On September 15, after a couple of Chinese cryptocurrency exchanges announced they were closing, bitcoin’s price dropped to a low of $2,970. Following this dip, BTC trade volumes began to surge as the price per bitcoin rose over $600 in less than an hour and during the course of the afternoon bounced back to a high of $3,820. Now the price of bitcoin is rocketing upwards again as it surpassed the $4K zone just three days later.

Also read: Japan’s FSA Approves Coincheck’s Bitcoin Exchange License

Bitcoin’s Monumental September 15 Rebound

Bitcoin’s price has been wavering between $4,050-4,095 during the past 6-hours. ‘Fear of missing out’ (FOMO) is real, and this may be part of the reason why cryptocurrency markets bounced back after suffering from 30-40 percent losses from the other day. Cryptocurrency enthusiasts called it a ‘flash sale’ and many bitcoiners were pleased to get a chance to ‘buy the dip.’ After bitcoin’s value fell below the $3K range, the ‘sale’ didn’t last long as buyers scurried frantically to get some cheaper BTC and altcoins.

Bitcoin’s price has been wavering between $4,050-4,095 during the past 6-hours. ‘Fear of missing out’ (FOMO) is real, and this may be part of the reason why cryptocurrency markets bounced back after suffering from 30-40 percent losses from the other day. Cryptocurrency enthusiasts called it a ‘flash sale’ and many bitcoiners were pleased to get a chance to ‘buy the dip.’ After bitcoin’s value fell below the $3K range, the ‘sale’ didn’t last long as buyers scurried frantically to get some cheaper BTC and altcoins.

Among all the ‘flash sale madness,’ there are definitely people who sold or had positions that were liquidated. After BTCC first announced closing operations, bitcoin’s price dropped from the $3800 range, stopping at several key territories and then finally dropped below $3K. In these moments, lots of people likely ‘new’ to the trading atmosphere ‘panic sold’ all the way down the line. After September 15, the bitcoin price bottomed out at $2,970, and things suddenly changed gears, when an enormous amount of buying took place. BTC’s value gradually pushed back up to the $3,800 territory during the course of the day.

Among all the ‘flash sale madness,’ there are definitely people who sold or had positions that were liquidated. After BTCC first announced closing operations, bitcoin’s price dropped from the $3800 range, stopping at several key territories and then finally dropped below $3K. In these moments, lots of people likely ‘new’ to the trading atmosphere ‘panic sold’ all the way down the line. After September 15, the bitcoin price bottomed out at $2,970, and things suddenly changed gears, when an enormous amount of buying took place. BTC’s value gradually pushed back up to the $3,800 territory during the course of the day.

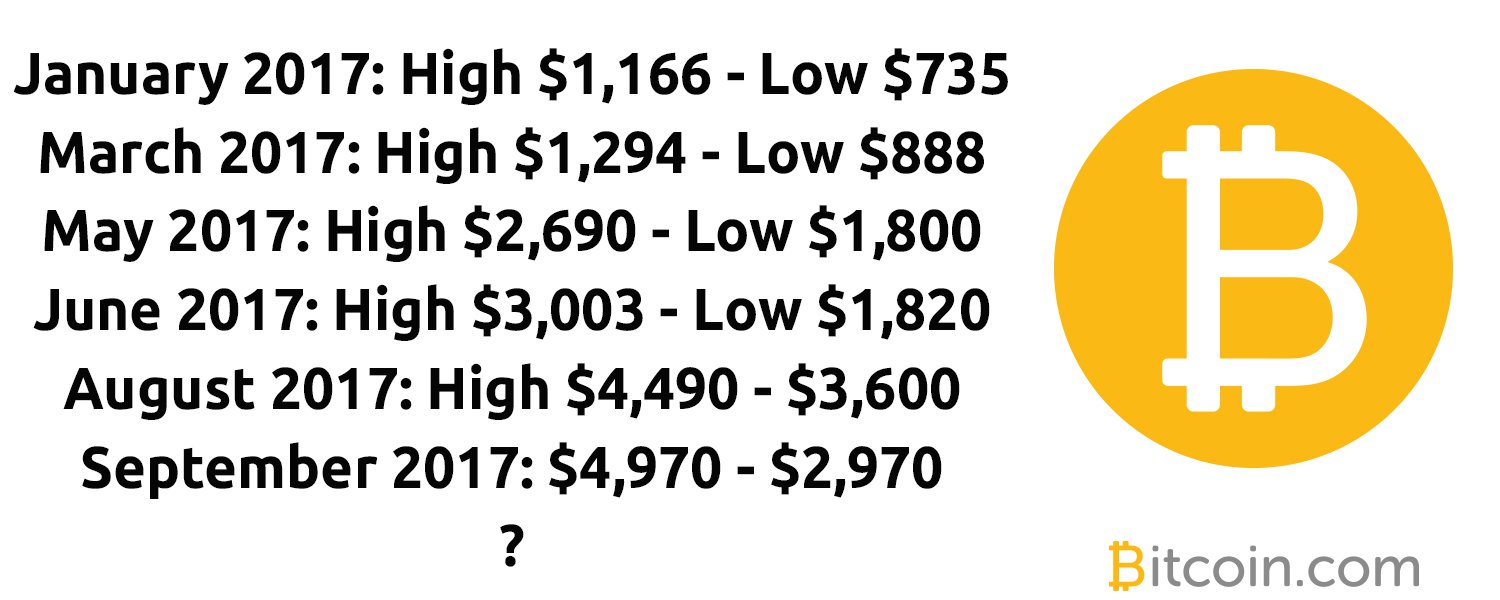

Bitcoin Dips This Year Have Followed a Consistent Pattern

Taders who were able to sell at the top and buy back in at the bottom made off with profits like bandits. Even though bitcoin’s price took a hit, lots of money was made that day. The signs of the market shifting down existed after litecoin creator, Charlie Lee, detailed a certain exchange in China would announce its closing. Traders also know that when the trouble began brewing back in January between China’s central bank and bitcoin exchanges, bitcoin’s price dipped 37 percent from a $1166 high to a low of $735. Of course, these individuals also remember BTC rallied to $1,300 following the Chinese fiasco in March and spiked to $2,690 in May. Let’s just say each significant BTC correction is followed by a slower but much larger rally upwards.

Now traders also know that the rebound that’s taken place this September could very well be a ‘bull trap’ or a ‘dead cat bounce.’ However, this is also when ‘FOMO’ sets in, and we don’t know if the bearish trend will continue, or if bitcoin’s value will blast off higher from here. Some traders in various forums like the Whale Club Telegram chat say that another drop below sub-$3K territory is coming, while others confidently stated; “you will never see bitcoin below $3K again.”

Just three days later bitcoin has once again pushed the bearish market sentiment aside as it now is coasting above the $4K range. The moral of the story is; “you gotta know when to hold em’ and when to fold em,’” if you are trying to make profits daytrading bitcoin. Otherwise, ‘hodl’ your digital assets and learn to ride out the storm. 🙂

What did you think about the September 15th bitcoin market rebound? Let us know in the comments below.

Images via Shutterstock, Bitcoin Wisdom, and Pixabay.

Do you agree with us that Bitcoin is the best invention since sliced bread? Thought so. That’s why we are building this online universe revolving around anything and everything Bitcoin. We have a forum. And a bitcoin casino, a mining pool, and real-time price statistics.