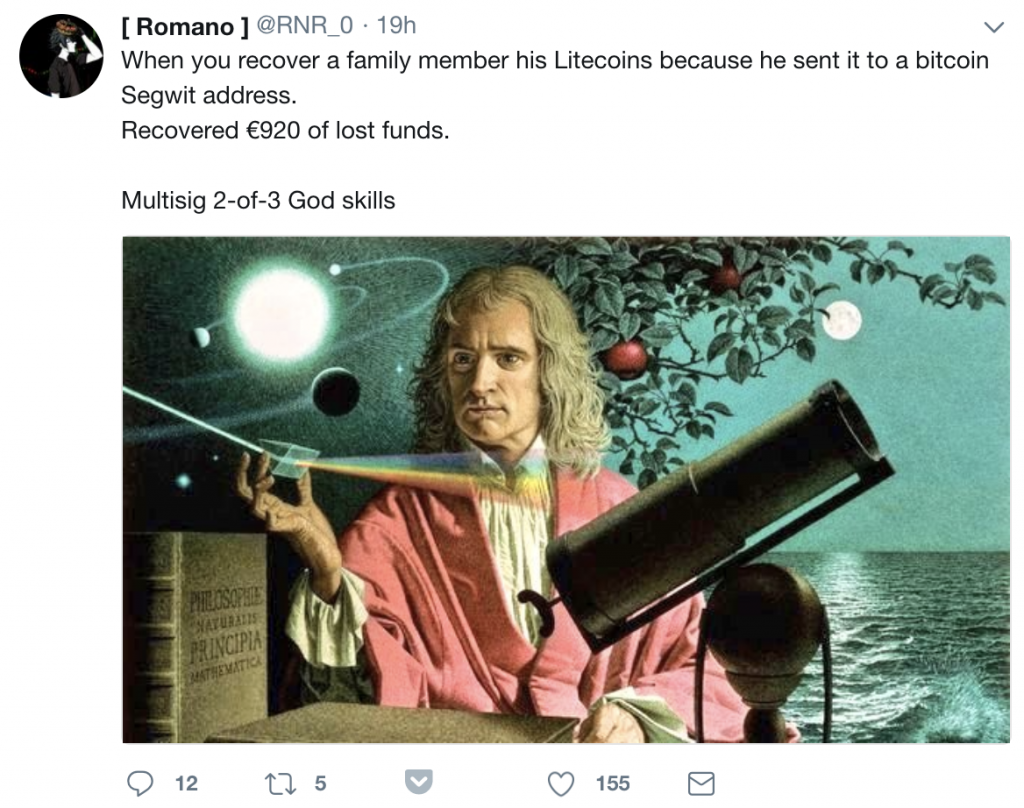

Sending the Wrong Coin to an Exchange Wallet

If you’ve mistakenly sent bitcoin cash to a bitcoin wallet, don’t bank on your exchange bailing you out. Some will, but the larger exchanges are unlikely to ride to the rescue. It’s your responsibility to check before sending funds to an exchange wallet, as mistakes are almost impossible to rectify. Other rookie mistakes include sending ethereum tokens to an ethereum exchange wallet, or requesting mining pool rewards be paid straight to an exchange. Don’t do that.

Revenge Trading

You’re pissed because you backed out of buying a coin at the last moment and it then mooned. Or you bought a dead cert – an absolute banker – and it flopped. Angry, you pile everything you’ve got into the next coin in the green and try to ride that train to Profitville. In doing so, you’re overexposing yourself and entering a market that you have failed to research.

What are your entry and exit positions? Why is the coin rising in value? You have no idea, because you’re acting on raw emotions. Revenge trading is the equivalent to catching your partner in the arms of another and then blindly throwing yourself at the first thing you can find to ‘even the score’. 9 times out of 10 it’ll all end in tears. The more you can disassociate your emotions from your trading, the better you’ll become.

