The number of global cryptocurrency hedge funds has reached a record high of 226, according to research firm Autonomous Next. The hedge funds tracked by leading hedge fund database provider Eurekahedge show a return of 1,477.85 percent in 2017 on average.

Also read: Japan’s DMM Bitcoin Exchange Opens for Business With 7 Cryptocurrencies

226 Crypto Hedge Funds

According to Autonomous Next, the London-based fintech practice of Autonomous Research, the number of hedge funds focused on trading cryptocurrencies more than doubled in the past four months. Reuters reported:

According to Autonomous Next, the London-based fintech practice of Autonomous Research, the number of hedge funds focused on trading cryptocurrencies more than doubled in the past four months. Reuters reported:

The number of crypto hedge funds more than doubled in the four months to Feb. 15…The research firm recorded a record high of 226 global hedge funds with such a strategy, up from 110 global hedge funds as of Oct. 18.

On August 29, the number of crypto hedge funds was only 55, and it was only 37 at the start of 2017. Furthermore, the firm revealed that assets under management of the funds are currently between $3.5 and $5 billion.

Autonomous Next partner Lex Sokolin commented:

While the softer prices of crypto assets do create a more difficult environment for investors, I do not think it will pause the influx of funds and other financial institutions building products in the space…It would take the extreme case of the entire space contracting by 80 percent and high regulation before the flow of funds turns around.

Crypto Funds Gained 1,478% in 2017

According to an independent hedge fund data provider, Eurekahedge, cryptocurrency-focused funds lost an average of 4.6 percent in January. “Some invest in just bitcoin, taking both long and short positions, some buy a basket of cryptocurrencies and others exploit the arbitrage between different exchanges’ prices,” Reuters further noted.

According to an independent hedge fund data provider, Eurekahedge, cryptocurrency-focused funds lost an average of 4.6 percent in January. “Some invest in just bitcoin, taking both long and short positions, some buy a basket of cryptocurrencies and others exploit the arbitrage between different exchanges’ prices,” Reuters further noted.

Eurekahedge is tracking nine hedge funds with collective assets of $1 billion. They “made an average of 1,477.85 percent in 2017,” the news outlet conveyed.

Eurekahedge is tracking nine hedge funds with collective assets of $1 billion. They “made an average of 1,477.85 percent in 2017,” the news outlet conveyed.

The founder of high growth blockchain fintech firm Bitspread, Cedric Jeanson, commented that “some of the hedge funds charge high fees – an average of 1.6 percent for management and 17.5 percent for performance for funds tracked by Eurekahedge – even though they are using largely passive strategies,” the publication added.

Referring to crypto funds in general, Diana Gibson, a managing director at investment consultant Cambridge Associates, pointed out:

Gains in 2017 were largely generated from being long.

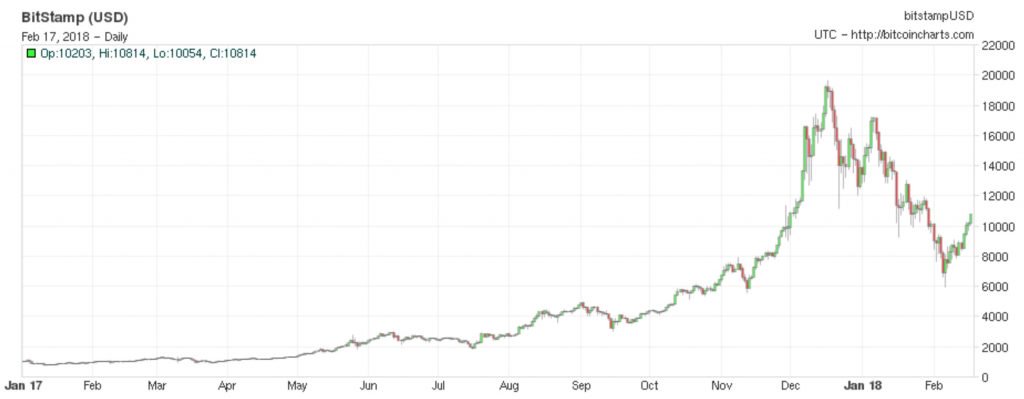

In December of last year, Pantera Capital’s bitcoin fund reportedly returned 25,004% for investors since its launch in 2013. The gain was due to the skyrocketing price of bitcoin which peaked at $19,666 on December 17, according to data from Bitstamp.

What do you think of all these hedge funds investing in cryptocurrencies? Let us know in the comments section below.

Images courtesy of Shutterstock, Bitcoincharts, Autonomous Next, and Eurekahedge.

Need to calculate your bitcoin holdings? Check our tools section.

The post Number of Cryptocurrency Hedge Funds Rises to 226 Globally appeared first on Bitcoin News.