The price of XRP, the token that powers the Ripple Consensus Ledger, continued its upward movement today, building on recent gains to hit a new all-time high.

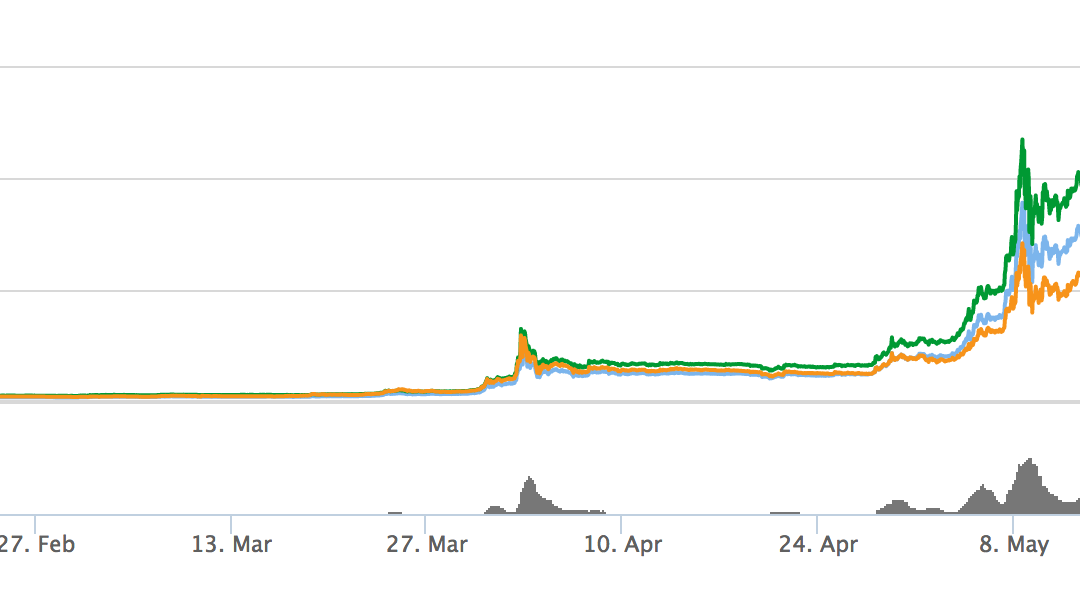

Overall, the token’s price climbed to as much as $0.33 at roughly 11:25 UTC, representing a roughly 40% gain in the space of just 24 hours, according to data provider CoinMarketCap. The cryptocurrency fell to less than $0.029 less than a month ago, and has climbed more than 1,000% since then.

As for what caused this sustained rally, analysts identified a few key factors.

Several traders pointed to fear of missing out (FOMO) as driving XRP’s continued price gains.

This fear is playing a key role in causing the cryptocurrency to push higher, Marouane Garcon, founder of private blockchain investment firm Loch Loyal, told CoinDesk:

“When something runs like XRP is running, people want in.”

Garcon stated that there is “definitely a snowball effect,” adding that it is difficult to blame investors for being interested when XRP is producing impressive gains.

Also providing tailwinds was an announcement by Ripple to add clarity to how it will manage its own holdings of XRP, and how it will use its funds to power its projects.

As revealed to CoinDesk earlier today, the company plans to lock up $14bn in funds, announcing a plan that staggers how such funds can be accessed.

Bank backing

While analysts emphasized the importance to FOMO, they also pointed out that Ripple has the backing of major banks, a development which they cited as contributing to the cryptocurrency’s recent price rally.

Petar Zivkovski, COO of leveraged cryptocurrency trading platform Whaleclub, weighed in on this situation, stating that he believes the distributed ledger network is developing a unique value proposition in a growing field of competitors.

“Big money is betting that Ripple will power bank-to-bank and bank-to-consumer international money transfers in the future. Remittance is a [$500bn per year] market and Ripple has made great headway into it by partnering with major banks,” he said.

He further told CoinDesk he now believes new money is being invested into the platform’s cryptocurrency as a result of its recent gains.

Disclosure: CoinDesk is a subsidiary of Digital Currency Group, which has an ownership stake in Ripple.

Water overflowing image via Shutterstock