By Jamie Redman,

Bitcoin is a revolutionary protocol that is changing the way we understand and utilize money. Over the past few decades, sovereign wealth has deteriorated. Citizens have put too much faith in government-issued legal tender and the central banking system. After the financial crisis of 2007-08, a new idea was born into the world that gave the human race a financial breath of fresh air.

Decades of Fraudulent Activities and Manipulation Pushed the Global Economy Down

Eight years ago the global economy took a turn for the worse. Central banks, smaller banks and politicians had pushed world markets into a prolonged recession once again. Many economists believe the recession has been the worst financial crisis since the 1920s-30s.

Eight years ago the global economy took a turn for the worse. Central banks, smaller banks and politicians had pushed world markets into a prolonged recession once again. Many economists believe the recession has been the worst financial crisis since the 1920s-30s.

Decades before 2008, central banks had fervently devalued national currencies and caused significant inflation. Alongside this, commodity markets were manipulated by monopolies until finally, the trigger of the subprime home mortgage sector pushed the economy over the brink.

Following this atrocity, the U.S. Federal Reserve and other central banks focused their efforts on worsening the situation. Putting fear into the populace, leaders told people the money supply must be expanded. Central planners said banks needed bailouts to avoid the risk of deflationary spirals. Prior to 2008, the U.S. monetary supply was $800 billion, in 2016 it is $4 trillion. But this money never found its way back to the ordinary citizens.

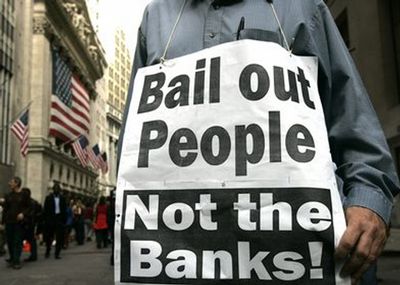

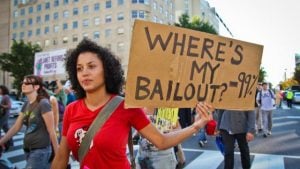

The stimulus packages that were supposed to facilitate better liquidity into global markets never happened. Instead, the vast money-printing operation went to banks who never loaned it and hoarded the funds. The economy became noticeably stagnant as the world’s wealth was channeled into 1% of the global population. The corruption and manipulation became so apparent in 2012 that people took to the streets calling themselves Occupy Wall Street.

The stimulus packages that were supposed to facilitate better liquidity into global markets never happened. Instead, the vast money-printing operation went to banks who never loaned it and hoarded the funds. The economy became noticeably stagnant as the world’s wealth was channeled into 1% of the global population. The corruption and manipulation became so apparent in 2012 that people took to the streets calling themselves Occupy Wall Street.

Unfortunately this did nothing to stop the pillaging, and many were merely pepper sprayed and arrested. The banking system continues to be corrupt, and the 1% remain the 1%. As fraudulent activities are still present within our financial system, something has risen from beneath the surface — Bitcoin.

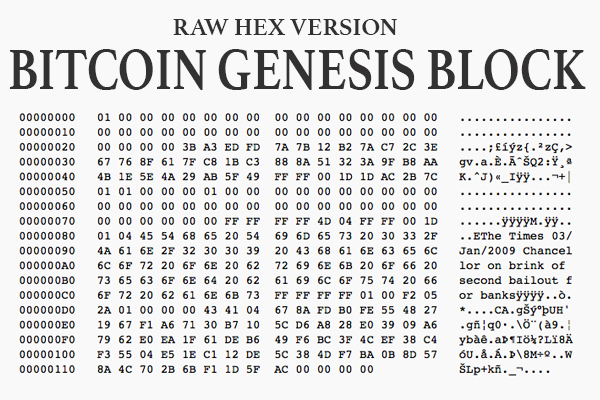

‘The Times 03/Jan/2009 Chancellor On Brink of Second Bailout for Banks’

In January of 2009, Satoshi Nakamoto gave the world Bitcoin. Before the Occupy protesters, a group of coders decided to build the decentralized currency into what it is today. In fact, these programmers — many of them free market advocates — decided to strike the root. These people knew the problem was the money system itself, the banking cartels, and nation states’ leaders.

In January of 2009, Satoshi Nakamoto gave the world Bitcoin. Before the Occupy protesters, a group of coders decided to build the decentralized currency into what it is today. In fact, these programmers — many of them free market advocates — decided to strike the root. These people knew the problem was the money system itself, the banking cartels, and nation states’ leaders.

Bitcoin is valuable because it’s the world’s first peer-to-peer, open source, and decentralized medium of exchange. Over the course of its life, it has also become a store of value and a payment rail. Many believe the cryptocurrency is meant to disintermediate the current financial system in a way never seen before.

The reason the protocol can do this is because it has no central point of control. Any individual around the world can access the Bitcoin network and use the money however they please. There is no corporate entity, no government issuer, and no bank operating this system. Consensus moves the system without any of these centralized concepts and benefits the world a great deal.

Bitcoin Protocol: What We Know

We are aware the current financial system is corrupt and most likely cannot be fixed. The banking cartels will continue to do as they please and hide under the cloth of politics. Traditional currencies will continue to be devalued, and inflation will always rise using them. As a result, this will diminish fiat’s ability to continue to hold value. Bitcoin is the remedy to protect individuals from this inflation and devaluation.

We are aware the current financial system is corrupt and most likely cannot be fixed. The banking cartels will continue to do as they please and hide under the cloth of politics. Traditional currencies will continue to be devalued, and inflation will always rise using them. As a result, this will diminish fiat’s ability to continue to hold value. Bitcoin is the remedy to protect individuals from this inflation and devaluation.

Bitcoin operates as a significant store of value using deflationary mechanisms as a powerful financial weapon. There will only be 21 million units, and this is causing people to recognize its worth. Traditional economists believe deflationary spirals could be a nightmare. However, the capped supply has caused people to save money— which is unusual in an inflationary economy.

We know that in time with this form of counter-economics the existing system will become weaker. The more attractive Bitcoin becomes, the fewer people will depend on traditional fiat assets. Currently millions of people are already part of this network and someday it will be billions of people. This is because when you offer a better solution to current monetary methods people will gravitate towards this hopefulness.

Bitcoin: Revolutionary Software &The Promise of Hope

The Bitcoin protocol provides a promise of hope that no other financial tool has brought thus far. It is an escape from the Federal Reserve and central banking system. It’s a solution to circumventing the capital controls laid out by bureaucrats. The banking cartels, congress, the president, parliament, and kings cannot shut down this network. This fundamental reason is why in time many will be attracted to Bitcoin’s attributes.

The promise of hope is peer-to-peer, open source, and ultimately a distributed protocol that cannot be defeated. Bitcoin is decentralized in a way that is harder to attack. Some day it will grow to be a distributed system with zero centralization. Authoritative power will be so blurry and so nonexistent that all will be seen is a mesh pattern of individuals— doing as they please. Subconsciously, much like the internet, Bitcoin is one of the powerful tools that will take us there.