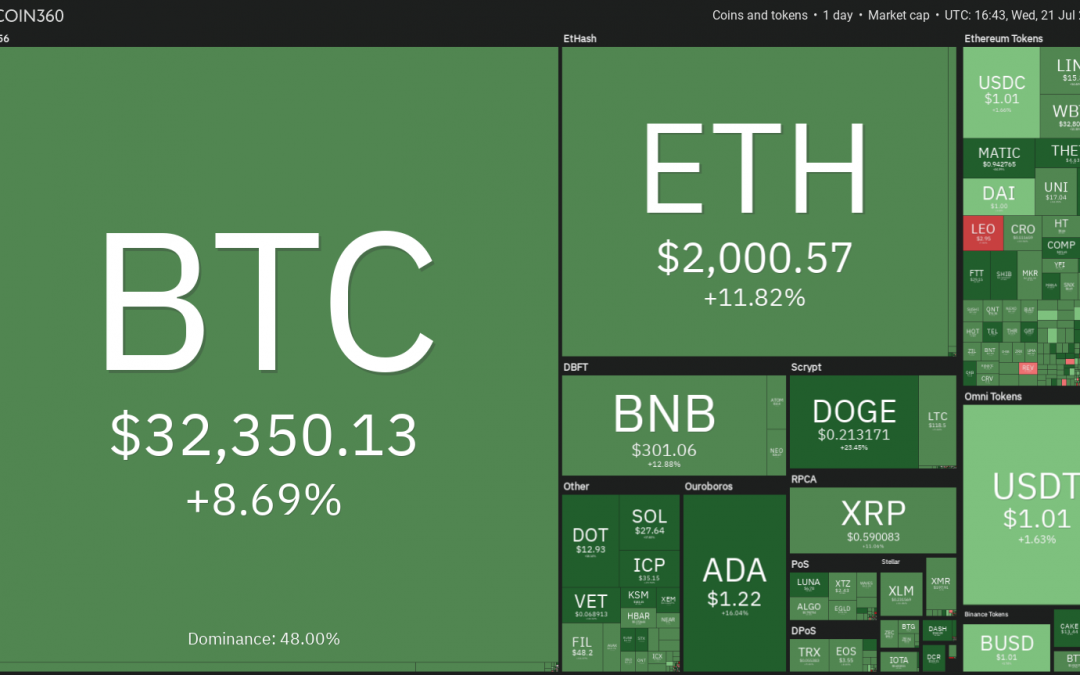

Bitcoin (BTC) is leading the recovery in crypto markets today after the price rallied back above the $32,000 level. Sam Trabucco, a quantitative trader at Alameda Research, said the firm had purchased the dip in Bitcoin on July 20.

Trabucco said the sharp recovery in equity markets, fewer long liquidations in the crypto derivatives market and the possible end of FUD caused due to China mining ban and Grayscale unlocking could act as recovery catalysts that could boost the crypto rally further.

However, analyst and podcast host Nebraskan Gooner views the recovery in Bitcoin as a shorting opportunity. Veteran trader Peter Brandt also expects Bitcoin to witness another downturn before a change in trend.

The correction may open up opportunities for several new investors to enter the crypto markets.

JPMorgan director of asset and wealth management Mary Callahan Erdoes said in a recent interview with Bloomberg that several of the bank’s clients want to invest in Bitcoin because they consider it as an asset class.

Let’s study the charts of the top-10 cryptocurrencies to determine the levels where resistance may creep in.

BTC/USDT

Aggressive selling by the bears pulled the price below $31,000 on July 19 and that was followed by another down move on July 20. However, the bulls purchased the dip below $30,000 today, resulting in a strong rebound.

The bears will try to stall the recovery at the 20-day exponential moving average ($32,643). If the price turns down from this resistance, the sellers will again try to sink the BTC/USDT pair below the critical support at $28,000.

If they succeed, the pair could start the next leg of the downtrend that could pull the price down to $20,000.

Conversely, if bulls drive the price above the 20-day EMA, the pair could challenge the 50-day simple moving average ($34,599). A break above this resistance will be the first sign of strength and open the doors for a possible rally to $36,670.

ETH/USDT

The long tail on the July 20 candlestick suggests that bulls purchased the dip to the strong support at $1,728.74. This is the third instance when Ether (ETH) has rebounded off this level since May 23.

The rebound has gained momentum today and the buyers will now try to push the price above the 20-day EMA ($2,008). If they succeed, the ETH/USDT pair could rally to the 50-day SMA ($2,213) which could act as a stiff resistance.

If the price turns down from the 50-day SMA, the bears will again try to pull the price below $1,728.74. If they manage to do that, the pair could start the next leg of the downtrend that may reach $1,536.92.

The buyers will have to clear the hurdle at the downtrend line to signal a possible change in trend.

BNB/USDT

Binance Coin (BNB) has bounced off the $251.41 support today which is a positive sign. This suggests that bulls are not waiting for a deeper correction to buy.

