The takeover of the ailing Credit Suisse bank by UBS boosted European equity markets on March 20, but not everyone is happy with the deal. According to the Swiss Financial Market Supervisory Authority, the value of additional tier-one (AT1) bonds will be written to zero, which will wipe out $17 billion worth of investments for AT1 bond investors.

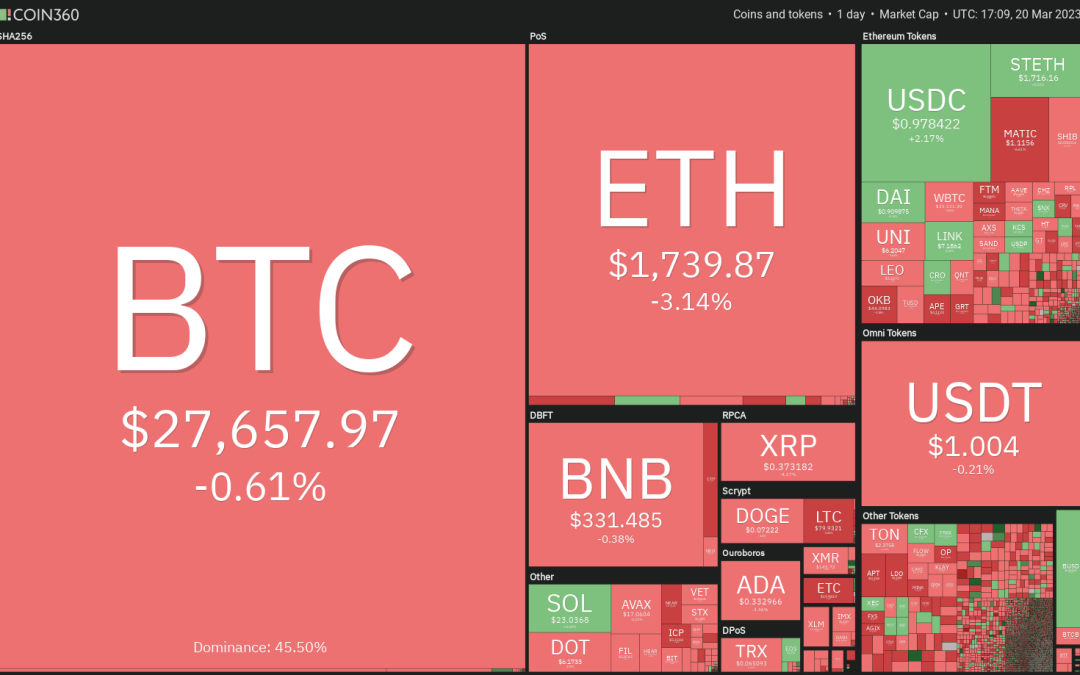

Among the turmoil in the global banking sector, Bitcoin (BTC) has shone brightly, as traders seem to have shifted their focus to the alternative available to the legacy banking system. Another thing working in favor of Bitcoin is that it has decoupled from the United States equities markets and is behaving as an uncorrelated asset class.

Bitcoin’s solid rally in the past few days has boosted trader sentiment. The Crypto Fear and Greed Index has soared into the greed zone with a score of 66/100. The next trigger for the markets will be the rate hike decision by the Federal Reserve on March 22.

Could Bitcoin reach $30,000 and pull altcoins higher, or is a correction likely in the near term? Let’s study the charts to find out.

S&P 500 index price analysis

The S&P 500 index (SPX) rallied from 3,808 on March 13 and rose above the 200-day simple moving average, or SMA (3,935), on March 16, but the bulls could not clear the hurdle at the 20-day exponential moving average, or EMA (3,962).

A positive sign is that the bulls purchased the dip below the 200-day SMA and are again attempting to overcome the obstacle at the 20-day EMA. If they succeed, the index could rally to 4,100 and then to 4,200.

The bears are likely to have other plans. They will try to halt the recovery at the 20-day EMA and sink the price back toward the support zone between 3,800 and 3,764. If this zone gives way, the selling could intensify, and the index may plummet toward 3,600.

U.S. Dollar Index price analysis

The U.S. Dollar Index (DXY) has been trading near the 20-day EMA (104) for the past few days, indicating indecision among the bulls and the bears.

If bears sustain the price below 103.44, the index may slip to the next support at 102.50. Buyers will try to defend this level, but if they fail in their endeavor, the index could tumble to the vital support at 100.82.

Alternatively, if the price turns up and breaks above 105.10, it will clear the path for a possible rally to the 200-day SMA (106). The bulls may encounter strong selling in the resistance zone between the 200-day SMA and the 61.8% Fibonacci retracement level of 108.43.

Bitcoin price analysis

Bitcoin (BTC) has been holding above the breakout level of $25,250 since March 17, which is a positive sign. After a one-day correction on March 18, the price continued its northward march on March 19, indicating that the bulls are in no mood to book profits.

