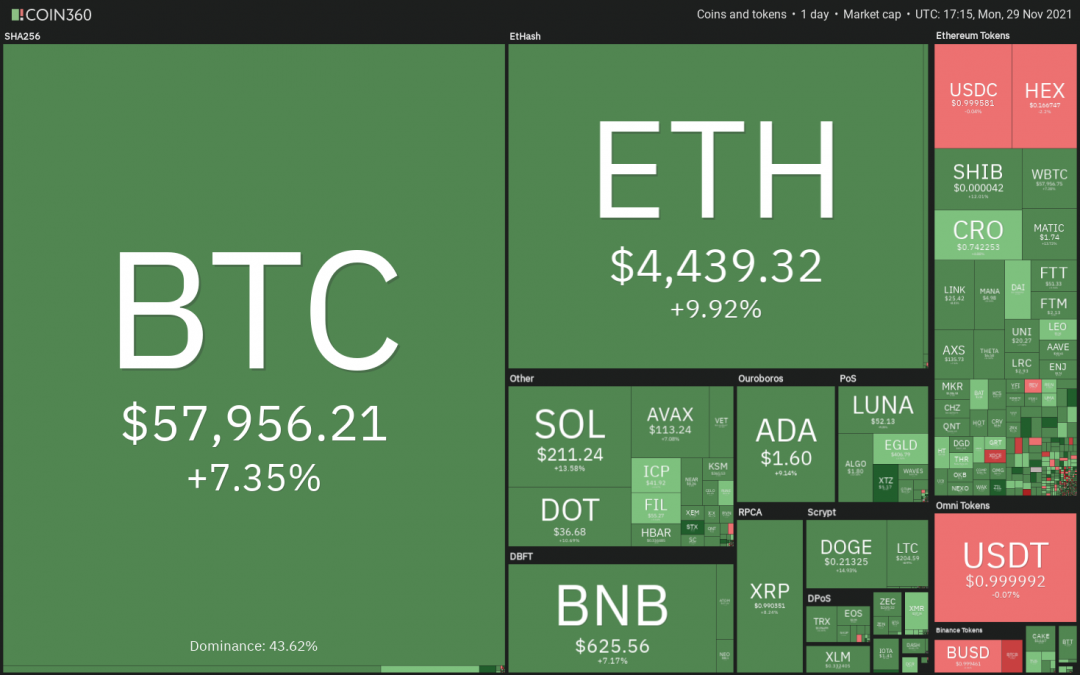

The crypto markets and the global equity markets staged a strong recovery on Nov. 29 in spite of the uncertainty from the newly discovered Omicron variant of COVID-19.

Long-term investors seem to view the recent dip as a prime buying opportunity. A recent filing by MicroStrategy showed that the firm purchased 7,002 Bitcoin (BTC) at an average price of $59,187. That boosted MicroStrategy’s total stash to 121,044 Bitcoin, bought at an average price of about $29,534 per coin.

However, analytics resource Material Scientist cited order book data to say that “a lot of Bitcoin liquidity has been taken” and warned that “stop hunters” may attempt to shake out the weak hands with a fall.

Is the current recovery a bull trap or is it the start of a sustained relief rally? Let’s study the charts of the top 10 cryptocurrencies to find out.

BTC/USDT

Bitcoin’s relief rally is facing resistance at the 20-day exponential moving average (EMA) ($58,712). This suggests that sentiment remains negative and bears are attempting to sell on rallies to the overhead resistance level.

Although the 20-day EMA continues to slope down, the RSI has risen above 46, suggesting that the bearish momentum could be weakening.

The bulls will have to push and sustain the price above the 50-day simple moving average (SMA) ($60,805) to signal that the corrective phase may be over. The rally could then challenge the overhead resistance zone at $67,000 to $69,000.

On the other hand, if the price turns down sharply from the 20-day EMA, the bears will attempt to break the strong support at the 100-day SMA ($54,184). If that happens, the BTC/USDT pair could slump to the psychologically critical level at $50,000.

The bulls are expected to defend this level aggressively because a break below it could result in panic selling. The pair could then slide to the next important support at $40,000.

ETH/USDT

Ether (ETH) rebounded off the neckline of the developing head and shoulders (H&S) pattern on Nov. 28, suggesting that bulls are defending the level with all their might. Sustained buying pushed the price above the 20-day EMA ($4,316) on Nov. 29.

A break and close above the overhead resistance at $4,551 will indicate that the correction may be over. The ETH/USDT pair could then rally to the all-time high at $4,868. A break above this level will invalidate the bearish setup and open the doors for a possible rally to $5,796.

Alternatively, if the price turns down from the current level and breaks below the 50-day SMA ($4,243), the bears will make one more attempt to sink the pair below the neckline. A close below this level will complete the bearish setup and start a down move.

The selling may accelerate below the 100-day SMA ($3,794). The pair could then start its journey toward the pattern target at $3,047.

BNB/USDT

The long tail on Binance Coin’s (BNB) Nov. 28 candlestick indicates that bulls are buying the dips below the 20-day EMA ($595). The bulls will now attempt to push the price to the overhead resistance zone at $669.30 to $691.80.

