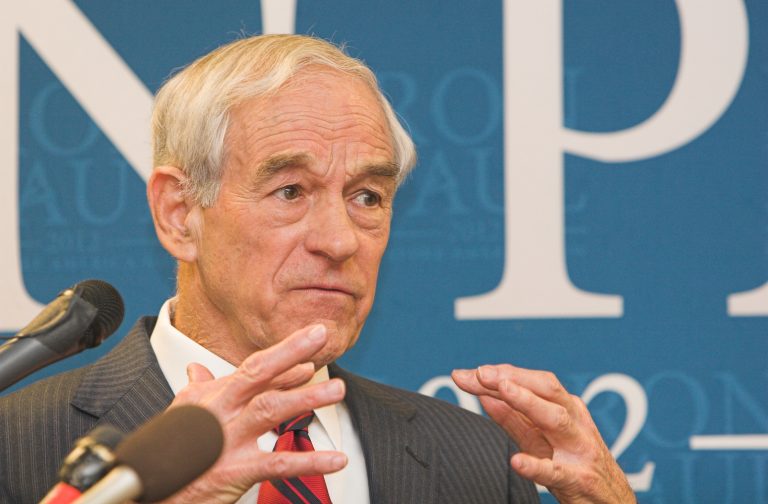

Ron Paul, the muckraking former congressman from Texas, is stirring things up once again, this time taking aim at the new real-time digital payment system proposed last week by the U.S. Federal Reserve. Presented as an innovative solution by government and media voices, the cryptosphere received the news of the Fednow program with little more than a disinterested shrug. Paul is not impressed either, maintaining that the implementation will crowd out competing protocols like Bitcoin, placing even more power in the hands of an already dangerously incompetent federal government.

Also Read: Argentina’s Peso Collapse Shows Governments Shouldn’t Control Money

Paul: Fednow Is Unnecessary

In a press release issued August 5th, the U.S. Federal Reserve announced it will develop “a new round-the-clock real-time payment and settlement service, called the FedNow Service, to support faster payments in the United States.” While the Fed already works with the private sector to provide such services via the Fedwire system, Fednow would be available 24-7, 365 days a year. While Fed representatives and some mainstream media outlets are making much ado over the announcement, with CNBC citing instant check clearance and cost reduction as a nice bonus, Ron Paul sees things a little differently.

The former congressman and medical doctor released a statement to campaignforliberty.org yesterday, saying: “Consumers already have numerous options to make real-time payments, so the Federal Reserve’s decision to begin work on a central bank-run and controlled real payments system — what Competitive Enterprise Institute Senior Fellow John Berlau calls “FedNow” — is baffling.”

Paul continued:

A Federal Reserve-run real payments system will crowd out private alternatives, leaving consumers with one government-run option for real-time payments. This will be bad for consumers and real-time entrepreneurs but good for power-hungry Federal Reserve bureaucrats who will no doubt use FedNow to help “protect” the Federal Reserve’s fiat currency system from competition from crypto currencies.

Though no expert on the technical inner workings of blockchains, Paul has been a strong proponent of crypto — and the underlying philosophy of financial autonomy and freedom from government control — for a while now. In a July 14 interview on CNBC’s Squawk alley, Paul maintained that “I’m all for cryptocurrencies and blockchain technology, because I like competing currencies.”

Competing Currencies Are Good for the Economy

As news.Bitcoin.com recently reported, several countries worldwide are now working on implementing their own central bank digital currencies (CBDC). Some of these are blockchain-based and others are not. Interestingly, various states are creating their own digital assets while simultaneously standing opposed to the free market use of bitcoin and other decentralized, permissionless assets. Although competition can be very good for consumers and value holders, voices like Paul point out that this competition is a very real, direct threat to central banks and governments who wish to maintain a violent monopoly on the money supply.

According to the U.S. Federal Trade Commission (FTC), “Competition in the marketplace is good for consumers and good for business. Competition from many different companies and individuals through free enterprise and open markets is the basis of the U.S. economy.” Of course, this quote references goods and services, and not necessarily currencies themselves, but the same foundational principles apply, either way. St. Louis Federal Reserve President James Bullard addressed the topic of crypto and currency competition specifically at a meeting on July 19:

Cryptocurrencies are creating drift toward a non-uniform currency in the U.S., a state of affairs that has existed historically but was disliked and eventually replaced.

Who exactly disliked this competition is not specified, and maybe for good reason. The free banking era of competing currencies in America was ended by the National Bank Acts of 1863 and 1864, implemented to help the U.S. government collect more taxes via a centralized, one-currency framework, and to raise money for the Civil War.

Currency competition can sometimes create difficult situations, as various media of exchange battle for dominance. Still, competition — especially in a borderless, digital age — ultimately means more options for the individual value holder, consumer, and spender, and a choice as to what is paid for. This doesn’t bode well for broke governments frothing at the mouth for war, additional spending programs, or virtually limitless debt ceilings.

Forced Monopolies Engender Trade Wars, Competition Provides Aid

Money was never a big motivation for me, except as a way to keep score. The real excitement is playing the game.

– U.S. President Donald Trump

This may be money to Trump, but to the average individual, money certainly matters for more than just an ego boost. Its soundness and market value are of prime importance for individuals securing their everyday needs for life, survival, and enjoyment.

Centralized monopolies on currency potentiate volatile trade wars, as currently witnessed between the U.S. and China. With no competition to turn to when one currency is co-opted by bad actors or political interests, folks have no option but to “play the game” of fiat, and go down with the ship, so to speak. Now that free banking eras are a thing of the past, to not finance these trade wars via taxes is to risk imprisonment.

The global economy can be a lesson in the value of competition as well. Take Venezuela, and the aid that has poured in via crypto donations; the survival that has been enabled for some, in dumping the hyperinflated, virtually worthless bolivar for bitcoin. Zimbabwe’s astronomically inflated economy (perhaps laughably, if not so tragic) forced the state to print 100 trillion-dollar bills. Other world currencies, including P2P crypto, showed up to shore the walls and bring stability to the reeling society. Bitcoin has been trading at reported premiums of 4% to 10% in Argentina, after the country’s peso plummeted 30% on Monday. Without competing currencies, none of this would be possible.

Fednow Is Not Ready, Bitcoin Is

The Federal Reserve has stated that the new payments system is set to be rolled out in 2023 or 2024. As Federal Reserve Board Governor Lael Brainard claims, “Everyone deserves the same ability to make and receive payments immediately and securely, and every bank deserves the same opportunity to offer that service to its community.” No more overdraft fees, no more waiting on that check to clear, and no more inconvenience in having to wait until money is received to pay one’s bills or taxes.

What Brainard and others are missing, according to Dr. Paul’s prognosis, is that centralized, violence-backed convenience isn’t anything wonderful or special. It’s akin to talking about the convenience of never having to walk long distances anymore, because luckily the state broke both of your legs. Should violence-backed fiat powers continue in creating centralized CBDCs, pushing agendas to remove paper money from societies worldwide, in combination with forbidding crypto competition, humankind could soon feel the real inconvenience of total financial immobility, firsthand. All this in view, maybe it’s best for the Fed to heed the doctor’s orders this time, and let the medicine of free market competition do its work.

What do you think about Fednow? Let us know in the comments section below.

Images courtesy of Shutterstock, fair use.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.

The post Ron Paul Slams Fednow Payment System and Encourages Crypto Competition appeared first on Bitcoin News.