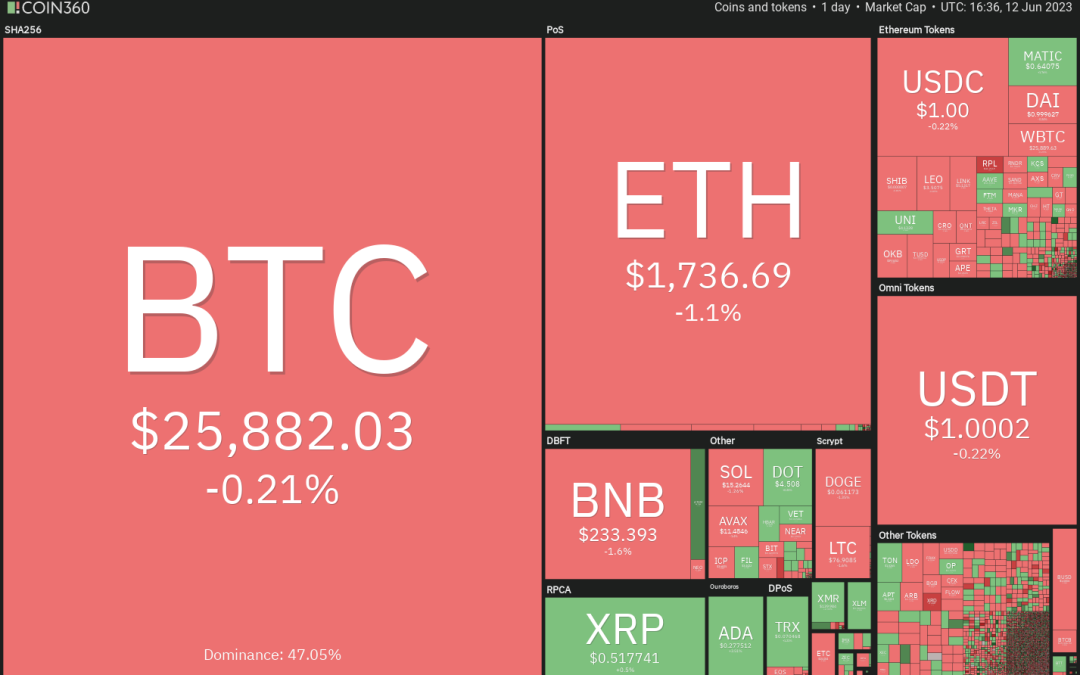

After the tough sell-off seen in the past week, the cryptocurrency markets will be looking for some support from the macroeconomic data this week. The all-important United States Consumer Price Index report on June 13 will be followed up by the Federal Reserve’s policy decision on June 14.

Both these events could trigger a sharp response from equities and crypto traders. While a knee-jerk reaction is expected, it will be interesting to note if there is any follow-up to it. Traders may remain cautious as market volatility is likely to pick up over the next few days.

Although the lawsuit by the U.S. Securities and Exchange Commission (SEC) against Binance and Coinbase has weakened sentiment, Bitcoin (BTC) whales are using this opportunity to increase their holdings. Behavior analytics platform Santiment said in a recent report that Bitcoin whales accumulated 57,578 Bitcoin since April 9, even as Bitcoin’s price fell by roughly 10% during the period.

What are the important support levels in Bitcoin and the major altcoins that need to hold for the recovery to start? Let’s study the charts to find out.

S&P 500 Index price analysis

The S&P 500 Index (SPX) reached the overhead resistance at 4,325 on June 9, but the long wick on the day’s candlestick shows that the bears are trying to stall the up move at this level.

The upsloping moving averages and the relative strength index (RSI) in the positive territory indicate that the path of least resistance is to the upside. If buyers thrust the price above 4,325, the index could start its march toward 4,500, where the bulls may encounter selling from the bears.

This positive view will invalidate in the near term if the price turns down and breaks below the moving averages. Such a move will suggest that the bulls are aggressively booking profits. The index could then tumble to the uptrend line.

U.S. Dollar Index price analysis

The U.S. Dollar Index (DXY) skidded back below the 20-day exponential moving average (EMA) of 103 on June 8, but the bears are struggling to sustain the lower levels.

Buyers are trying to propel the price back above the 20-day EMA, which could start a rally to 104.70 and subsequently to 106. This level is likely to act as a formidable resistance.

The flattish 20-day EMA and the RSI just above the midpoint suggest that the index may remain inside the large range between 100.82 and 106 for a while longer.

Alternatively, if the price turns down and slips back below the 20-day EMA, it will suggest that the bears are selling on rallies. The index could then start a deeper correction to the 50-day simple moving average (SMA) of 102.

Bitcoin price analysis

The bulls have managed to sustain Bitcoin above the important support of $25,250 for the past few days, indicating strong buying at the level.