The buyers will now try to push and sustain the price above the downtrend line. If they manage to do that, it will suggest that bears are losing their grip. The BNB/USDT pair could then start its journey toward the overhead resistance at $433.

Conversely, if the price turns down from the downtrend line, it will indicate that bears are selling on rallies. The sellers will then again attempt to pull the price down to the critical support at $211.70. A break below this support could complete a bearish descending triangle pattern and start the next leg of the downtrend.

ADA/USDT

Cardano (ADA) plunged to the critical support at $1 on July 20 but the bulls aggressively purchased this dip, resulting in a strong rebound today. The relief rally could now reach the 20-day EMA ($1.25) where bears may offer a stiff resistance.

If bulls drive the price above the 20-day EMA, the ADA/USDT pair could rise to the 50-day SMA. If the momentum clears this hurdle, the pair could rise to the downtrend line. A breakout and close above this resistance will invalidate the bearish descending triangle pattern, which could open the doors for a rally to $1.94.

Conversely, if the price turns down from the 20-day EMA, the bears will again try to sink the pair below $1. If that happens, panic selling may ensue and the pair could start its downward journey to $0.80 and then to $0.68.

XRP/USDT

XRP has bounced off the critical support at $0.50 today, indicating that bulls are attempting to defend this level aggressively. The rebound could rise to the 20-day EMA ($0.61), which is likely to act as a stiff hurdle.

If the price once again turns down from the 20-day EMA, it will suggest that sentiment remains negative and traders are selling on rallies. The bears will then try to pull the price below the $0.50 support.

If that happens, the XRP/USDT pair could resume the downtrend. The next support is at $0.45 and then $0.40. Alternatively, if bulls drive the price above the 20-day EMA, it will indicate that bears are losing their grip. The pair may then rise to the overhead resistance at $0.75.

DOGE/USDT

Dogecoin (DOGE) has once again bounced off the $0.15 support today, suggesting that bulls are aggressively attempting to defend this level. The relief rally could now reach the overhead resistance at $0.21.

The downsloping moving averages and the RSI in the negative zone indicate that bears will try to stall the rally at $0.21. If the price turns down from this resistance, the DOGE/USDT pair could again drop to $0.15 and remain range-bound for a few days.

A breakout of $0.21 will be the first sign of strength and could result in a rally to the 50-day SMA ($0.26). On the contrary, if the price turns down and plummets below $0.15, the pair may witness panic selling and could drop to $0.10.

DOT/USDT

Polkadot (DOT) plummeted near the psychological level at $10 on July 20 where buying emerged. This has resulted in a strong recovery today.

The buyers may face stiff resistance at the 20-day EMA ($14). If the price turns down from this resistance, bears will again attempt to sink the DOT/USDT pair below $10. If they succeed, the downtrend could extend to $7.80.

Contrary to this assumption, if bulls push the price above the 20-day EMA, the pair could move up to the 50-day SMA ($17.82). A breakout and close above this resistance will signal a possible change in trend.

UNI/USDT

Uniswap (UNI) turned down from the overhead resistance at $16.93 on July 19 and started its southward march toward the next critical support at $13 but the bulls had other plans. They purchased at lower levels today, resulting in a strong recovery.

The up-move could face stiff resistance at the 20-day EMA ($17.89). If the price turns down from this resistance, the bears may fancy their chances and will again try to sink the UNI/USDT pair below $13.

If they succeed, the pair could start the next leg of the downtrend and slide to the psychological support at $10. Conversely, if bulls propel the price above the 20-day EMA, the pair may reach the downtrend line. A breakout of this resistance will indicate that bears are losing their grip.

Related: It is time for the US to create a ‘Ripple test’ for crypto

BCH/USDT

Bitcoin Cash (BCH) dropped to $383.53 on July 20 from where it is attempting to start a relief rally. This suggests that bulls are accumulating at lower levels.

The pullback could reach the 20-day EMA ($465) where bears are likely to mount a stiff resistance. If the price turns down from the 20-day EMA, the sellers will make one more attempt to sink the BCH/USDT pair below $370.

If they manage to do that, the decline could extend to the next support at $330. On the other hand, if bulls thrust the price above the 20-day EMA, the pair may rally to the overhead resistance at $538.11.

LTC/USDT

Litecoin (LTC) plunged below the $118 support on July 19, completing a bearish descending triangle pattern. The decline had pushed the RSI into oversold territory, suggesting that selling was overdone in the short term.

The LTC/USDT pair has started a recovery today and may retest the breakdown level at $118. If bears flip this level into resistance, the pair could make one more attempt to resume the downtrend. A break below the $100 psychological support could start the next leg of the down move that may reach $70.

On the contrary, if bulls push and sustain the price above $118, the pair could climb up to the 20-day EMA ($127) where bears may again try to stall the relief rally. If they succeed, the pair could again turn down but if bulls drive the price above the 20-day EMA, a rally to the 50-day SMA ($145) is possible.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.