Power-to-gas (P2G)—the conversion of electrical power into gaseous energy carriers—is a quickly improving and potentially disruptive energy conversion technology. It offers many of the same services of other energy storage technologies and has the added ability to be stored for long periods in the form of a useful commodity fuel product, hydrogen. The hydrogen economy has had false starts before thanks in part to high costs and infrastructure challenges. P2G is primed for significant growth in coming years as demand for clean hydrogen grows, electrolyzer capital costs fall, and cheap renewable energy bathes the grid.

P2G provides a variety of services to the electric grid for renewables integration. While these services can also be provided by most grid-tied storage technologies, P2G has unique attributes that can give it an edge. Seasonal energy storage—of interest in places like California where a record 80 GWh of renewable power was curtailed in the windy and sunny month of March—is an application well-suited for P2G, since long-term storage capacity can be scaled up by adding low tech tanks.

Researchers at the University of California, Irvine’s Advanced Power and Energy Program found that hydrogen energy storage systems can have lower capital costs than lithium-ion batteries for discharge durations of more than about 20 hours—a duration easily exceeded in the months-long seasonal storage arena. Electrolyzers can also ramp production up or down on command and maintain that new state for a nearly indefinite period, functioning as a demand response (DR) resource. For example, within seconds, a 10-MW electrolyzer operating at a steady 5 MW can look like a load (by ramping to 10 MW) or a generator (by dropping to 0 MW). ITM Power, an electrolyzer vendor, identifies three value streams in the example of electrolyzers operating on the UK’s National Grid:

- A capacity payment for enhanced frequency response

- An action payment for Demand Turn Up, a service that evens out demand during times of high renewable production

- The value of hydrogen

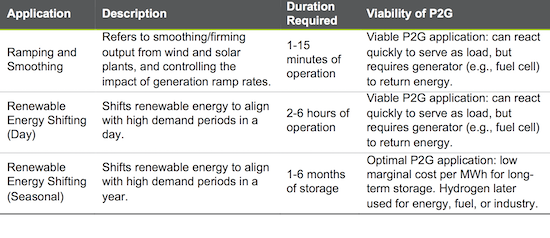

In another possible P2G monetization route, Arizona utility APS recently announced a reverse DR program designed to avoid the curtailment of renewables. As curtailment grows in various high renewables areas, access to cheap or free electricity is also expected to grow. Table 1 outlines some of the applications for P2G:

Table 1: Overview of P2G Applications for Renewables Integration. Source: Navigant Research

Some argue that P2G should exclude transport end-uses and refer only to energy end-uses for the gas, such as injection into the natural gas grid or onsite storage for future power production. However, the broader definition is an affirmation of the benefits P2G brings to the electric grid and renewables integration regardless of the end-use for the gas. Indeed, Navigant Research anticipates that the transportation segment, where hydrogen is often valued most highly, will jump-start P2G demand and help drive down electrolyzer and other infrastructure costs. As costs fall, growth is expected in the non-transport segments where gas is less precious: first industrial hydrogen, then onsite energy storage and natural gas grid injection.

Deals and deployments have surged across a variety of sectors in recent years. Many electrolyzer vendors have record backlogs. Electrolyzers are being deployed at light duty fuel cell EV (FCV) hydrogen fueling stations in growing numbers in California, Germany, Japan, and elsewhere. In late 2016, Proton OnSite announced the world’s largest proton exchange membrane (PEM) electrolyzer deal, consisting of 13 MW of electrolyzers being used for fuel cell buses in China’s Guangdong province.

In September 2017, Shell and ITM Power announced plans for the largest single-site PEM system, a 10-MW system at a crude oil refinery in Western Germany. And in June 2017, Nel ASA announced a framework agreement for the largest P2G project ever: a 100-MW gas grid injection project to be installed in France, based around the more mature alkaline electrolyzer technology. In its database of 80 deployed or planned P2G systems, Navigant Research identifies trends toward faster deployment, larger systems, and a shift from pilot systems to commercial projects. In addition to those highlighted above, other segments with growing interest in clean hydrogen include fuel cell forklifts, long-haul trucking, and microgrids.

Hurdles remain for widespread adoption. Despite a shift toward commercial systems, the industry is still heavily dependent on subsidies, though this reliance is likely to subside as costs fall. For costs to fall, demand must grow to drive economies of scale; though this has been a key missing element in the past, the rapidly growing deployments outlined above suggest that this hurdle is being cleared. A key gauge of P2G demand—and a health indicator for the hydrogen economy at large—will be the rate of adoption of FCVs. Though sales have lagged far behind those of battery EVs, several new vehicle releases through 2020 should help push FCVs closer to the mainstream.

From a macroeconomic perspective, the current low cost of natural gas (NG) is a challenge for clean hydrogen, since NG can be used to cheaply produce fossil-based hydrogen; renewable hydrogen mandates aimed at curbing carbon emissions are starting to tilt this toward the advantage of P2G. Finally, regulations in many areas limit the ability of electrolyzer plants to access cheap (or free) wholesale electricity—a key area of focus for many in the P2G industry. The list of challenges remains long. Yet most market drivers increasingly favor P2G, and the increased rate of deployments bear this out.

The P2G ecosystem is evolving to encompass more stakeholders, including electrolyzer vendors, renewables developers, distributed energy resources (DER) controls vendors, gas and electric utilities, and a wide variety of hydrogen end-users. As renewables developers incorporate more storage into their plants, the economics of P2G should be analyzed on any project of sufficient scale. Similarly, DER controls vendors targeting the battery storage market should consider developing products that can readily address P2G systems.

Electric utilities are gradually beginning to recognize the value P2G can bring to their grid; Navigant Research sees European utilities leading deployment, with Asia Pacific and North American counterparts following. Gas utilities, which are beginning to recognize hydrogen as a potentially significant fuel of the low carbon future, should direct renewable gas research and programs accordingly. A longer-term vision of companies like Engie and others is to generate hydrogen where cheap renewables exist, and export it to demand centers. Ultimately, though, hydrogen end-users could play the most important role in driving P2G in the coming decade. From consumer FCVs to oil refineries, end-users are starting to recognize that generating hydrogen from renewables can be a win-win for markets across the globe.

Lead image credit: depositphotos.com