There is no way to measure the amount of Bitcoin (BTC) that is being sent to self-custody wallets so far, according to one industry executive.

Amid the ongoing FUD over lawsuits against major cryptocurrency exchanges, investors have been increasingly offloading their Bitcoin from crypto trading platforms.

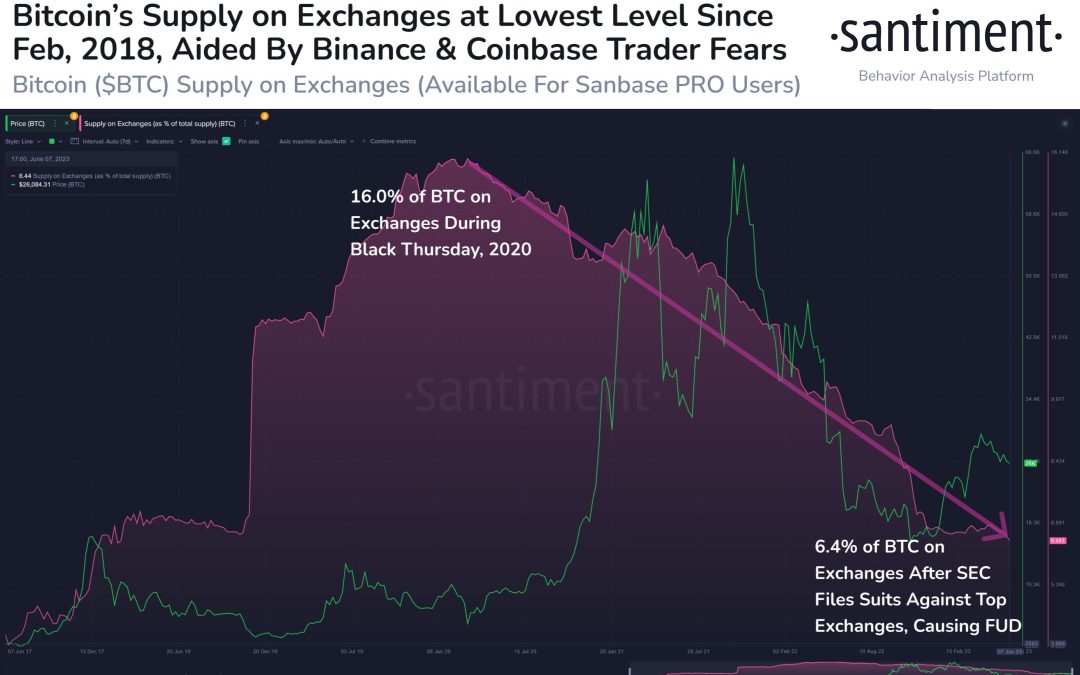

As of mid-June, Bitcoin’s exchange supply fell to its lowest level since February 2018, according to data from the crypto intelligence platform Santiment. The massive exchange outflows have been triggered by the growth of self-custody fueled by uncertainty around Binance and Coinbase, Santiment said.

The growing self-custody trend has a massive impact on cryptocurrency markets, Santiment’s head of marketing Brian Quinlivan told Cointelegraph on June 15.

One of the most notable results of self-custody is that it tends to decrease circulation, thereby reducing the market capitalization tracked by websites like CoinGecko and CoinMarketCap.

“Circulation does tend to dry up as coins are moved off of exchanges,” Quinlivan said, adding that the increasing self-custody trend has a downside in the form of stagnant coins.

“This stagnancy can have a negative impact on market cap due to the lowered utility of the network as a whole,” the exec noted, adding:

“However, as long as there is still a healthy amount of exchange activity, which there has been, this generally should be enough to cancel out the negative impact of this current phenomenon.”

Quinlivan noted that coins moving off exchanges have more of a long-term impact on markets. “Traders sometimes assume that if a massive amount of tokens is suddenly moved off exchanges by whales, prices will immediately rise,” he said, adding that the firm has seen that it was usually a much more gradual rise.

The Santiment executive noted that Bticoin’s supply on exchange has plummeted from 16.1% on Black Thursday in March 2020 to 9.8% today. “Prices are still up 283% during this time span,” Quinlivan added.

While the self-custody trend continues to expand, it’s not quite possible to find out how much BTC is sitting on cold wallets, according to Quinlivan. He said:

“Assuming we have every exchange address in existence, which nobody does, then we would be able to measure precisely how much is moving to cold wallets at any given time just by subtracting out all of these known exchange addresses.”

The executive went on to say that for now, blockchain analysts can only give their best estimation.

“It is why our exact number of 9.8% of BTC on exchanges may vary slightly compared to other data out there. The longer time goes on, though, the more accurate data we are able to capture,” Quinlivan noted.

Related: Binance CEO CZ responds as data points to billions in exchange outflows

The news comes amid Bitcoin’s market capitalization continuing to shrink, according to data from CoinGecko.

Since mid-April, Bitcoin’s market value has dropped more than 15%, amounting to $494 billion at the time of writing. As previously reported by Cointelegraph, the BTC market cap reached its highest point of $1.28 trillion in November 2021, when BTC price hit the all-time high at $68,000.