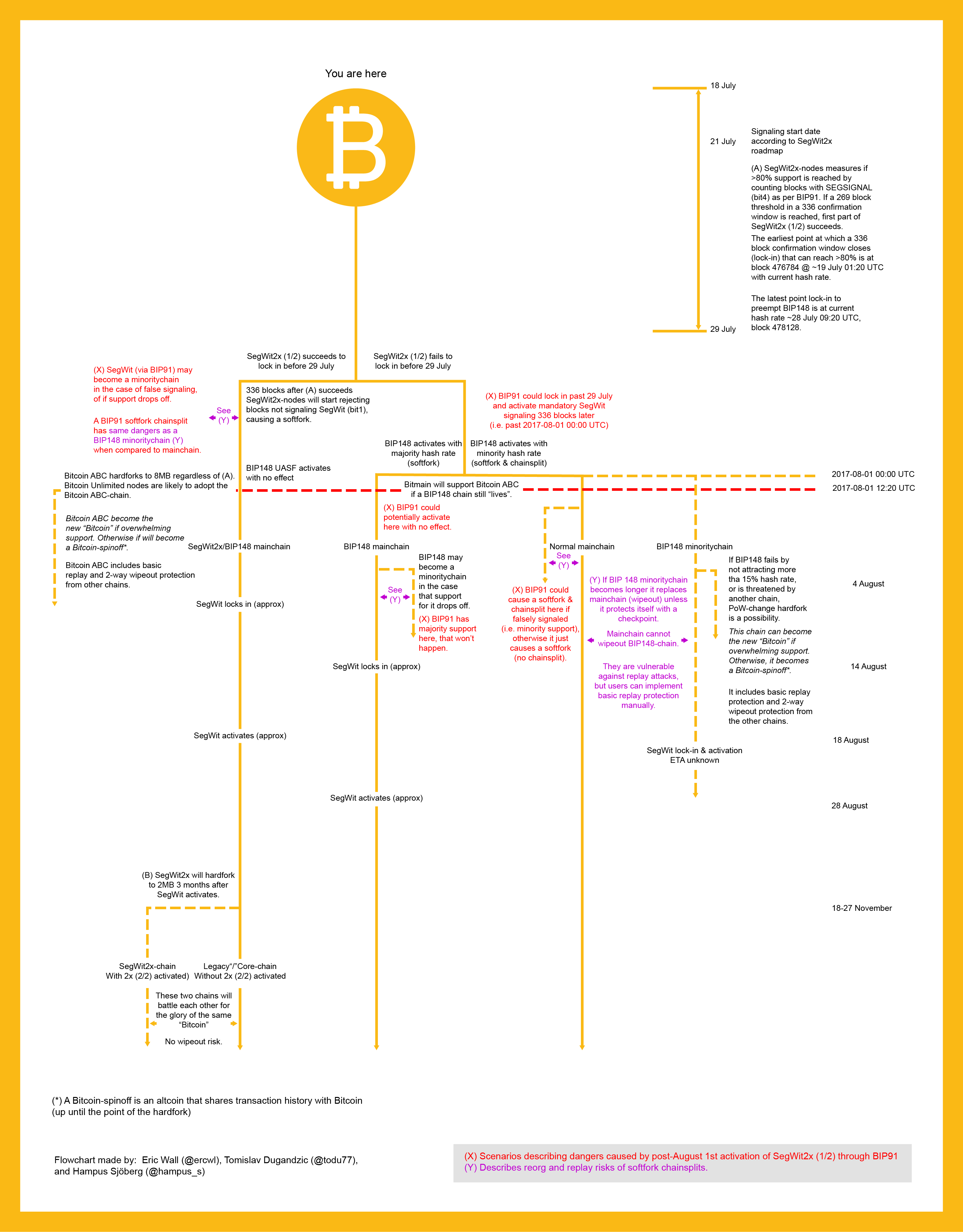

Below is a detailed flow chart graphic that depicts the possible outcomes to the upcoming scaling proposals that may be implemented in the near future. We hope to help our readers get a better understanding of what’s going on with these specific Bitcoin network developments.

