Real-world asset (RWA) protocols have become a hot trend within DeFi circles.

A real-world asset (RWA) protocol is a decentralized application that allows entities to tokenize and trade real-world assets. These assets range from stocks and government bonds to real estate and commodities. They are also known as asset tokenization protocols.

DeFi provides certain advantages over TradFi by making the smart contracts transparent and enabling a wide degree of financialization of these assets by making them divisible, transferable, and tradable on decentralized platforms.

The top uncollateralized lending protocols for institutions in TrueFi and Maple increased by 26.6% and 117.8% in 2023. Centrifuge, a real-world asset tokenization platform, surged by 32% year-to-date.

In comparison, the gains recorded by the DeFi pulse index (DPI) in the same period was 13%. Whereas, Glassnode’s index of DeFi blue-chip tokens lost 7% since the year’s start.

Recent data from Nansen found that the governance tokens of RWA protocols surged significantly in January and April thanks to the rising interest in them.

Previously, experts had suggested that many “DeFi veterans have already implemented RWA-based strategies, however, the lack of sufficient RWA on-chain severely hinders the ecosystem development.”

This is changing due to increased tokenization of real-world assets.

TradFi interest boost RWA activity

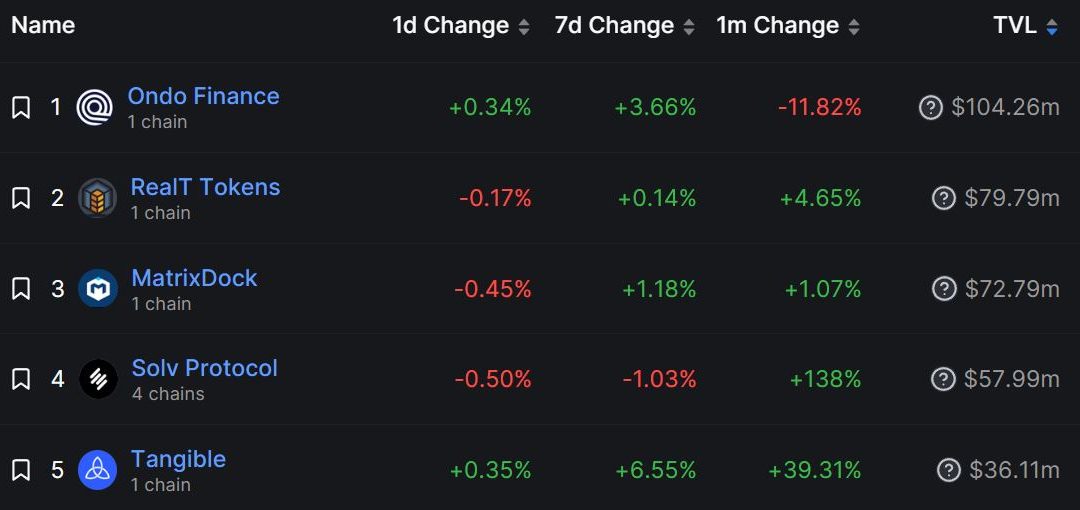

The top RWA protocol by total locked value, Ondo Finance, is a DeFi platform that enables stablecoin holders to directly invest in exchange-traded funds (ETFs) managed by top-tier asset managers like BlackRock and Pimco. U.S. bonds of more than $100 million have been issued via Ondo, per DeFiLlama data.

Goldman Sachs, Microsoft and Deloitte have eyed digital asset tokenization by partnering with the blockchain startup Digital Asset. German technology giant Siemens issued a digital bond on a public blockchain worth $64 million in February 2023.

The RWA assets account for 25% of the largest decentralized stablecoin DAI’s collateral, having increased from zero before the start of the year.

MakerDAO, the community-led DAO, has approved the conversion of centralized stablecoins like USDC to U.S. Treasury bonds. The DAO accepts tokenized government and corporate bonds and commodities as collateral for minting DAI.

So far, debt market protocols like Maple Finance, Truefi, Goldfinch and Clearpool have led the price action and activity among RWA protocols. These protocols enable non-collateralized lending for institutions.

Some of the top-ranked RWA protocols by TVL, like Ondo Finance, MatrixDock and RealT, do not have a governance token attached to them. Nevertheless, these protocols have attracted usage thanks to the chances of a potential airdrop in the future.

Related: DeFi securitization of real-world assets poses credit risks, opportunities: S&P

Notably, the non-collateralized lending protocols carry the risk of debt default. FTX’s collapse led to a significant decline in Maple Finance’s price and pushed the protocol to the brink of insolvency.

The yields of the U.S. Treasury bonds are also set to fall once the Fed starts cutting its benchmark interest rates, which could make these assets less attractive.

Nevertheless, it is encouraging to see the increasing tokenization of real-world assets and their financialization through DeFi finally catching positive momentum as they gain institutional support.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.