Strong inflows into the ProShares Bitcoin Strategy ETF (BITO) in the past two weeks pushed its Bitcoin (BTC) exposure to a new record high.

No Bitcoin outflows despite ‘rollover’ risks

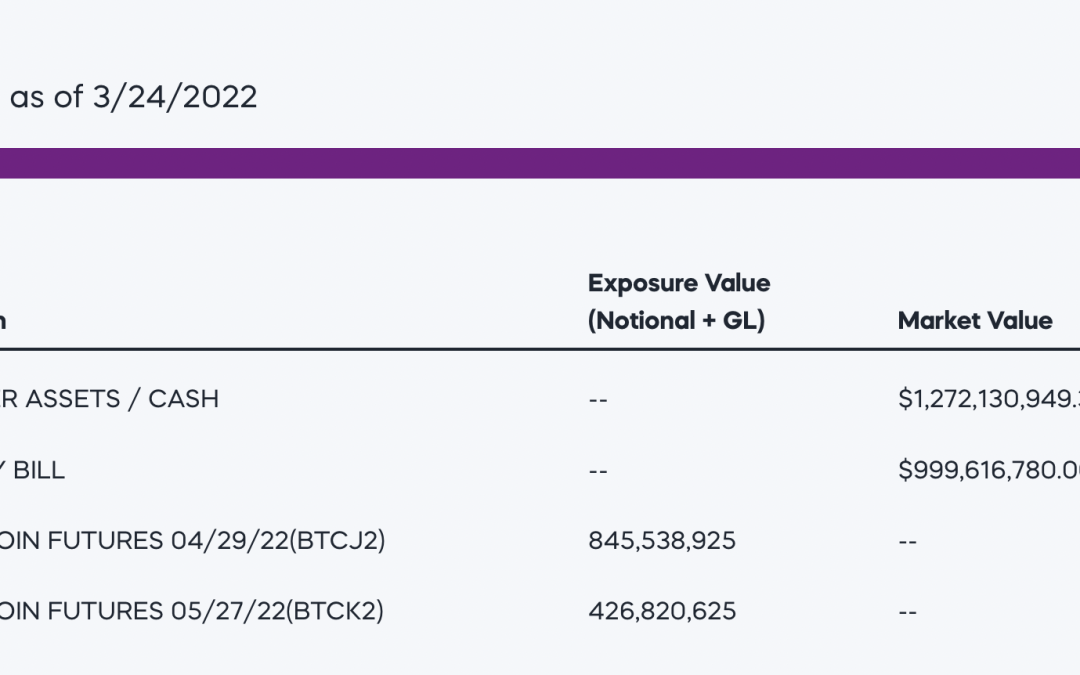

The fund, which uses futures contracts to gain exposure to Bitcoin’s price movements, had a record 28,450 BTC under its management — worth about $1.27 billion at today’s price — as of March 24, compared to nearly 26,000 BTC a month before, according to official data from ProShares.

Interestingly, the inflows appeared in the days leading up to the “rollover” of BITO’s 3,846 March future contracts in the week ending March 25.

To recap, a rollover involves traders moving their futures contracts as their expiry nears to a longer-dated contract, so to maintain the same position.

BITO’s rolling periods typically follows up with an increase in Bitcoin net outflows, noted Arcane Research in its latest report, while citing the last rolling period due to the market uncertainty caused by the Russia-Ukraine conflict.

But on March 21 it also witnessed an inflow of 225 BTC to its coffers just as BITO rolled its 437 March contracts to April. That prompted Arcane to see a growing institutional demand for the fund. It wrote in its report:

“The strong inflows to BITO suggest that bitcoin appetite through traditional investment vehicles is increasing.”

BITO has witnessed consistent net inflows for the remainder of this week, according to further data provided by Glassnode.

Bitcoin to $50K next month?

The inflows to ProShares Bitcoin ETF increase coincided with a rally in the spot BTC market on March 25.

On Friday, Bitcoin climbed another 2.5% to over $45,000, its highest levels in over three weeks. Alexander Mamasidikov, co-founder of crypto wallet service MinePlex, noted that that BTC’s price could jump to $50,000 next.

“The growth seen in the ProShares BTC ETF to a new all-time high of 28,000 BTC is proof that the clamor for a Bitcoin-linked Exchange Traded Fund product is backed by an active demand,” he told Cointelegraph, adding:

“These positive price trend activities have impacted BTC thus far and a sustained accumulation or investment from both retail and institutional investors is poised to push the coin to form strong support above $50,000 towards mid-April.”

No love for Grayscale?

Interestingly, institutions have been picking ProShares Bitcoin EFT over its rival Grayscale Bitcoin Trust (GBTC), a fund that has been trading at a 25% discount to spot BTC.

The issue with picking GBTC over BITO is that its discount continues to grow, which means investors would remain at the risk of underperforming spot Bitcoin, at a much higher rate that they risk with BITO that trades around 2% lower than the current BTC prices.

Nonetheless, there is still a slim chance of GBTC emerging as a winner. Namely, Grayscale Investments, the New York-based investment firm backing GBTC, has expressed interests in converting the trust fund into a spot Bitcoin-backed ETF. If it happens, GBTC’s 25% discount should return to zero.

“Buying BITO shares guarantees you will underperform Bitcoin,” said Ryan Wilday, a veteran financial analyst in an analysis published February , adding:

“And buying GBTC shares likely results in similar or worse underperformance compared to BITO, with a very slim chance of outsized performance in the event GBTC is turned into a spot ETF.”

Related: Record GBTC discount may spark $100K Bitcoin price rise — analyst

The U.S. Securities and Exchange Commission (SEC) has never approved a spot Bitcoin ETF application, believing BTC is vulnerable to price manipulation.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.