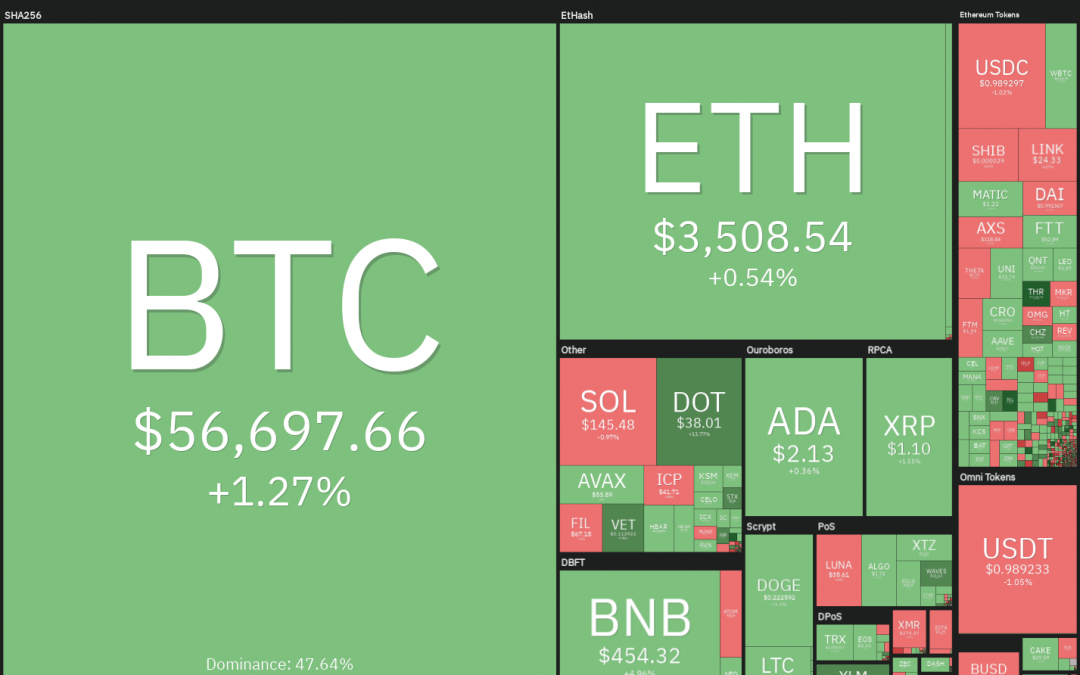

Bitcoin (BTC) has been sustaining above $54,000 for the past few days but that has not resulted in euphoria among investors. Google Trends data shows that Bitcoin search interest has not picked up in recent days and is nearing one-year lows. Some analysts believe that this is a sign that only stronger hands are accumulating.

A recent report from CoinShares also showed that institutional investors pumped more than $226 million into Bitcoin products in the week ending Oct. 8. The analysis firm estimates that the total assets under the management of institutional crypto products have ballooned to $66.7 billion, just 5% below the record hit in May.

Data from Glassnode also shows that the Bitcoin wallets of long-term holders contain 13.3 million Bitcoin, accounting for 70% of the entire Bitcoin supply. The long-term holders have not sold their holdings and have also added more than 2.37 million Bitcoin to their wallets over the past seven months. Bitcoin purchasing by long-term whales outstrips newly mined coins by 12.7 times, the report added.

Could Bitcoin continue its up-move or is it time for a few days of consolidation? Let’s study the charts of the top 10 cryptocurrencies to find out.

BTC/USDT

Bitcoin turned down from $57,680 on Oct. 12 but the long tail on the day’s candlestick suggests buying on dips. The bears again tried to pull the price below the breakout level at $52,920 but the long tail on the day’s candlestick indicates that bulls are not relenting.

The rising 20-day exponential moving average (EMA) ($51,338) and the relative strength index (RSI) in the positive zone indicate an advantage to buyers. If bulls drive the price above $57,839.04, the BTC/USDT pair could rally to $60,000.

This level may act as a tough resistance but if bulls push the price above it, the pair could retest the all-time high at $64,854. The bullish momentum may pick up if bulls overcome this obstacle.

The breakout level at $52,920 remains the key support to watch on the downside. A break below this level and the 20-day EMA will be the first sign that bulls may be losing their grip.

ETH/USDT

Ether (ETH) has rebounded off the 20-day EMA ($3,390) for the past three days, indicating that bulls are accumulating on dips. The bulls will now try to push the price to the neckline of the inverse head and shoulders (H&S) pattern.

A breakout and close above the neckline will complete the bullish setup, which has a target objective of $4,657. The gradually rising 20-day EMA and the RSI above 55 indicate a modest advantage to the bulls.

However, the rally may not be linear as the ETH/USDT pair could face stiff resistance at $4,027.88 and later at $4,372.72.

Contrary to this assumption, if the price turns down from the current level or the neckline and breaks below the moving averages, the ETH/USDT pair could drop to $3,160 and later to the psychological support at $3,000.

