Distributed financial technology firm Ripple is on the verge of locking up billions of dollars worth of its native XRP cryptocurrency inside dozens of smart contracts designed to hold value in escrow until a certain time, or certain conditions are met.

The move to voluntarily freeze its own assets in escrow contracts is designed to combat fears that Ripple might flood its booming market with some of the $16bn worth of cryptocurrency it currently stores and that resulted from holding large amounts of its own currency that hasn’t been made available to the public.

Specifically, the San Francisco firm has promised to lock-up 88% of those funds, or about $14bn worth, in a series of smart contracts that briefly make 1bn XRP available each month for a period of at least four-and-a-half years.

Revealed today exclusively to CoinDesk, Ripple hopes the self-inflicted freezing of funds will give XRP owners and aspiring owners a sense of certainty that the market will not suddenly be flooded with the currency, potentially lowering the price.

While Ripple CEO Brad Garlinghouse argued in interview with CoinDesk that flooding the market would be irrational, and go against his firm’s own self-interest, he added that it was time to move the tokens to the smart contracts and remove the element of trust altogether.

Garlinghouse said:

“We want to make sure that the Ripple Consensus Ledger is the most robust, and that XRP is the most liquid, and I think this is a very positive step towards that.”

Currently, Ripple’s market cap is listed on most tracking sites as about $11bn, based on 38.3bn XRP in circulation. But unlike other cryptocurrencies including bitcoin and ethereum, not all the cryptocurrency is in circulation. In fact, according to Ripple’s own numbers the company owns almost twice the amount in circulation, or 61bn XRP.

A sense of security

To help give potential future XRP owners certainty that the market won’t be flooded with this trove of cryptocurrecy, Ripple built 55 smart contracts using its own escrow feature released for public used in March, each holding 1 billion XRP and expiring on the first day of every month for a period of 54 months.

As each contract expires, the cryptocurrency will briefly become available for Ripple to use as it sees fit.

Historically, Garlinghouse said funds have been spent at a rate of about 300m XRP per month for the past 18 months to incentivize market makers to offer tighter spreads for payments, methods he describes as Ripple being “good stewards” of the nascent XRP economy.

For example, he says funds have also been sold to institutional investors to help raise additional capital above the $93m already raised to help pay for engineers that oversee the open-source code base. Then, at the end of the month whatever XRP is unused will be added to the end of the escrow queue in the form of an additional month-long contract, starting the process all over.

A specific time-frame to implementation has not been revealed, but Garlinghouse expects the process to be completed by the end of this year. Head of research at Ripple investor Blockchain Capital, Spencer Bogart, said that if the contracts are safely implemented they could positively impact XRP user perception.

“The fact that Ripple owns the majority of outstanding XRP and could potentially flood the market with supply has historically discouraged investors from evaluating XRP any further,” he told CoinDesk. “Properly implemented cryptographic escrow with sufficiently limited supply would go a long way toward alleviating that particular fear.”

Blockchain Capital does not currently have a stake in XRP, he said, but does own equity in the company.

More than speculation

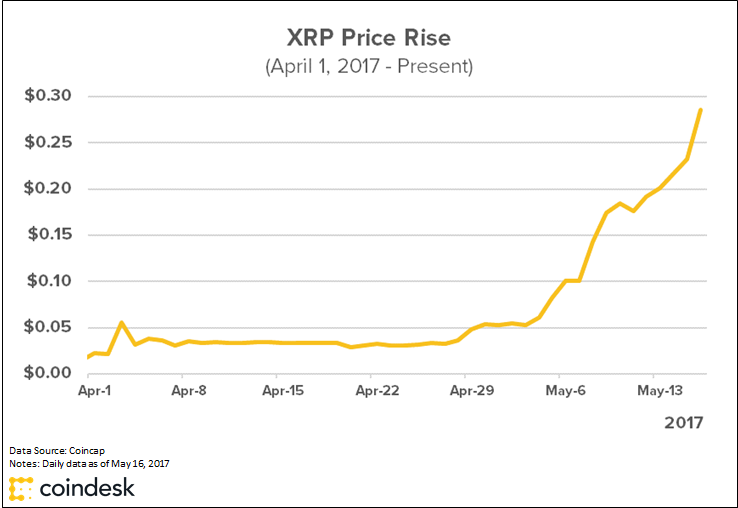

Collectively, the total number of XRP in existence is worth about the same as the entire bitcoin market cap, elevating the stakes far beyond just cryptocurrency speculation in its own right.

In addition to the cryptocurrency’s explosive growth over the past few months, the company that wants to make it easier for banks to send each other cross-border payments has continued to grow the number of its partners.

With the help of Germany’s former Minster of Defense who is an advisor to Ripple has been increasingly engaging global customers. The firm recently added 10 new financial firms to its network and completed a pilot with 47 global banks.

While Garlinghouse said the banks weren’t among the XRP owners concerned about Ripple flooding the market with currency, he does believe that the more stable sense among open-source developers of liquidity being released into the wild could result in increased activity among the community.

In the end, the result could in fact trickle down to the banks as the end users, he said. The increased liquidity being created by the cryptocurrency safely entering the market could in turn make it easier for a larger number of banks to conduct transactions without negatively impacting the price of doing so.

Garlinghouse concluded:

“I think increasingly, the market has realized that if we have a bank using us for messaging and settlements, there’s an opportunity to also introduce them to how they can lower their liquidity costs by leveraging a liquidity solution enabled through XRP.”

Disclosure: CoinDesk is a subsidiary of Digital Currency Group, which has an ownership stake in Ripple.

Lock and key image via Shutterstock