Although the downsloping moving averages indicate an advantage to bears, the positive divergence on the RSI suggests that the selling pressure could be reducing. The bulls will try to thrust the price above the 20-day EMA ($26,654), clearing the path for a potential rally to the resistance line of the descending channel.

Instead, if the price turns down from the 20-day EMA, it will suggest that the bears are maintaining their selling pressure. The BTC/USDT pair could then retest the support at $25,250. If this level breaks down, the pair may decline to the support line of the channel and eventually to $20,000.

Ether price analysis

Ether (ETH) tried to start a recovery on June 11, but the shallow bounce suggests that the bears are selling on every minor rally.

The bears are trying to strengthen their position further by dragging the price below the immediate support at $1,700. If that happens, it will suggest the start of a deeper correction. There is minor support at $1,600, but if this level gives way, the decline may extend to $1,352.

On the contrary, if the ETH/USDT pair once again rebounds off $1,700, it will signal that the bulls are fiercely protecting the level. A rally above the resistance at $1,778 could clear the path for a potential up move to the moving averages.

BNB price analysis

BNB’s (BNB) price fell from $305 on June 5 to $220 on June 12, a 27% fall within a few days. This indicates that the bears are in firm command.

The sharp decline has pulled the RSI into deeply oversold territory, suggesting that a relief rally is possible in the next few days. The BNB/USDT pair could first rise to $240 and thereafter attempt a rally to the 38.2% Fibonacci retracement level of $252.50.

If the price turns down from this level, it will suggest that the sentiment remains negative and traders continue to sell on rallies. The bears will then again try to tug the price below $220. If they pull it off, the pair could nosedive to $200 and then to $183.

XRP price analysis

XRP (XRP) has been a relative outperformer in the past few days, as the bulls have managed to sustain the price above the moving averages.

The buyers will have to overcome the obstacle at $0.56 to start the next leg of the uptrend. The XRP/USDT pair could then rise to $0.65.

However, this may not be easy because bears are likely to protect the $0.56 level with vigor. If the price dips below the 20-day EMA ($0.50), it could signal that the bulls are losing their grip. The pair may then slump to the 50-day SMA ($0.47), which is an important level to keep an eye on.

If the price rebounds off this level, the pair may oscillate between the 50-day SMA and $0.56 for a few days.

Cardano price analysis

Cardano (ADA) succumbed to intense selling pressure after breaking down from the ascending channel pattern on June 5.

The downward move continued, and on June 10, the ADA/USDT pair plunged below the crucial support at $0.24. This drop sent the RSI deep into the oversold territory, indicating that the selling may have been overdone in the near term.

Strong buying at $0.22 started a recovery that may first reach $0.29 and then the 20-day EMA ($0.33). This zone is likely to witness intense battles between the bulls and the bears. If the price turns down from the zone, it will suggest that bears remain in the driver’s seat.

Related: Bitcoin and select altcoins show resilience even as the crypto market sell-off continues

Dogecoin price analysis

The bears pulled Dogecoin (DOGE) below $0.06 on June 10, but the bulls purchased this drop and the price recovered to close above the support.

However, the bulls are struggling to start a meaningful pullback, indicating that demand dries up at higher levels. The bears will once again try to sink the price below the strong support at $0.06. If they do that, the DOGE/USDT pair could slump to the next major support near $0.05.

The bulls are expected to guard the zone between $0.06 and $0.05 with all their might because a break below it may lead to panic selling. Buyers will have to kick the price back above $0.07 to gain strength.

Solana price analysis

Solana (SOL) slipped below the strong support of $15.28 on June 10, but the long tail on the candlestick shows aggressive buying at lower levels.

Buyers attempted to start a rebound, but the doji candlestick pattern on June 11 shows that the bears are not willing to let go of their advantage easily. They are again trying to pull the price below the support at $15.28. If they succeed, the price could decline to the next support at $12.69.

Contrarily, if the price turns up from the current level and rises above $16.18, it will signal the start of a stronger recovery. The SOL/USDT pair could then rise to the 20-day EMA ($18.85), where the bears may again mount a strong defense.

Polygon price analysis

Polygon (MATIC) plummeted below the vital support of $0.69 on June 10, indicating that bears are in firm control.

A minor solace for the buyers is that the price recovered sharply off the strong support near $0.50 as seen from the long tail on the day’s candlestick. The MATIC/USDT pair will attempt a bounce, which is likely to face strong selling at the breakdown level of $0.69.

If the price turns down from this level, it will suggest that the bears are trying to flip $0.69 into resistance. That could result in a retest of $0.50. If bulls want to start a sustained recovery, they will have to drive and sustain the price above the 20-day EMA ($0.79).

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.