Overtrading

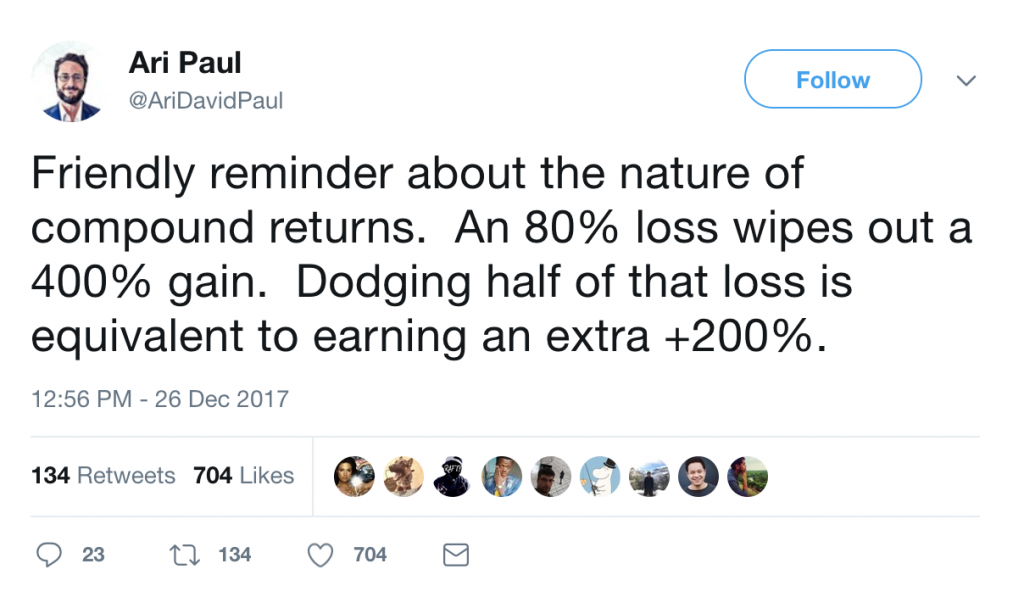

Just as too many cooks spoil the broth, too many trades spoil your gains. It’s an easy trap to fall into, and one that every novice trader makes. You buy a coin and wake up the next day to find it’s risen by 20%. Better sell, right, and cash in your profit? Not necessarily. As the mantra goes “Cut your losses and let your winners run”.

Selling an asset simply because it is in profit is a simplistic trading strategy that’s liable to rob you of some of your greatest gains. There’s nothing more frustrating than selling a coin at a modest profit only to watch it appreciate 10x. Overtrading to collect minuscule gains will also see an increasing amount of your assets eaten up by exchange fees.

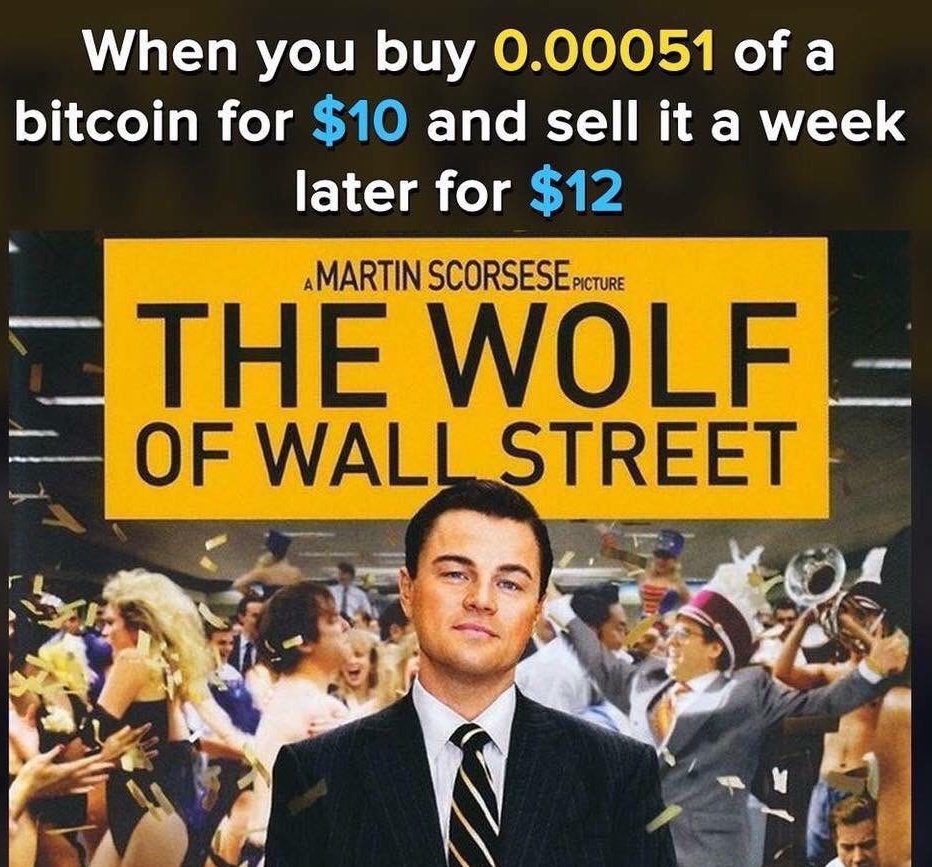

Overconfidence

On a hunch, you buy a coin and watch it double in price over the course of the next week. You repeat the process with another coin and the same thing happens. You are the bomb. You’re the man. Everything you touch turns to gold. On a roll, you pile into your next pick, which you can just sense is ready to moon. And then…and then it dumps. What happened? You got cocky, that’s what.

A little self-belief is healthy; it’s what empowers traders to go against the flow and make their own decisions. Overconfidence, on the other hand, is a surefire recipe for disaster. That’s when you disregard the warning signs, buoyed by a sense of invincibility.

Eliminating these seven deadly mistakes doesn’t mean you qualify as a professional cryptocurrency trader; that’s still years away, characterized by late nights and early mornings spent staring at screens and mastering charts. Cut out the rookie errors though and you might just survive long enough to become a pro.

What other trading mistakes do rookies make? Let us know in the comments section below.

Images courtesy of Shutterstock.

Bitcoin Games is a provably fair gaming site with 99% or better expected returns. Try it out here.

The post Seven Deadly Trading Mistakes Every Rookie Makes appeared first on Bitcoin News.