BNB/USDT

Binance Coin (BNB) broke and closed below the 20-day EMA ($417) on Oct. 10 but the bears could not build on this advantage. The bulls defended the psychological support at $400 and pushed the price back above the 20-day EMA on Oct. 11.

Although bears pulled the price below $400 on Oct. 12, the move appears to have been a bear trap because the BNB/USDT pair recovered quickly and rebounded to the neckline. The buyers pushed the price above the neckline on Oct. 13.

The bullish inverse H&S pattern will complete if the pair closes above the neckline. This setup could start an up-move to $519.90 where heavy opposition is expected.

A break and close above this level could propel the pair to the pattern target at $554. The bears will have to pull the price below $392.20 to gain the upper hand.

ADA/USDT

Cardano (ADA) broke and closed below the support line of the symmetrical triangle on Oct. 12. This suggests that the uncertainty of the past few days has resolved in favor of the bears.

The bulls will try to push the price back above the 20-day EMA ($2.21) but if they fail, the ADA/USDT pair could drop to $1.87. This is a critical level to monitor because if it breaks down, the decline may extend to $1.63.

The 20-day EMA has started to turn down and the RSI has dropped below 44, indicating advantage to bears. This negative perspective will be invalidated if bulls push and sustain the pair above the resistance line of the triangle.

XRP/USDT

Ripple (XRP) bounced off the 20-day EMA ($1.06) on Oct. 12 but the bulls are finding it difficult to sustain the price above the 50-day simple moving average ($1.08). This suggests a lack of buyers at higher levels.

If bears sink and sustain the price below the 20-day EMA, the XRP/USDT pair could drop to the psychological support at $1. A break and close below this level could intensify selling and sink the pair to $0.85.

Conversely, if the price rises from the current level, the bulls will make one more attempt to push the price above the overhead resistance at $1.24. If they manage to do that, the pair could rally to $1.41.

SOL/USDT

Solana (SOL) broke below the 50-day SMA ($144) on Oct. 12 but bears could not capitalize on this weakness. The bulls bought the dip aggressively and pushed the price back to the 20-day EMA ($151) on the same day.

The SOL/USDT pair rose modestly above the 20-day EMA today but strong selling by the bears has pulled the price back to the 50-day SMA. If bears sink and sustain the price below the 50-day SMA, the decline could extend to $116.

This negative view will invalidate if the price turns up from the current level and breaks above the downtrend line. The pair could then climb to the 61.8% Fibonacci retracement level at $177.80. A break and close above this level could pave the way for a rally to $200.

DOGE/USDT

Dogecoin (DOGE) broke below the 20-day EMA ($0.23) on Oct. 10 and the bulls have not been able to reclaim the level since then. This suggests that bears are putting up a strong defense at the 20-day EMA.

The DOGE/USDT pair could drop to $0.21 and if this support cracks, the next stop could be $0.19. This level has acted as astrong support during the previous two occasions; hence, bulls may again defend it with vigor.

Contrary to this assumption, if the price turns up from the current level and rises above the 20-day EMA, the pair could rally to the downtrend line. A break and close above this resistance will indicate the possible end of the down move.

Related: Crypto scoring big with European football

DOT/USDT

Polkadot (DOT) bounced off the 20-day EMA ($33.02) on Oct. 12, indicating that the sentiment remains positive and traders are buying on dips. The bulls will now try to push the price above the overhead resistance at $38.77 where bears are expected to mount stiff resistance.

If the price turns down from $38.77, the DOT/USDT pair could again drop to the moving averages. This is an important support for bulls to defend because a break below the 50-day SMA ($31.37) could open the doors for a decline to $25.50.

Alternatively, if the price continues to rise from the current level and breaks above $38.77, the uptrend could resume. The first target on the upside is the all-time high at $49.78 and then the pattern target at $52.04.

LUNA/USDT

Terra protocol’s LUNA token dropped to the 50-day SMA ($35.87) on Oct. 12 but the bulls bought this dip as seen from the long tail on the day’s candlestick. The buyers tried to push the price back above the 20-day EMA ($39.15) on Oct. 13 but failed.

The 20-day EMA has started to turn down and the RSI has slipped below the midpoint, indicating that bulls may be losing their grip. If bears pull and sustain the price below the 50-day SMA, the LUNA/USDT pair could drop to $32.50.

This level could act as a strong support but if it cracks, the selling could intensify and the pair may plummet to $25. Alternatively, if the price rebounds off the current level and rises above the 20-day EMA, the bulls may push the pair to $45.01.

UNI/USDT

Uniswap (UNI) bounced off the strong support at $22 on Oct. 12 and bulls pushed the price above the moving averages on Oct. 13. However, the long wick on the day’s candlestick indicates selling at higher levels.

The 20-day EMA ($24.29) is flat and the RSI is just below the midpoint, indicating a balance between supply and demand. A break and close below $22 could tilt the advantage in favor of bears. The UNI/USDT pair could then drop to $18.

Conversely, if the price rises from the current level and breaks above the neckline of the inverted H&S pattern, the bullish momentum could pick up. The pair could first rally to $31.41 and then march toward the pattern target at $36.98.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.