The $600m market for initial coin offerings may soon be set to expand.

Announced today, investment firm Pantera Capital is launching a new hedge fund focused on investments solely in tokens that power public blockchain protocols.

Called Pantera ICO Fund LP, the fund intends to raise $100m, with $35m already raised in support from the firm’s existing investor base, undisclosed new investors, and according to the company, unnamed venture capital firms. The new fund will complement Pantera Bitcoin Partners, a joint investment fund launched by Pantera, Fortress, Benchmark Capital and Ribbit Capital in early 2014 to invest in the cryptocurrency.

In interview, Pantera’s leadership team framed the fund as an extension of its past investments, which have included traditional investments in startups that have sought to incentivize distributed networks through the use of tokens. Included in the Pantera portfolio are Ripple and the Zcash Electric Coin Company, which use the XRP and ZEC tokens, respectively.

Pantera CEO Dan Morehead and Augur co-founder Joey Krug will serve as chief investment officers for the fund. With the move, Krug is also joining Pantera full-time.

The fund is currently open only to US institutions and individuals, though it intends to eventually open up support to non-US participants.

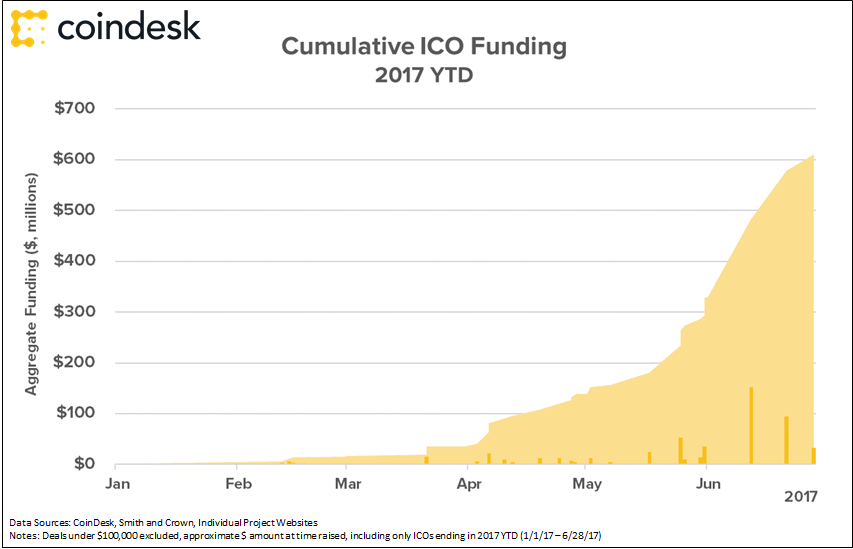

As explained by Paul Veradittakit, venture investor at Pantera Capital, the fund creation was sparked by the recent rapid uptick in interest in tokens and protocols. According to CoinDesk data, funding for ICOs has already surpassed traditional venture capital banking in 2017.

The mechanism has gone so far as to attract mainstream brands, with messenger service Kik announcing it would soon test a network token.

“Six months ago, ICOs were a few million dollars,” Morehead told CoinDesk. Even ethereum’s crowdsale was only $18m. I think, with Kik, we’re at a watershed moment, a company with millions of active users is transitioning to open source.”

However, Pantera’s investment strategy will be more nuanced than simply working with major brands that may be interested in the concept.

According to Krug, the fund will primarily seek to fund new protocols, ones which they believe will use cryptographically unique data in a way that’s integral to their operations.

“If you look at the tokens, they fall into two categories. Rent-seeking tokens, where you can remove the token and the network will be better off, and non-rent seeking tokens, where you remove the token and it doesn’t work,” he said, adding:

“The latter have the strongest chance of generating longer value.”

Market strategy

In interview, Pantera further opened up about how it would seek to inject its capital in the market, comments that shed light on how its movements could impact the day-to-day holdings of retail investors who may also be seeking exposure to crypto assets.

In this way, Morehead said that the market shouldn’t expect Pantera to be frequently entering and exiting deals, though he said the fund would take steps to preserve its profitability and maximize opportunity if warranted.

“We’re going to make relative value judgements. If the token has reached a fair value and there’s a new token that’s inexpensive, we would trade,” he said. “But, we’re investing in tokens, we’re not making markets.”

Krug also explained a bit about how it will seek to make technical evaluations on the prospects of various projects, evaluating the technical foundations of the designs of proposed protocols, as well as the strength of the team.

It’s worth noting that investing in ICOs is still an inexact science, as, owing to the difficulty of changing blockchain infrastructure protocols, its unknown whether pivoting will be as easy for entrepreneurs building on top of the tech.

That’s where Pantera is hoping Krug’s experience will pay dividends.

Augur raised $5.3m in an ICO for its ethereum-based prediction market platform in 2015 through the sale of tokens that power its reputation system. Today, its network is valued at $305m, with tokens trading for $27 at press time, according to data from Coinmarketcap.

‘Bubble’ talk

Also discussed was the rapid escalation in value observed in the total cryptocurrency market, which surpassed $100bn earlier this year, up from $18bn on 1st January, and the effect of what some have called a “bubble” forming in the market.

Still, Krug sought to take a more long-term view, asserting that despite short-term fluctuations, he’s confident that the ICO process will emerge as a compelling way to fund protocol development, one that will continue to interest investors and entrepreneurs.

“In the long term, we’re at the very beginning,” he remarked.

Likewise, Morehead said that, as with its bitcoin fund, the ICO fund is likely to see ups and downs. Overall, he focused on the fact that the funds would expand Pantera’s investment capabilities while helping to fund and fuel growth in the market.

Krug concluded:

“Hopefully, this will see through corrections.”

Coin collection via Shutterstock

The leader in blockchain news, CoinDesk is an independent media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Have breaking news or a story tip to send to our journalists? Contact us at [email protected].