This week, the U.S. consumer price index for October showed a 6.2% increase from a year ago, the highest inflation rate since 1990, news that directly contributed to bitcoin’s mid-week surge to new all-time highs.

What’s causing that inflation? Well, Bitcoin advocates and gold bugs argue that it’s all about the debasement of fiat currencies through massive printing. That perspective sees it as a self-perpetuating monetary phenomenon that will be very difficult for central banks to stop.

You’re reading Money Reimagined, a weekly look at the technological, economic and social events and trends that are redefining our relationship with money and transforming the global financial system. Subscribe to get the full newsletter here.

Most mainstream economists attribute it almost entirely to the disruptions caused by supply chain breakdown in the wake of the pandemic. They say inflation is transitory, a temporary problem that will be resolved once shipping networks return to normal.

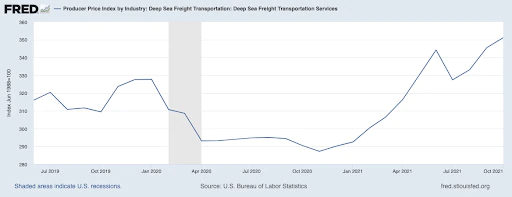

The following chart doesn’t answer who is correct. But it does put some illustration onto the supply chain problem. This is the deep sea freight cost component within the Bureau of Labor Statistics’ producer price index for the past two years, drawn from the Federal Reserve Bank of St. Louis’s FRED database.

The freight price index is up 20% from a year ago. Those rising prices will themselves feed into U.S. consumer prices downstream. More importantly, it’s a direct manifestation of the shipping logjam that is associated with and contributing to supply chain interruptions. It’s worth watching for signs that the supply chain problem is either worsening or correcting itself.