On Nov. 15, the Bitcoin Cash (BCH) network faces a contentious fork and many BCH users have been wondering what to do with their funds before the consensus changes. In order to address some questions concerning the upcoming fork, news.Bitcoin.com has outlined some of the options available for BCH proponents.

Also read: A Look at Bitcoin Replay Attacks and Self-Managed UTXO Protection

Pre-Fork Preparations

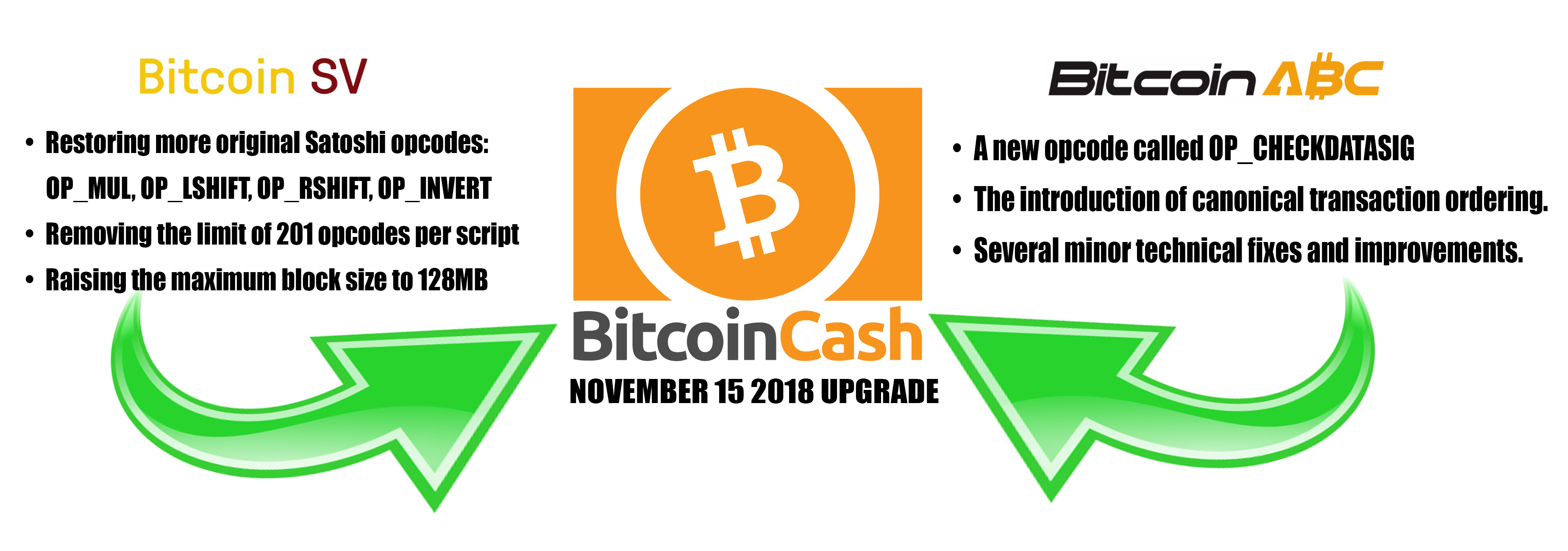

Cryptocurrencies fork from time to time and more often than not, upgrades are usually quite smooth. However, every once in a while some consensus changes can be controversial and ultimately lead to a blockchain split. At the moment the Bitcoin Cash fork planned for Nov. 15 is in dispute, and the two development teams, Bitcoin ABC and Bitcoin SV, have not yet come to an agreement.

After hearing about the fork on social media and cryptocurrency-centric forums, many newcomers have asked if they should prepare for the consensus change, especially when it may result in a split. There are plenty of options available for people who possess bitcoin cash, but in the end, the decision will ultimately differ with each individual and organization.

‘Sit and Wait’ with Custodial and Noncustodial Services

Many cryptocurrency veterans who have already experienced a number of disputed consensus changes, especially ones that have led to blockchain splits, will likely tell you to “sit back and wait.” Nobody truly knows the outcome, so basically, the “sit and wait” method doesn’t take much effort. However, there are a couple of things to think about. For example, if you use a noncustodial wallet that gives you the ability to possess your own keys, whether it be a 12-24 word mnemonic phrase or a file, then the “sit and wait” process is considered a safe method by experienced crypto-enthusiasts. No matter what happens, your current funds, as well as any future split coins, will sit while you hold your private keys.

