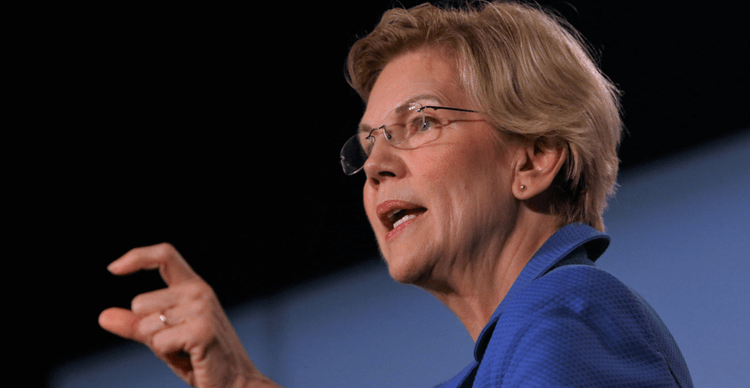

The remarks from the crypto-sceptic Senator come just a day after she wrote to the Treasury Secretary calling for more action against ‘growing threats’ in the crypto sector

Senator Elizabeth Warren wrote to the Secretary of the Treasury Janet Yellen on Tuesday, asking her to use her positional power to implement more regulations on crypto. Warren hit out at cryptocurrencies saying they posed dangers to the environment and the public because of poor regulation in the industry. She explained that “comprehensive and coordinated” rules would help manage the risks associated with crypto and thus protect the consumer and the financial system.

“FSOC must act quickly to use its statutory authority to address cryptocurrencies’ risks and regulate the market to ensure the safety and stability of consumers and our financial system,” she wrote.

Acknowledging the growing demand for crypto, Warren, a former presidential candidate, held that it exposed both consumers and the financial system to growing threat levels. The Democrat, who has long been a cynic and critic of Bitcoin, noted the urgency of the matter, saying that if the US continues shying away from addressing the matter, crypto would integrate more profoundly into the financial system and eventually the impact would be dire if the bubble bursts.

Warren, also a member of the Senate Banking Committee, later in the day attended a scheduled crypto hearing where she continued her rail against crypto. She described it as being run by “some shadowy, faceless group of super coders and miners”.

In a rather unexpected turn of events, the Senator seemed to change her tune on virtual assets rather dramatically as she spoke during a CNBC Squawk Box interview yesterday. She acknowledged that digital currencies might well offer a solution to customers who lack access to banking services. The Senator painted central bank digital currencies (CBDCs) as assets of interest, arguing that they could fill the void that major banks have previously failed to address.

“There has been an enormous failure by the big banks to reach consumers all across the country. Digital currency and central bank digital currency may be an answer there.”

However, she maintained that embracing virtual assets had to be cautiously done while considering the impact that they could have on financial systems. Warren insisted that the acceptance of cryptocurrencies must be mindful of the associated risks. On taxation, she asserted that all forms of wealth ought to be taxed, and crypto wasn’t an exception to the rule.

The post Senator Warren claims CBDCs could be useful to the unbanked appeared first on Coin Journal.