By combining bleeding-edge technologies like Bitcoin, smart-contracts and the self-driving car, ride-sharing companies such as Uber and Lyft could become obsolete as payment intermediaries.

Uber Testing Self-Driving Cars

Everyone’s excited about Uber’s latest pilot program to test self-driving vehicles in the city of Pittsburgh, Pennsylvania. But the dirty little secret is that both Uber and Lyft plan to replace human drivers as soon as possible to boost profits. A fleet of “robot cars” won’t complain or unionize for higher wages, which the company would pocket for itself.

Everyone’s excited about Uber’s latest pilot program to test self-driving vehicles in the city of Pittsburgh, Pennsylvania. But the dirty little secret is that both Uber and Lyft plan to replace human drivers as soon as possible to boost profits. A fleet of “robot cars” won’t complain or unionize for higher wages, which the company would pocket for itself.

Uber, whose rapid rise resulted in $1.5 billion USD revenue in 2015, currently takes a 20 percent cut on every ride. Thus, if the company’s “driver-partners” are eliminated (or at least made less relevant), the company could rake in almost the entire cost of the ride.

What Is Uber Really?

Despite positioning themselves as the vanguard of the new P2P economy, they’re anything but. In fact, their middle-man business model is nothing new. To be exact, such app-based businesses are merely financial intermediaries. “A financial intermediary is an entity that acts as the middleman between two parties in a financial transaction,” by definition, and Uber certainly seems to fit the bill.

Despite positioning themselves as the vanguard of the new P2P economy, they’re anything but. In fact, their middle-man business model is nothing new. To be exact, such app-based businesses are merely financial intermediaries. “A financial intermediary is an entity that acts as the middleman between two parties in a financial transaction,” by definition, and Uber certainly seems to fit the bill.

In the book titled, The Sharing Economy: The End of Employment and the Rise of Crowd-Based Capitalism, author Arun Sundararajan asked, “Are today’s sharing economy platforms really ‘markets’? Or are they simply 20th-century organizations with a new employment model, and thus no more than old hierarchies in digital bottles?”

As Bitcoin expert, Andreas Antonopoulos, explained at a recent talk in LA:

They’re a peer-to-peer taxi service. Well, peer-to-Goldman Sachs-to-peer taxi service. Because they’re not P2P. Uber sits in the middle and Uber is the Goldman Sachs with wheels.

But while one might argue that Uber also provides insurance, the insurance companies are also payment intermediaries, he noted. Moreover, this pattern is ubiquitous because of credit cards, which Antonopoulos sees as a “centralizing force,” where you and your personal information are the product.

Credit Cards Are a ‘Centralizing Force’

“Why can’t I pay the person?” he continued. “Because they can’t take credit cards. Why can’t I pay my driver? Because they can’t take credit cards. Why can’t I pay the driver and the insurance company on the basis of a four minute ride to insure me for those four minutes while I’m in that car? Because I have to put a credit card in the middle.”

“Why can’t I pay the person?” he continued. “Because they can’t take credit cards. Why can’t I pay my driver? Because they can’t take credit cards. Why can’t I pay the driver and the insurance company on the basis of a four minute ride to insure me for those four minutes while I’m in that car? Because I have to put a credit card in the middle.”

Today, direct payments with fiat can only be done using physical cash, which is increasingly relegated to tipping in developed nations.

Has your Uber driver ever asked for your credit card number? Of course not. But Uber and Lyft do. And they store your private information in their central database, creating a honeypot for hackers. As Antonopoulos put it:

The credit card pops up again and again as this massive centralizing force. The banking system is no longer a system where people pay people. It is a system where people corporation that pay corporation that pay people, maybe.

Disrupting the ‘Disruptors’

But what happens if we mash up these bleeding-edge technologies? Combine smart-contracts with decentralized ride-sharing apps, cryptocurrencies, self-driving cars, and it no longer makes sense to give Uber a share of your revenue.

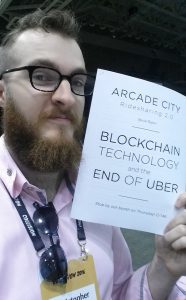

Indeed, decentralized ride-sharing applications such as Arcade City see this as a major business opportunity. The app harnesses the power of decentralization and cryptocurrency to fill the void left by Uber and Lyft in Austin, Texas, after being banned by the city.

“Even aside from the absence of Uber and Lyft, many of these people are tired of being jerked around by the major ride-share corporations and will be happy to use a decentralized alternative that puts more power in their hands,” Arcade City founder Christopher David told Bitcoin.com. Under such a model, drivers would be free to:

– Set their own rates;

– Negotiate and transact directly with riders;

– Build direct relationships with riders for a stable and recurring customer base;

– Self-organize into ‘pods’, co-ops, or their own businesses.

Moreover, Bitcoin technology and smart contracts can also enable a car to be self-owning. To wit, your Honda Civic can effectively become its own corporation and even its own shareholder with an ability to pay for its own lease, gas, and insurance by giving people rides.

Also, instead of sitting in the driveway when not in use, a car could generate some income for its owner. Meanwhile, costs not only drastically decline, but personal information remains safe, away from centralized institutions.

Disintermediation Ahead

By looking at Uber’s business model, the “new” sharing-economy actually has the same old boss. Why? Because the legacy payment structure remains in tact. The P2P economy does indeed have the potential to unleash the power of crowd-based capitalism. But for this to happen, payments must also be peer-to-peer without a corporation in the middle.

By looking at Uber’s business model, the “new” sharing-economy actually has the same old boss. Why? Because the legacy payment structure remains in tact. The P2P economy does indeed have the potential to unleash the power of crowd-based capitalism. But for this to happen, payments must also be peer-to-peer without a corporation in the middle.

By removing financial intermediaries, P2P networks can actually live up to their promise and revolutionize how people do business. The role of the crowd would be transformed from being the source of labor and capital to actually owning and running the marketplace in a decentralized fashion.