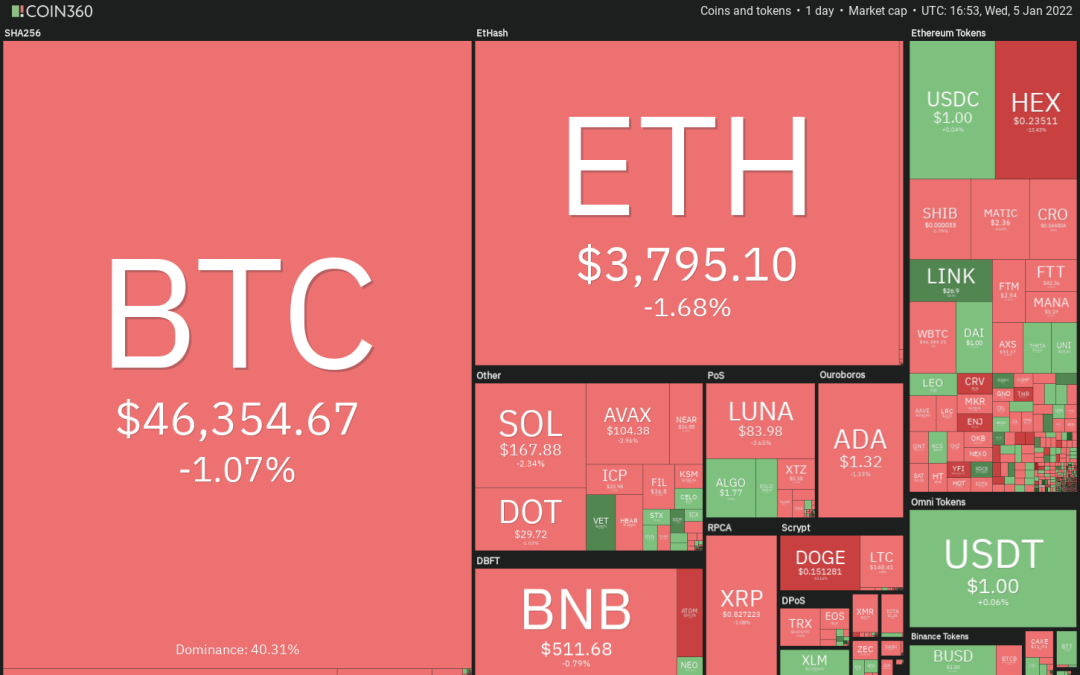

Bitcoin (BTC) and most major altcoins are stuck in a tight range with bulls buying near the support and bears selling at resistance levels. Usually, such tight ranges are followed by an expansion in volatility.

Although a few analysts have not ruled out a quick drop to low $40,000s, most traders expect Bitcoin to rebound sharply and move up to $60,000.

Goldman Sachs said in a note to investors that if Bitcoin continues to increase its market share over gold as a store of value and crosses the 50% mark, then it could rally to $100,000 over the next five years.

On-chain analytics provider Glassnode said in its report on Jan. 3 that Bitcoin’s illiquid supply has increased to more than 76% of the total circulating supply. According to Glassnode researchers, the drop in liquid supply suggests that price capitulation looks unlikely in the near future.

Could Bitcoin surprise with a sharp move down and pull the major altcoins lower? Let’s study the charts of the top 10 cryptocurrencies to find out.

BTC/USDT

Bitcoin’s price is sandwiched between the 20-day exponential moving average (EMA) ($48,033) and the critical support at $45,456. Although both moving averages are sloping down, the relative strength index (RSI) is attempting to form a positive divergence. This indicates that the selling pressure could be reducing.

If bulls push and sustain the price above the 20-day EMA, the BTC/USDT pair could rise to $51,936.33. This level is likely to act as a stiff resistance. If the price turns down from it, the pair could remain range-bound between $51,936.33 and $45,456 for a few more days.

A break and close above $51,936.33 will suggest the start of an up-move that could reach $60,000. On the contrary, if the price turns down and plummets below $45,456, the selling could intensify and the pair could then drop to the $42,000 to $40,000 support zone.

ETH/USDT

Ether (ETH) turned down from the 20-day EMA ($3,881) but the positive sign is that bulls are not giving up much ground. This indicates buying on dips. The bulls will now attempt to push the price back above the 20-day EMA.

If they do that, it will indicate that the correction could be ending. The ETH/USDT pair could then rise to the 50-day SMA ($4,086), which could again act as a resistance. A break and close above this level will suggest the start of an up-move to $4,488 and then to the all-time high at $4,888.

Contrary to this assumption, if the price turns down from the 20-day EMA, a drop to the $3,643.73 to $3,503.68 support zone is possible. This is an important support for the bulls to defend because a break and close below it could open the doors for a possible decline to $3,270 and then to $2,800.

BNB/USDT

Binance Coin (BNB) has turned down from the 20-day EMA ($530) and is currently taking support at the psychological level at $500.

