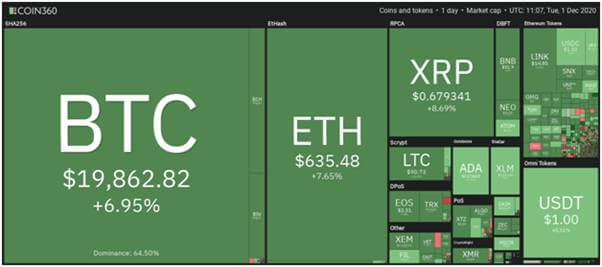

Major altcoins are struggling to post higher prices after Bitcoin’s run to a new 2020 high

Ethereum (ETH), Ripple (XRP) and Bitcoin Cash (BCH) are all trading up on the day, with Bitcoin’s remarkable jump to an all-time high near $20,000 appearing to jolt crypto bulls.

At the time of writing, the majority of the altcoin market is green, with prices for the above altcoins likely to rise further if momentum holds going into the week. However, to reach new 2020 highs, ETH/USD, XRP/USD and BCH/USD will all need to break above major overhead resistances.

Cryptocurrency price action map. Source: Coin360

ETH/USD

Ethereum’s strong rebound from lows of $488 continues with bulls pushing ETH/USD above $600.

The aggressive buying observed over the past weekend has slowed down as prices stall near $620. To resume the uptrend, the buy-side pressure will need to pick momentum again, breaking above $640. This is likely given the optimism as the cryptocurrency nears the launch of the ETH 2.0 beacon chain.

ETH/USD daily chart. Source: TradingView

ETH/USD daily chart. Source: TradingView

The RSI remains near the overbought territory to indicate momentum is still with the bulls. The 20-day and 50-day simple moving averages are also upsloping to suggest an uptick as the most probable action short term.

If bulls retake control, the next target is $645 and then $680. Above that, buyers would target breaching resistance at $800.

However, should the rejection above the $600 level continue, ETH/USD could drop to the 20-SMA ($527) and then 50-SMA ($452).

XRP/USD

XRP bulls are battling to keep prices above the 61.8% Fibonacci retracement level at $0.66. The level capped yesterday’s rebound from lows of $0.45, which suggests that bulls need to aim for a higher close to maintain the uptrend.

XRP/USD daily chart. Source: TradingView

XRP/USD daily chart. Source: TradingView

While a downturn is likely, the daily RSI remains etched within the overbought region to suggest that control is with the bulls.

On the upside, the next resistance level is at the 78.6% Fibonacci retracement level ($0.72) and $0.79 (previous high).

The opposite scenario will see bears push XRP/USD below $0.66. In this case, the downward target would be at the 50% Fibonacci level ($0.62) and 38.2% Fibonacci retracement level at $0.58. The 20-EMA provides further support at $0.49.

BCH/USD

The BCH/USD pair traded at highs of $322 yesterday, with the relief rally from $251 lows hitting resistance near the 61.8% Fibonacci retracement level at $326.

BCH/USD daily chart. Source: TradingView

BCH/USD daily chart. Source: TradingView

Currently, BCH/USD is struggling for an upside as bears look to strengthen. If sellers push Bitcoin Cash price lower, the downturn could see it drop to the 20-EMA at $285 and then the 23.6% Fibonacci retracement level at $280.

However, bulls might still break above overhead resistance and target $347 and then $380.

The post Price Analysis: Ethereum, Ripple, Bitcoin Cash appeared first on Coin Journal.