If you don’t use a noncustodial wallet to hold your BCH, then you can still do the “sit and wait” method with an exchange. This choice is made if an individual trusts their service provider to handle the consensus change properly. Most people know the golden rule that “if you don’t hold your keys, you don’t own bitcoin,” but some people still hold funds on exchanges in spite of this warning. The good news is that an overwhelming majority of exchanges have supported split coins in the past. If a split takes place again, a number of trading platforms may honor both chains, but that depends on whether or not the networks are reliable.

However, it is all entirely up to each exchange in regard to how they deal with the fork and a split. There could be a chance that only one chain will be viable in the eyes of a given business, and the course of action will effectively be that company’s decision. It will also mean each company will be in control of the situation and may not honor another chain’s withdrawals for a period of time, if at all.

In contrast to holding your funds in a noncustodial wallet, using an exchange means you are subject to the company’s protocol during a fork. In the days leading up to this fork, most exchanges have told customers they will pause BCH deposits and withdrawals for an unknown period of time. This action will take place just a few hours prior to the consensus changes, and a list of infrastructure providers and their contingency plans can be seen here.

Splitting, Waiting for Split Services and Full Node Options

Some users advocate splitting coins and there are a few ways to go about this process. For instance, the Electron Cash developers have introduced a splitting mechanism and a user guide on how to split coins using the Electron Cash wallet plugin, which was released last week. The tool was created by the BCH developers Mengerian, Mark Lundeberg and Jonald Fyookball. They built it to give users the ability to add “replay protection” by using the script that is valid on the Bitcoin ABC client.

BCH users can also search for a coin-splitting source online. Following the fork, for instance, BCH proponents can send a small fraction of BCH to the Cashgames.Bitcoin.com platform and then send the funds back to themselves. Cashgames.bitcoin.com plans to help split a wallet’s UTXOs right after the fork, so users can withdraw split coins right away. The small fraction of BCH sent back to the original wallet will come from a parent transaction that used OP_CHECKDATASIG, which in turn will give the existing UTXOs held within the wallet “replay protection.” Bitcoin.com’s Faucet, Cash Games and Mining Pool services will send BCH originating from an output using OP_CHECKDATASIG.

If the blockchain bifurcates, users can also choose to patiently wait until more splitting tools and services are offered by BCH infrastructure providers. With some of the prior forks in the past, after the split, some wallets introduced more robust splitting tools and most exchanges also split coins for their customers.

Obviously, those who are programming-savvy can choose to rely on their own options when dealing with the ruleset changes. Coin splits can also be done with other opcodes, including one of the new opcodes proposed by the Bitcoin SV implementation. BCH proponents who are technically inclined can use various methods to either split their UTXOs or keep them valid on all chains. Some BCH supporters will be running several full node clients and will be monitoring all of the BCH implementations. Others will be using the Chopsticks API, which will fetch the transaction hash across four BCH clients: ABC, BU, SV and Naybc.

As with anything, life is made up of an infinite amount of choices, and cryptocurrency investment is no different. The best way to make good decisions is by being well-informed and talking with others who are experienced for advice.

What will you be doing for the Nov. 15 BCH consensus changes? Let us know what you think about this subject in the comments section below.

Disclaimer: The methods described in this editorial guide are intended for informational purposes only. In any given cryptocurrency situation there are always multiple methods that are ultimately made by the decisions of the user. There are various steps mentioned which are optional. Neither Bitcoin.com nor the author is responsible for any losses, mistakes, skipped steps or security measures not taken, as the final decision-making process to do anything is solely the reader’s responsibility. For good measure always cross-reference guides with other walkthroughs found online.

Images via Shutterstock and Bitcoin.com

At news.Bitcoin.com all comments containing links are automatically held up for moderation in the Disqus system. That means an editor has to take a look at the comment to approve it. This is due to the many, repetitive, spam and scam links people post under our articles. We do not censor any comment content based on politics or personal opinions. So, please be patient. Your comment will be published.

The post Preparing for the Looming Bitcoin Cash Fork appeared first on Bitcoin News.