“We don’t have a set foundation to build on yet.”

That’s how Neha Narula, director of research at MIT’s Digital Currency Initiative (DCI), characterized his institution’s outlook on progress (or lack thereof) in the blockchain industry at the fourth annual MIT Bitcoin Expo this week.

Hosted by the student-run MIT Bitcoin Club, the two-day event served to highlight both the scope of the ongoing work at the university, and the difficulties and challenges being faced by the global developer groups seeking to popularize the technology for wider use.

Narula told the audience:

“[Blockchain technology] has the potential to affect billions of people … but we also think we are at the very early stages of figuring out what is going on. We are still doing the groundwork. We are defining the layers of the tech stack, and as a consequence, the protocols are still shifting and changing.”

Some of those changes were visible at the conference, where several discussions focused on the all-too-familiar themes of how to scale the bitcoin blockchain while keeping the protocol secure.

So far, the question of how to increase bitcoin’s throughput (right now digital currency only handles around seven transactions per second) has divided the community. Some want to scale bitcoin by increasing the block size limit, while others prefer to prioritize off-chain solutions.

Then, there is the question of who gets to make those decisions anyway. Some argue consensus is best left to the protocol’s nodes and transaction validators (miners). But here, too, the issue quickly becomes complex.

While all miners are full nodes by default, developers are concerned too few people are maintaining full copies of the blockchain altruistically.

To that end, David Vorick, co-founder of the decentralized cloud storage platform Sia, urged more people to spin up full nodes for the benefit of the network.

Full nodes enforce the consensus rules, so the argument is that if not enough enthusiasts run this component of the network, important decision making will fall into the hands of miners, who may be incentivized differently.

Vorick warned:

“If you are not running a full node, your opinion on whether or not you like a hard fork is less relevant.”

Reducing bloat

Today, most of the nodes on the bitcoin network are lightweight, simplified, payment verification (SPV) nodes that rely on the records kept by other full nodes. But, the problem with running full nodes, developers argue, is they incur costs, such as 125GB of hard-drive space.

Some developers feel that growing storage requirement is just one more thing causing node operators to drop out of the network.

Consider that a year ago, there were 5,700 reachable bitcoin nodes. That number has now dropped to around 4,900, according to Bitnodes, a website that tracks the size of the bitcoin node network.

Vorick wasn’t the only one to focus on bitcoin’s health in this area.

As part of an effort to reduce the size of a full node, bitcoin core developer Peter Todd presented a proposal for TXO commitments. Todd feels bitcoin’s UTXO (unspent transaction output) database is becoming too bloated, making it more difficult for bitcoin users to run a full node.

Todd told Coindesk:

“TXO [proposal] is a change in how you store and transmit that data. It doesn’t change the consensus itself. We previously thought it did, but you can actually skip that part.”

Elsewhere, Todd was vocal about wanting to keep the bitcoin block size at 1MB. He feels Bitcoin Unlimited (a proposal for raising the block size limit) would make node ownership too onerous, leading to further centralization and creating a security risk for the network.

Off-chain focus

Other speakers at the event kept the focus away from controversial development ideas. Though one could argue, in doing so, they have simply prioritized one set of solutions for the scaling debate.

Similar to other recent technical conferences, like Scaling Bitcoin Milan, the MIT event saw discussion of so-called top-level or ‘layer 2’ bitcoin solutions that many argue will require the much-debated Segregated Witness upgrade.

Tadge Dryja, who recently joined the DCI as a researcher, presented a proposal for Lightning Network, which he co-created, in which he made the case for SegWit’s benefits to projects like his own. Lightning, which uses off-chain payments for processing transactions, is viewed by many as one of the most promising options for scaling bitcoin without the increase in block size.

Dryja indicated he is currently working on a Lightning wallet software. But unless the network adopts Segregated Witness, which solves the transaction malleability problem, he’ll have a lot more work ahead, he said.

He told the audience:

“This gets really hard when you have transaction malleability. There are ways to do it without Segwit, but it is really annoying, and I have to recode everything.”

Videos of day 1 and day 2 of the event are available on Youtube.

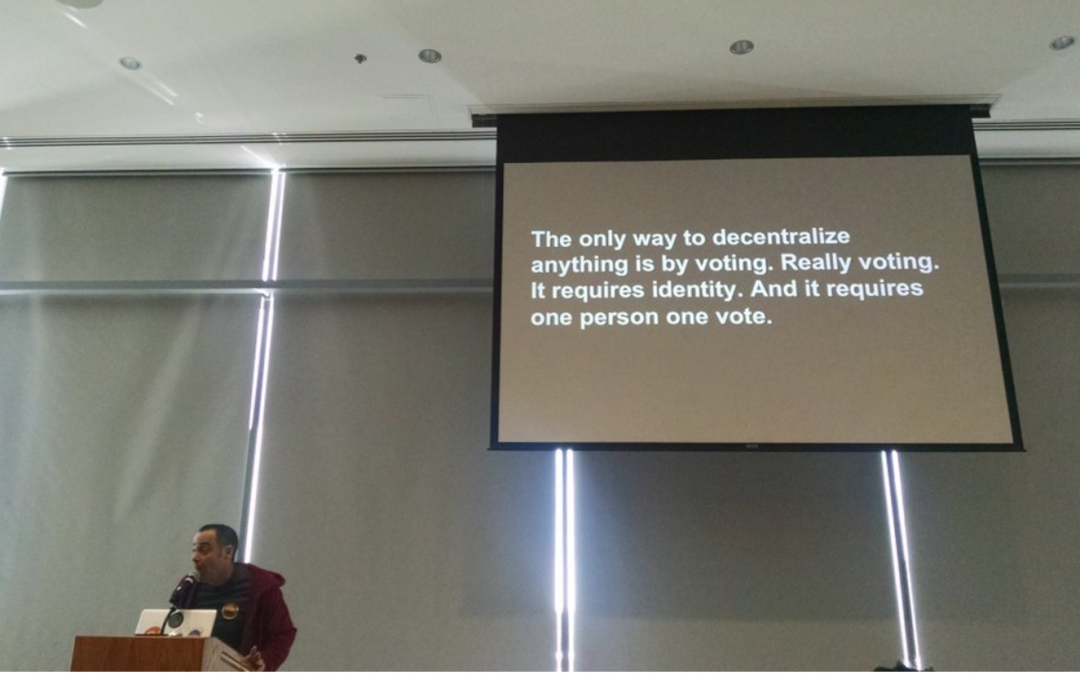

Classroom image via Shutterstock; James D’Angelo image via Paul Goldstein