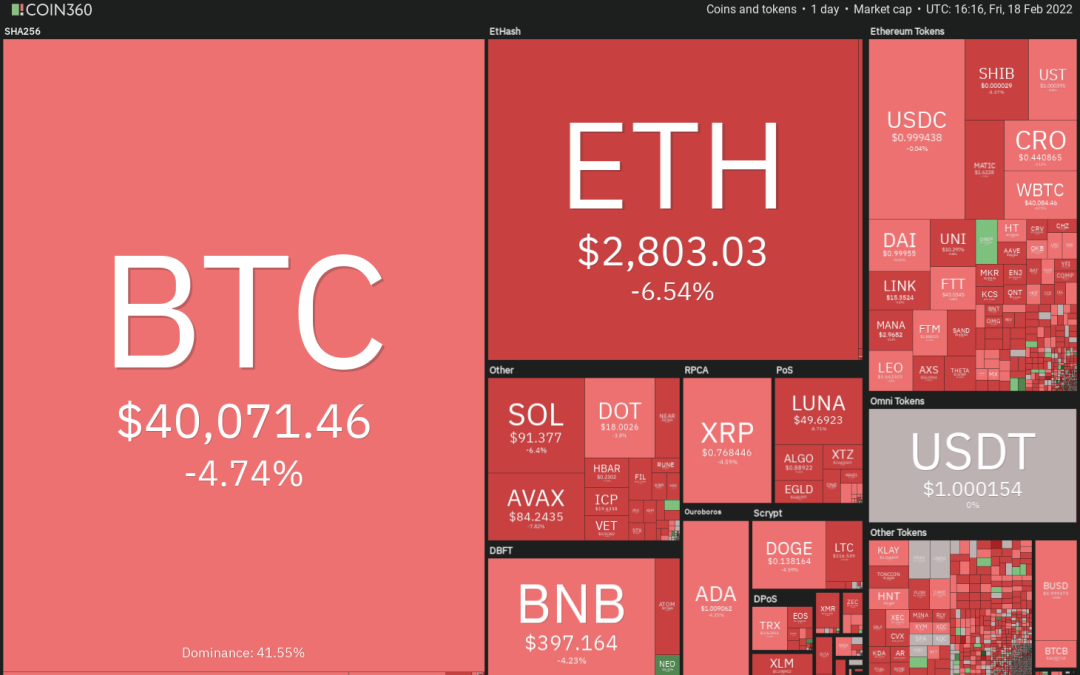

Bitcoin (BTC) sold off along with the U.S. equity markets on Feb. 17 on reports that Russia expelled Bart Gorman, the second highest-ranking American official from the U.S. Embassy in Moscow and U.S. President Joe Biden cautioned that the threat of a Ukrainian invasion by Russia remains “very high.”

Although the near-term correlation between Bitcoin and the U.S. equity markets remains high, Pantera Capital CEO Dan Morehead said in a recent newsletter that the “markets will decouple soon.” Morehead mentioned that the U.S. Federal Reserve’s rate hikes will be negative for bonds, stocks and real estate and cryptocurrencies may be the “best place” to park capital.

While traders are fixated on the near-term price action, Jurrien Timmer, the director of Global Macro at Fidelity Investments, dismissed it as noise. Timmer highlighted the similarities in the growth of Bitcoin and Apple networks and concluded that Bitcoin could rally above $100,000 in the long term.

Bitcoin and several major altcoins are at a critical juncture. Could bulls hold the key support levels? Let’s analyze the charts of the top-10 cryptocurrencies to find out.

BTC/USDT

Bitcoin plunged below the moving averages on Feb. 17, indicating that bears are in no mood to relent and are selling on rallies. The price is near $39,600, which is an important level for the bulls to defend.

The relative strength index (RSI) has slipped into the negative territory and the 20-day exponential moving average (EMA) ($41,635) has started to turn down. This suggests that bears are attempting to gain the upper hand.

A break and close below $39,600 could increase the selling pressure and the BTC/USDT pair may drop to $36,250.

If the price rebounds off the current level, the bulls will again try to push the pair above the moving averages. If they succeed, the pair could gradually rally toward $45,821 but buyers will have to clear this hurdle to signal a possible change in trend.

ETH/USDT

Ether (ETH) turned down from close to the neckline of the developing inverse head and shoulders pattern on Feb. 16. This suggests that bears are trying their best to invalidate the possible reversal setup.

The ETH/USDT pair could now drop to the strong support at $2,652. This is an important level for the bulls to defend because a break below it could open the doors for a further downside to $3,476.

Contrary to this assumption, if the price rebounds off the current level, the bulls will again attempt to push and sustain the price above the neckline. If that happens, it will suggest the start of a new up-move. However, the prospects of such a move look bleak at the moment.

BNB/USDT

BNB turned down from the 50-day simple moving average (SMA) ($430) on Feb. 16 and broke below the 20-day EMA ($408) on Feb. 17.