If bears sink and sustain the price below the $500 to $489.20 support zone, the selling momentum could pick up and the BNB/USDT pair could drop to $435.30. The downsloping moving averages and the RSI in the negative territory indicate advantage to bears.

Conversely, if the price rebounds off the current level, it will suggest that bulls continue to defend this support. They will then make one more attempt to push the price above the 20-day EMA. If that happens, that pair could rise to $575.

SOL/USDT

Solana (SOL) turned down from the 20-day EMA ($178) on Jan. 2, indicating that bears are selling on every minor rally. The bears will now try to pull the price below the strong support at $167.88.

If they succeed, the SOL/USDT pair could drop to $148.04, which could act as a strong support. If the bounce off this level fails to rise above $167.99, it will indicate that demand dries up at higher levels.

That could intensify the selling and the pair could drop to the critical support at $120. The bulls will have to push and sustain the price above the moving averages to signal that the selling pressure could be reducing. The pair could then rally to $204.75.

ADA/USDT

Cardano (ADA) has been trading between the 20-day EMA ($1.36) on the upside and $1.28 on the downside. This is a minor positive as it suggests that bulls are not willing to cede ground to the bears.

The 20-day EMA is flattening out and the RSI is just below 46, suggesting that the selling pressure could be reducing. If bulls thrust the price above the moving averages, the ADA/USDT pair could rise to $1.60 and then to the resistance line of the channel.

A break and close above the channel will signal that the downtrend could be over. This positive view will invalidate if the price turns down and breaks below $1.18. That could pull the price to the crucial support at $1.

XRP/USDT

Ripple (XRP) turned down from the 20-day EMA ($0.86) on Jan. 3 suggesting that the sentiment remains negative and traders are selling on relief rallies.

The long tail on the Jan. 4 candlestick shows strong buying in the $0.77 to $0.75 support zone. The XRP/USDT pair could now consolidate between $0.75 and the 20-day EMA for the next few days.

A break and close above the moving averages could clear the path for a rally to $1. If bulls clear this hurdle, the pair could start its journey toward the stiff overhead resistance at $1.41. Alternatively, if the price breaks and closes below $0.75, the pair could drop to $0.60 and then to $0.50.

LUNA/USDT

Terra’s LUNA token turned down from the overhead resistance at $93.81 on Jan. 3 and has reached the 20-day EMA ($83). This suggests that bears are selling on rallies.

If bears pull the price below $81.11, the selling could intensify as short-term traders may rush to the exit. The LUNA/USDT pair could first drop to $76.72 and then extend the decline to the 50-day SMA ($67).

Contrary to this assumption, if the price bounces off $81.11, it will suggest that bulls continue to buy on dips. The bulls will then make one more attempt to clear the overhead barrier at $93.81 and push the pair to the all-time high at $103.60.

Related: Bitcoin monthly RSI lowest since September 2020 in fresh ‘oversold’ signal

DOT/USDT

Polkadot (DOT) has been trading between the 20-day EMA ($28) and the overhead resistance at $31.49 for the past few days. The flat 20-day EMA and the RSI just above the midpoint suggest a balance between supply and demand.

If the price breaks and closes above the $31.49 to $32.78 resistance zone, it will indicate that the balance has tilted in favor of the bulls. The DOT/USDT pair could then start its northward march toward $40.

Conversely, if the price turns down and breaks below the 20-day EMA, the pair could extend its stay inside the range between $31.49 and $22.66 for a few more days. The bears will have to sink and sustain the price below $22.66 to signal the resumption of the down move.

AVAX/USDT

Avalanche (AVAX) slipped below the moving averages on Jan. 4, indicating that bears are aggressively defending the downtrend line. The flat 20-day EMA ($107) and the RSI just below the midpoint suggest a state of equilibrium between the bulls and the bears.

If the price sustains below the moving averages, the bears will attempt to sink the AVAX/USDT pair below $98. If they manage to do that, the pair could drop to the strong support at $75.50.

On the contrary, if bulls drive the price back above the moving average, the pair could rise to the downtrend line. A break and close above this level will signal a possible change in trend. The pair could first rise to $128 and then retest the all-time high at $147.

DOGE/USDT

Dogecoin (DOGE) has been trading in a tight range between the 20-day EMA ($.0.17) and $0.16 for the past few days. This suggests that both the bulls and the bears are not placing large bets and are playing it safe.

Usually, tight ranges are followed by sharp moves. The downsloping moving averages and the RSI in the negative zone suggest the path of least resistance is the downside.

If the price breaks below $0.16, the bears will attempt to pull the DOGE/USDT pair below the strong support at $0.15. If they succeed, it could result in a decline to $0.13 and then to $0.10.

On the other hand, if the price turns up from the current level and rises above the 20-day EMA, the pair could rally to the stiff overhead resistance at $0.19. The bulls will have to clear this hurdle to signal a possible change in trend.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.