A break and close above $669.30 will complete an inverted H&S pattern. This bullish setup has a target objective at $828.60. The 20-day EMA is trying to turn up and the RSI is at 56, suggesting that bulls are attempting to gain the upper hand.

The first sign of weakness will be a break and close below the 20-day EMA. The bears will then try to sink and sustain the price below the 50-day SMA. Such a move could result in a decline to the strong support at $510.

SOL/USDT

Solana (SOL) once again dropped below the support line of the symmetrical triangle on Nov. 28 but the bears could not sustain the lower levels. This suggests aggressive buying on dips.

The SOL/USDT pair broke above the 50-day SMA ($204) on Nov. 29 and the bulls will now try to surmount the barrier at the 20-day EMA ($212). If they succeed, the pair could rally to the resistance line where the bears may pose a stiff challenge.

A break and close above the resistance line will suggest that the correction may be over. The pair could then rally to $240 and later to $259.90.

On the contrary, if the price turns down from the 20-day EMA, the bears will again attempt to sink and sustain the pair below the support line. The selling could accelerate on a break and close below the 100-day SMA ($172).

ADA/USDT

Cardano (ADA) is in a downtrend. The price bounced off $1.41 on Nov. 28 but the bulls are struggling to sustain the higher levels.

The 20-day EMA ($1.78) continues to slope down and the RSI is near the oversold zone, indicating that bears are in control. If the price turns down from the current level, the bears will attempt to sink the ADA/USDT pair below $1.40.

If they succeed, the downtrend could resume with the next target objective at $1.20. The bulls will have to push and sustain the price above the 20-day EMA to negate the bearish view. The pair could then rise to the strong resistance at $1.87.

XRP/USDT

The long tail on Ripple’s (XRP) Nov. 28 candlestick shows aggressive buying near the strong support at $0.85. The price has reached the psychological level at $1, which may now act as a resistance.

If the price turns down from the current level, it will suggest that the bears have flipped the $1 level into resistance. The XRP/USDT pair could then drop to $0.85. A break and close below this level will signal the start of a deeper correction to $0.70.

Alternatively, if the price rises above $1, the pair could rally to the 20-day EMA ($1.05). This level could again act as a stiff resistance but if bulls overcome this hurdle, the pair could rally to the 50-day SMA ($1.10).

DOT/USDT

Polkadot (DOT) bounced off $32.21 on Nov. 28, indicating that bulls are attempting to defend the strong support at $32. The recovery is facing selling at the 100-day SMA ($37.16) suggesting that bears are selling on relief rallies.

If the price turns down from the current level or the breakdown level at $38.70, the bears will attempt to extend the decline. A break and close below $32 could start the next leg of the down move that may reach $26.

The 20-day EMA ($40.41) continues to slope down and the RSI is in the negative zone, suggesting that bears have the upper hand. The bulls will have to push and sustain the DOT/USDT pair above the breakdown level at $38.70 to invalidate the bearish view.

Related: Binance resumes DOGE withdrawals days after Elon Musk’s comments

DOGE/USDT

Dogecoin (DOGE) bounced off the $0.19 support on Nov. 28, suggesting that bulls are accumulating at lower levels. The buyers pushed the price above the $0.21 overhead resistance on Nov. 29 but could not clear the hurdle at the 20-day EMA ($0.22).

The long wick on Nov. 29’s candlestick indicates that sentiment remains negative and traders are selling on rallies. If the price sustains below $0.21, the bears will make one more attempt to pull the price below $0.19. If they do that, the DOGE/USDT pair could plummet to the support at $0.15.

Contrary to this assumption, if bulls push and sustain the price above the 20-day EMA, it will signal a change in the short-term trend. The pair could then rise to the 100-day SMA ($0.24) and pick up momentum if this resistance is crossed.

AVAX/USDT

Avalanche (AVAX) bounced off the 20-day EMA ($106) on Nov. 27 and again on Nov. 28 but the bulls are struggling to sustain the rebound. This indicates that demand dries up at higher levels.

The shallow rebound increases the possibility of a break below the 20-day EMA. If bears sink the price below the 20-day EMA and the $100 support zone, the selling could intensify. The AVAX/USDT pair could then drop to the 61.8% Fibonacci retracement level at $91.39.

Conversely, if the price rebounds off the support zone, the bulls will again attempt a recovery. If buyers propel the price above $120, the pair could rise to $130. A break and close above this resistance could open the doors for a retest of the all-time high at $147.

SHIB/USDT

SHIBA INU (SHIB) has been trading below $0.000040 for the past three days but the bears have not been able to capitalize on this weakness and pull the price to the 100-day SMA ($0.000027). This indicates a lack of sellers at lower levels.

If bulls drive and sustain the price above $0.000040, the SHIB/USDT pair could rise to the 20-day EMA ($0.000044). This level is again likely to act as a strong resistance. If the price turns down from this level, it will indicate that sentiment remains negative and traders are selling on rallies.

The bears will then make one more attempt to sink the price below $0.000035 and resume the downtrend. This negative view will invalidate in the short term if bulls push and sustain the price above the 50-day SMA ($0.000046). The pair could then rally to $0.000052.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.