Also Read: The Blockchain Split Scenario: Staying Informed and Backing Up Bitcoin Keys

A Visual Flow Chart Depicting the Possible Outcomes of Bitcoin Proposals That Might be Implemented

Over the next few weeks, the Bitcoin network and its participants may see some scaling proposals implemented to the protocol and the subject can be confusing. Right now there are multiple scenarios between three possible plans that include a user-activated soft fork (UASF), Segwit2x, and a user-activated hard fork (UAHF). We’ve done a run down of each proposal, community sentiment, and possible outcomes in recent articles to give our readers some information on the topics.

We want to take it a bit further and give our readers a visual glimpse at the possible outcomes of Segwit2x, UASF, UAHF, all the Bitcoin Improvement Proposals (BIP) involved, signaling periods, and a timeline of dates and requirements. Bitcoin.com would like to also thank our friends Hampus Sjöberg, Eric Wall, and Tomislav Dugandzic for allowing us to use the initial template for this flow chart.

Lots of Support Directed at the ‘New York Agreement’

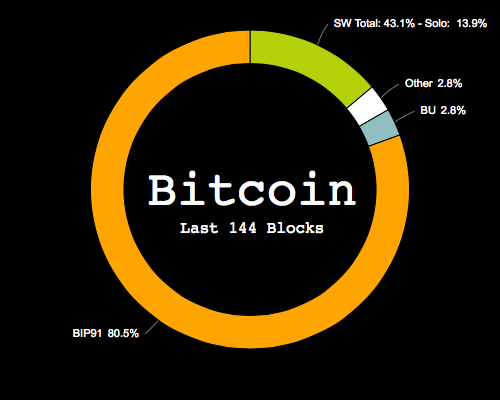

At the moment there is a lot of support showing for BIP91 with intentions to activate Segregated Witness (Segwit) as part of the “New York Agreement” (NYA) roadmap. At the time of writing as you can see from the chart below BIP91 support is approximately 80.5 percent and the proposal needs to maintain 80 percent to lock in Segwit over 336 blocks. Following a successful lock in period another 336 blocks has to pass to successfully activate Segwit. After the Segwit activation, NYA participants agreed to implement a 2MB hard fork which is proposed to take place ~3 months after the Segwit activation.

User-Activated Forks and Exchange Contingency Plan Announcements

Another part of the discussion is the two user-activated forks that may be attempted on August 1. If Segwit2x fails to activate Segwit, then there is a possibility both user-activated forks will proceed with their plans on that date. UASF participants will then try to activate Segwit using full nodes aimed at blocking non-segwit blocks and hoping hash power will follow this move. Further, the UAHF is a contingency plan against this effort and plans to utilize a bitcoin implementation called Bitcoin ABC. This plan will remove segwit from the bitcoin code and use an adjustable block size instead. Moreover, the company Viabtc has pledged to support Bitcoin ABC with its own mining pool and will call the token “Bitcoin Cash” if the protocol splits off from the main chain.

Additionally, there have been some exchanges that have announced how they will handle a possible Bitcoin network fork. So far multiple exchanges have issued contingency plans and warnings about the possible network changes planned. This includes exchanges such as Bity, GDAX and Coinbase, China’s top three trading platforms, and thirteen Japanese cryptocurrency exchanges have made statements concerning these events. On August 1 specifically, these exchanges say they will likely disable deposits and withdrawals, and possibly halt trading as well.

In addition to the announcements from nineteen global bitcoin exchanges on July 19, the firm Coinbase announced it would not support the user-activated hard fork and its associated token. The San Francisco-based bitcoin company says it will not honor the UAHF blockchain because “it is incompatible with the current Bitcoin ruleset and will create a separate blockchain.” Coinbase users are advised to withdraw their bitcoins from Coinbase by July 31st if they desire access to UAHF coins. Nevertheless, the trading platform will monitor the UAHF situation but doesn’t plan on supporting any new blockchains anytime soon.

What do you think about the upcoming network changes? Let us know what you think about our flow chart in the comments below.

Images via Shutterstock, XBT.eu, Hampus Sjöberg, Eric Wall, Tomislav Dugandzic, JCBA, Pixabay, and Bitcoin.com.

Do you want to vote on important Bitcoin issues? Bitcoin.com has acquired Bitcoinocracy, and rebranded the project to Vote.bitcoin.com. Users simply sign a statement with a non-empty Bitcoin address and express their opinions. The project focuses on determining truth backed by monetary value and transparency.