Billion-dollar investment firm Rothschild Investment Corp quadrupled its exposure to Bitcoin (BTC) since April, new records show.

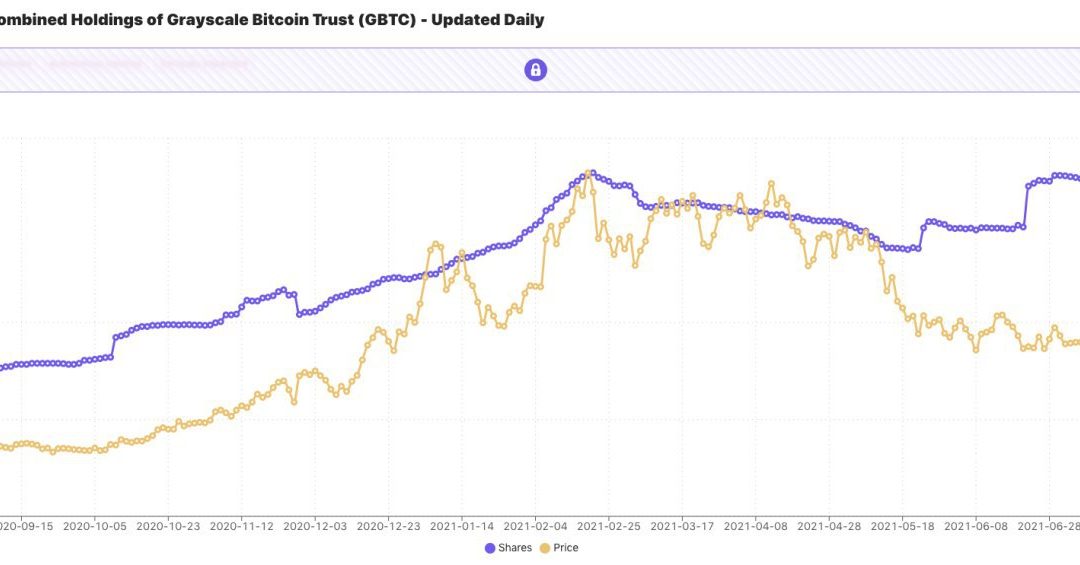

In a filing with the United States Securities and Exchange Commission (SEC) on Saturday, Rothschild confirmed that it now owns 141,405 shares of the Grayscale Bitcoin Trust (GBTC).

Rothschild GBTC shares near 150,000

A quiet but nonetheless substantial player among institutions, Rothchild Investment Corp has also invested in Grayscale’s Ether (ETH) equivalent, the Grayscale Ethereum Trust.

Its exposure to Bitcoin has increased considerably this year, the filing shows — in April, its GBTC shares totaled 38,346.

In BTC terms, with each GBTC share equal to 0.000939767 BTC, Rothschild thus has an equivalent Bitcoin exposure of 132.8 BTC ($3.94 million).

The data implies that declining prices have not fazed executives, while Bitcoin has been maintaining a drawdown for three months after hitting its all-time highs of $64,500 in mid May.

As Grayscale CEO Michael Sonnenshein noted this week, institutional players are likely taking little notice of short-term price moves, instead concentrating on a much lower-time-preference strategy when it comes to cryptocurrency.

“Investors in this asset class are really not focused on… short-term movements in price,” he told CNBC.

“These are really investors looking at their allocations in the medium to long term, and so any volatility or dampening of volatility is not something anyone is fazed by.”

On Monday, Ark Invest purchased a reported 310,000 GBTC shares of its own, bringing its combined holdings to 8.81 million or 0.5% of its portfolio. At its peak, GBTC represented 0.9% of the ARK portfolio in late March.

Good timing for Grayscale FUD?

As Cointelegraph reported, Grayscale is at the center of discussions this week, as it unlocked over 16,000 BTC worth of GBTC shares on Sunday.

Related: Institutional demand for Bitcoin evaporates as BTC struggles below $31K

Concerns, while arguably unfounded, long abounded that the event would create downward Bitcoin price pressure, with the sharpening of the drawdown on Monday and Tuesday fuelling the fire.

Regardless, since GBTC investors cannot redeem shares for BTC and then sell for fiat currency, Bitcoin markets are in fact left out of the equation when it comes to unlockings.

Grayscale itself only sells a tiny amount of the Trust’s BTC holdings for fund management purposes.