A new research paper from a pseudonymous author puts the valuation of a single bitcoin at $5.8 million. The paper makes the case that bitcoin is the best form of money in existence today and should be valued as the dominant world currency.

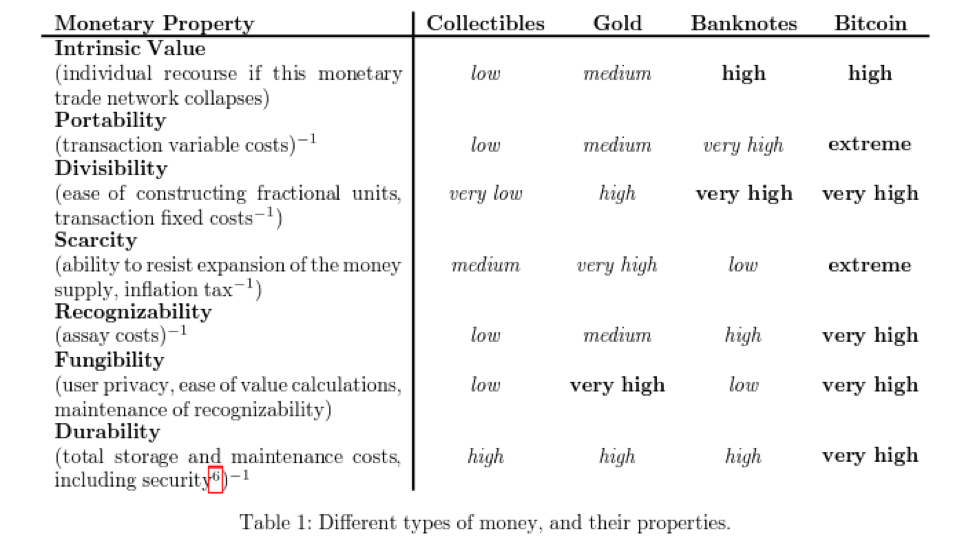

Throughout the paper, points are made around bitcoin’s intrinsic value, the use cases of the digital asset, eventual levels of adoption, and a complete take over as the world’s most widely-used form of money.

The paper is titled Bitcoin: A $5.8 Million Valuation and the author is listed as Mr. Game & Watch, which is the name of a playable character in the Super Smash Bros. video game series based on various generic characters from the Game & Watch series of games from Nintendo. When asked for more information about his identity, Mr. Game & Watch told CoinJournal:

“I prefer not to share my identity. The article advocates many serious crimes, and may offend many important people. Also, I would hope that the words speak for themselves. I will say that I am American and my background is in academia — that much would easily be guessed.”

Bitcoin’s Intrinsic Value

Before making the case for a $5.8 million bitcoin price, the pseudonymous author of the paper discusses the “intrinsic value” of a bitcoin.

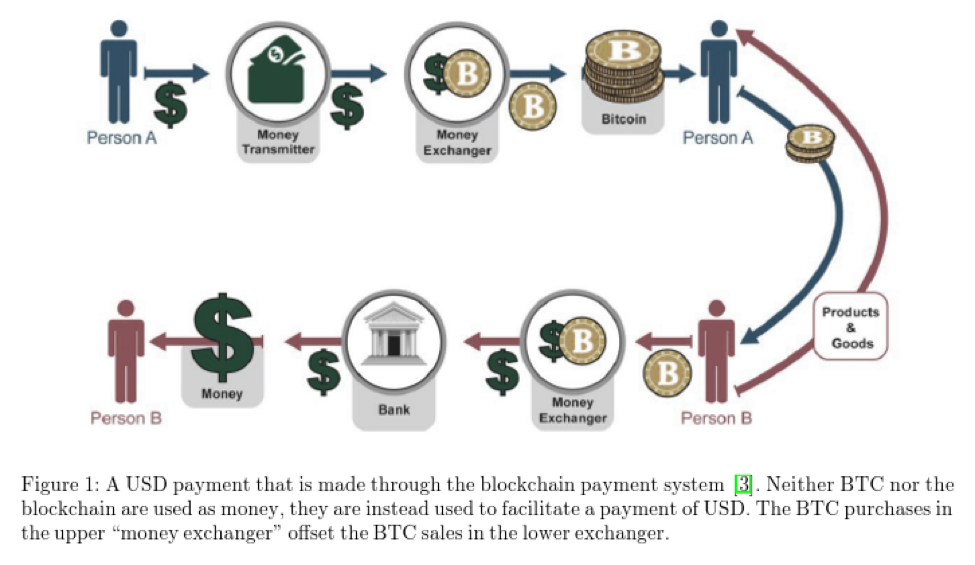

“The [bitcoin] collectible is required to make use of the [Bitcoin] payment network — even for transactions denominated in USD (not BTC),” states the abstract of the paper. “The payment network is of enormous general utility, particularly to criminals and victims of political oppression worldwide.”

