Over 100k “synthetic” bitcoins or $1.07 billion has been minted on Ethereum as people look to earn from DeFi.

More than $1 billion, or over 100,000 bitcoins, are locked in DeFi protocols, up from around 72,000 bitcoins earlier this month.

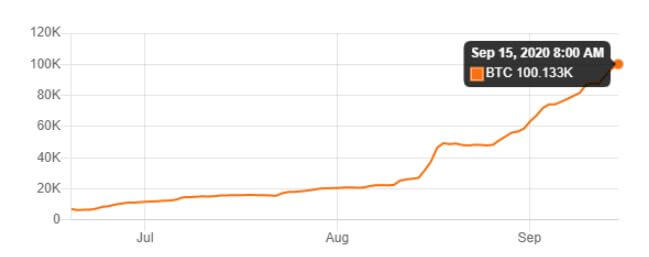

According to data from DeFi Pulse, the tokenization of Bitcoin on the Ethereum network has greatly increased since the start of the year. However, most of the minting has occurred since June 2020.

At the start of June, just over $47.5 million worth of Bitcoin had migrated to Ethereum via synthetic BTC (Bitcoin minted on protocols such as Wrapped Bitcoin (wBTC) and RenVM (renBTC). Since then, or in just about four months, tokenized Bitcoin value in DeFi has jumped by more than 150%.

Data from DeFi Pulse shows that roughly 100, 133 bitcoins have been tokenized in various Ethereum-based decentralized finance protocols as of September 15th.

At prevailing BTC/USD prices of around $10,740, Bitcoin accounts for over $1 billion of the total value locked in protocols on Ethereum. Comparatively, that figure was about $750 million a week ago as Bitcoin price struggled to hold the $10k peg following a bearish run across crypto and traditional markets.

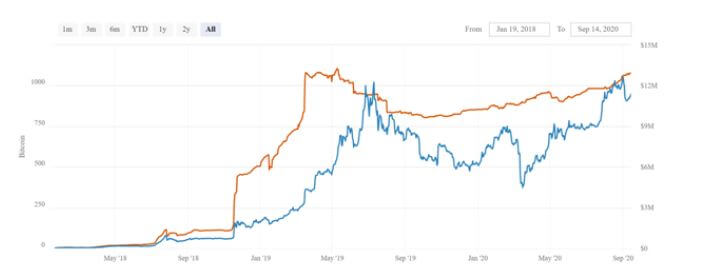

As the value locked in DeFi protocols via the tokenization of Bitcoin spikes, the story is quite different for Lightning Network. According to Bitcoinvisuals.com, the layer 2 protocol has attracted just 1,078 bitcoins or around $11.3 million.

Meanwhile, the total value locked in DeFi has surged again after a major dip off last week’s crash that saw Bitcoin decline from $12,000-$10,000 and DeFi tokens crash. The total value locked had dropped from $9.6 billion to $6.14 billion, wiping off over $3billion between September 2 and 10. As of writing, TVL (USD) has climbed to over $8.5 billion.

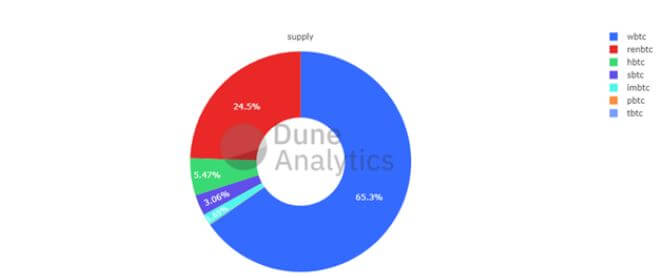

Wrapped Bitcoin (wBTC) and Ren (renBTC) account for the largest number of tokenized Bitcoin. According to Dune Analytics, wBTC accounts for 57, 457 in tokenized Bitcoin worth over $610 million while renBTC has tokenized over 21,500 BTC worth over $230 million.

Together, tokenization has put around 0.47% of Bitcoin supply on Ethereum. Although the $1.2 billion is already significant, the frenzy that is DeFi could yet see more synthetic bitcoins minted.

Protocols with the most tokenized Bitcoin used in yield farming are Curve Finance, Aave and Balancer. Curve has 27,700 bitcoins, Aave 17,700 bitcoins and Balancer over 9,600 bitcoins as of writing.

The post Over $1B worth of Bitcoin is locked in DeFi appeared first on Coin Journal.