The rising 20-day EMA ($24,463) and the relative strength index, or RSI, near the overbought territory indicate that bulls remain in control. The next major resistance is in the zone between $30,000 to $32,500.

If the price turns down from the current level or the overhead resistance, the key level to watch out for is $25,250. If the price rebounds off this level with strength, it will suggest that bulls have flipped $25,250 into support. The level will thereafter act as a floor during future declines.

Ether price analysis

Buyers pushed Ether (ETH) above the $1,800 resistance on March 18 and 19 but could not sustain the higher levels. This shows that bears are trying to stall the recovery.

A minor positive in favor of the bulls is that they have not allowed the price to slide back below the $1,743–$1,680 support zone. The rising 20-day EMA ($1,654) and the RSI above 61, suggest that the path of least resistance is to the upside.

If buyers propel and sustain the price above $1,850, the ETH/USDT pair may start its journey toward $2,000 and subsequently to $2,200.

This positive view will invalidate in the near term if the price turns down and plummets below the 20-day EMA. That may trap the aggressive bulls, resulting in long liquidations. The pair could then slump to $1,461.

BNB price analysis

BNB (BNB) formed an inside-day candlestick pattern on March 19 and 20, indicating indecision among the bulls and the bears.

The bears are mounting a strong defense above $340, but the bulls have not given up much ground. The upsloping 20-day EMA ($311) and the RSI near the overbought zone give a slight edge to the bulls. If buyers kick the price above $350, the BNB/USDT pair may rally to $400.

On the contrary, if the price breaks below $325, the pair could drop to $318. A strong rebound off this level will suggest that the bulls have flipped the level into support, while a break below $318 may sink the pair to the 200-day SMA ($288).

XRP price analysis

XRP (XRP) reached the 200-day SMA ($0.40) on March 19, but the bulls could not overcome this barrier, as seen from the long wick on the candlestick.

The XRP/USDT pair continues to swing between the 200-day SMA and the horizontal support at $0.36. The flattish 20-day EMA and the RSI near the midpoint do not give a clear advantage either to the bulls or the bears. This indicates that the range-bound trading may continue for a while longer.

On the upside, a break and close above the 200-day SMA will indicate that bulls have overpowered the bears. The pair could first climb to $0.43 and later to $0.51. This positive view will be negated if the price turns lower and plunges below $0.36. The pair could then tumble to the support line of the channel.

Cardano price analysis

The bears are defending the 200-day SMA ($0.36) on Cardano’s ADA (ADA) while the bulls are buying the dips to the 20-day EMA ($0.34).

This tight range may not remain for long. If buyers push the price above the 200-day SMA, the ADA/USDT pair could attempt a rally to the neckline of the developing head-and-shoulders pattern. The bears are expected to defend the neckline with vigor because a break and close above it will signal a potential trend change.

On the contrary, if the price sustains below the 20-day EMA, the pair could drop to the immediate support at $0.31 and next to $0.30.

Related: Paris Blockchain Week 2023: Latest updates by Cointelegraph

Polygon price analysis

Polygon’s MATIC (MATIC) has been trading near the 20-day EMA ($1.16) for the past few days. The 20-day EMA has flattened out and the RSI is just below the midpoint, indicating a balance between supply and demand.

The $1.30 resistance is an important level to watch out for. If buyers clear this hurdle, the MATIC/USDT pair could soar to $1.57. This level may witness a tough battle between the bulls and the bears. If bulls come out on top, the pair may extend its up-move to $1.75.

The crucial level to watch on the downside is the 200-day SMA ($0.96). If the price breaks and sustains below this level, it will suggest that bears have seized control. The pair could then nosedive to $0.69.

Dogecoin price analysis

Dogecoin (DOGE) rose above the 20-day EMA ($0.07) on March 17, but the bulls could not push the price above the 200-day SMA ($0.08). This shows that the bears are unwilling to let go of their advantage.

The flat 20-day EMA and the RSI near the midpoint suggest range-bound action in the near term. The boundaries for the range could be the 200-day SMA on the upside and $0.07 on the downside.

If bulls kick the price above the 200-day SMA, it will suggest that the markets have rejected the lower levels. The DOGE/USDT pair could then rally to $0.09 and thereafter to $0.10. Alternatively, a break below $0.07 could clear the path for a retest of $0.06.

Solana price analysis

Solana’s SOL (SOL) turned down from the 200-day SMA ($22.7) on March 18 but rebounded off the 20-day EMA ($20.98) on March 19. This suggests solid demand at lower levels.

Buyers pushed the price above the 200-day SMA, and the SOL/USDT pair has reached the downtrend line. If bulls push and sustain the price above the downtrend line, it will point to a potential trend change. There is a minor resistance at $27.12, but it is likely to be crossed. The pair may then attempt a rally to $39.

The first support on the downside is the 20-day EMA and then $18.70. If both these levels fail to hold, the pair may retest the vital support at $15.28.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.