The abstract also notes that bitcoin can maintain its useful properties even when under heavy harassment from a wealthy or violent adversary (such as a government). The author does not view altcoins as a threat to bitcoin’s dominance, mainly due to the invention of sidechains, which allow bitcoins to effectively be transferred to alternative blockchains with unique features and value propositions.

The paper goes on to explain bitcoin’s intrinsic value in clearer terms:

The paper goes on to explain bitcoin’s intrinsic value in clearer terms:

“BTC’s intrinsic value is that it alone will allow the wielder to access the network’s blockspace. In turn, the intrinsic value of blockspace is that it, together with BTC, enables special USD transactions – we will call these ‘Peer-to-Peer Digital USD Payments’, or ‘PDUPs’.”

Bitcoin Use Cases and Adoption

After making the case for bitcoin’s intrinsic value, the author goes into further detail about the pros and cons of Bitcoin as a payment system and the types of people that have a need for PDUPs.

The requirement to learn a new technology and transaction process, interact with new intermediaries like wallet providers and exchanges, and bitcoin’s price volatility are mentioned as disadvantages of the Bitcoin payment system. In terms of advantages, potential anonymity (which can be improved upon) and the inability to censor or shut down the payment network are covered.

“These PDUPs cannot be made without BTC,” the paper reinforces.

In the author’s view, there are a variety of reasons as to why someone would speculate on the bitcoin price, but those who actually use bitcoin do so to take advantage of this so-called PDUP service.

The author then gets blunt about the types of use cases that are made possible with Bitcoin.

“Because PDUPs return financial sovereignty to the user, they are, for better or for worse, optimal for illegal transactions,” states the paper. “PDUPs are often the cheapest (or only) way to engage in gambling, capital flight, tax evasion, and payments for ransomware.”

The paper later adds, “As the enabler of the PDUP, Bitcoin is therefore intrinsically valuable. BTC helps its owner get paid, cheat on his taxes, shield his assets from a messy divorce, gamble, engage in underage drinking, defend his life and property, get stoned, and get laid.”

According to the author, this intrinsic value of bitcoin is said to be “quite sustainable” because it will persist wherever a local government is uncompetitive.

The $5.8 Million Bitcoin Price

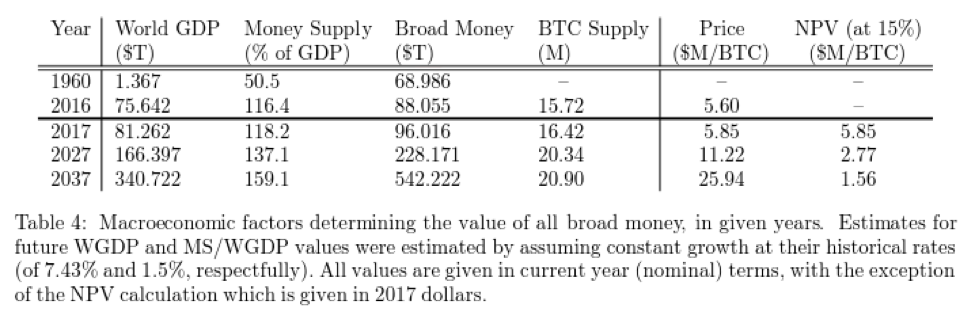

The author of this research paper eventually asks the reader to consider bitcoin as the dominant world currency. If such a consideration is deemed acceptable, then the author believes that correctly valuing bitcoin is a simple exercise of estimating the total value of all the world’s money, which leads to the $5.8 million bitcoin price.

Estimates from the World Bank on the total amount of “broad money” in existence are used as an estimate of all the money in the world in the paper.

For some of the reasoning behind this claim of bitcoin as the world’s most dominant currency, Mr. Game and Watch turns to Nassim Taleb.

Taleb has observed that nearly all of the drinks sold in the United States are Kosher, even though less than 0.3% of Americans are Kosher. This asymmetry is explained by the fact that it is easier for stores to carry one type of drink and those who aren’t Kosher don’t much care if the drinks they consume are Kosher or not.

The author believes this same phenomenon exists with bitcoin.

“The generalization also applies to Bitcoin, as both factors are strongly present,” states the paper.

“First, sellers of goods (or of labor) far prefer to use a single currency, over two. Second, there exists a selective intolerance of the USD – some USD-users are willing to become BTC-users, but many BTC-users are unable to become USD users.”

Other reasons for the further adoption of bitcoin included in the paper are eventual network capacity, cultural norms, and self-fulfilling prophecies.