The BNB/USDT pair has been consolidating between $390.50 and $445.40 for the past few days. The flattish 20-day EMA and the RSI just below the midpoint suggest a balance between supply and demand.

This balance will tilt in favor of the bears if the price breaks and sustains below $390.50. That could open the doors for a possible drop to $357.40. Conversely, a break and close above $445.40 could open the doors for a possible rally to $500. Until then, the range-bound action is likely to continue.

XRP/USDT

The failure of the bulls to sustain Ripple (XRP) above $0.85 may have led to profit-booking by short-term traders. That pulled the price down to the strong support at $0.75.

The buyers are likely to defend the zone between the moving averages. If the price bounces off this support zone, the XRP/USDT pair could rise to $0.85. A break and close above this level could challenge the resistance at $0.91. The gradually rising 20-day EMA and the RSI near the midpoint suggest a minor advantage to buyers.

This positive view will invalidate if the bears pull the price below the 50-day SMA ($0.73). Such a move could trigger several stop-losses, resulting in a possible decline to $0.65 and then $0.60.

ADA/USDT

Cardano (ADA) has been sandwiched between the 20-day EMA ($1.09) and the psychological support at $1 for the past few days. This tight-range trading is likely to result in a strong directional move within the next few days.

The downsloping moving averages and the RSI in the negative zone indicate that the path of least resistance is to the downside. If the bears sink and sustain the price below $1, the ADA/USDT pair could resume its downtrend. The pair could then decline to $0.80 and later to $0.68.

Contrary to this assumption, if the price rises from the current level, the bulls will try to drive the pair above the moving averages. If they do that, the pair could rally to the resistance line of the channel.

SOL/USDT

Solana (SOL) turned down from the 20-day EMA ($103) on Feb. 16 and the bears will now try to pull the price below the minor support at $90.72. If that happens, the decline could extend to strong support at $80.83.

The gradually downsloping 20-day EMA and the RSI in the negative territory indicate that bears have the upper hand. A break and close below $80.83 could signal the resumption of the downtrend. The SOL/USDT pair could then drop to the support line of the channel.

On the contrary, if the price rebounds off the current level, the buyers will try to propel the pair above the 20-day EMA and challenge the resistance line of the descending channel. A break and close above this level will signal that the downtrend could be over.

AVAX/USDT

Avalanche (AVAX) broke and closed above the downtrend line on Feb.16 but the bulls could not build upon this advantage. Strong selling by the bears at higher levels has pulled the price back below the downtrend line.

The bulls are attempting to defend the moving averages. If the price rebounds off the current level, the buyers will try to push and sustain the AVAX/USDT pair above the downtrend line and $98.77. Such a move will suggest a rally to $117.53.

Conversely, if the price breaks below the moving averages, the uptrend line will be tested. A break and close below this support could accelerate selling and the pair may drop to $76.14 followed by a decline to $65.

Related: XRP ‘mega whales’ scoop up over $700M in second-biggest accumulation spree in history

LUNA/USDT

Terra’s LUNA token broke and closed above the 20-day EMA ($55) on Feb. 15, but the bulls could not sustain the higher levels. This may have attracted selling by the short-term traders, which has pulled the price back below the 20-day EMA.

Both moving averages are sloping down and the RSI is in the negative zone, indicating that bears have the upper hand. If the sellers pull the price below $49, the LUNA/USDT pair could drop to the strong support at $43.44. The buyers are expected to defend the zone between $43.44 and $37.50 aggressively.

Alternatively, if the price rebounds off the current level, the bulls will make one more attempt to push the pair above the 20-day EMA. If they succeed, the pair could rally to the downtrend line of the channel.

DOGE/USDT

Dogecoin (DOGE) turned down from the 50-day SMA ($0.15) on Feb. 16, suggesting that bears are selling on relief rallies to this resistance.

There is a minor support at $0.13. If the price bounces off this level, the bulls will again try to push the DOGE/USDT pair above the 50-day SMA. If they succeed, the pair could rise to the overhead resistance at $0.17.

The flattish 20-day EMA ($0.14) and the RSI in the negative zone indicate a minor advantage to sellers. If the price slips below $0.13, the pair could drop to the strong support at $0.12 where the buyers are likely to step in to arrest the decline.

DOT/USDT

Polkadot (DOT) turned down from the 20-day EMA ($19.82) on Feb. 17, indicating that the sentiment remains negative and traders are defending the overhead resistance levels.

The bears will now try to pull the price to $16.81, which is an important support to watch out for. If the price rebounds off this level, the bulls will again attempt to drive the DOT/USDT pair above the downtrend line. If they succeed, the pair could rise to $23.19.

Alternatively, if bears pull the price below $16.81, the selling could intensify and the pair could extend its decline toward the next support at $10.37. The downsloping moving averages and the RSI in the negative territory indicate the path of least resistance is to the downside.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.