In 2012, NSP and Del Solar merged, claiming that at 1.5-GWp the new company would be the largest cell manufacturer in the world.

In 2015, Motech Solar merged with Top Cell announcing that at 3-GWp the new entity would be the largest cell manufacturer in the world.

In October, NSP (2.6-GWp cell capacity), Gintech (1.9-GWp cell capacity) and Solar Tech (1.4-GWp Cell Capacity) announced that they are merging to create the second largest cell manufacturer in the world with 5.9-GWp of cell capacity. The newly formed company, United Renewable Energy or UREC will also depart the already departed merchant cell business model to create a new vertically integrated business model that resembles, basically, what everyone else is already doing. The usual glowing press releases were offered by company PR departments and repeated by pretty much everyone. The companies have signed the ubiquitous letter of intent, which sounds impressive but holds no legal sway and cannot force anyone to do anything.

One thing for certain, by the time the merger is completed during Q3 2018 UREC will no longer be able to claim the title of second largest because yes, things really do move this fast.

In the announcement from NSP, which will be the leading entity in the three-way equal partnership, the group indicated that the primary reason for the merger was the “highly competitive and concentrated market for solar cells/modules.” Translation, the companies could no longer compete in an incentive-driven industry with significant downward price pressure. The group has invited other Taiwanese cell manufacturers to join.

UREC will have five business units, with Gintech in charge of wafers, Solartech in charge of cells and new business, and NSP in charge of modules and projects.

As to UREC’s plans to exit the merchant cell business, it is unclear when this will happen or even if it will happen. A stated reason for the exit is the highly competitive concentrated business environment the manufacturers faced as independent entities. As SunEdison, First Solar and SunPower have found, UREC will face a highly competitive and concentrated market for project development if indeed the group’s current goals remain as stated.

The Walking Solar Unprofitable

The photovoltaic industry can be brutal in that most participants enter believing they are part of the climate change solution, are part of something bigger than themselves and can profit from their good intentions only to be beaten down by low price expectations and an industry-wide lack of insight into the true cost of manufacturing solar modules.

Many point to soft costs as the next cost frontier but this is based on believing that the low margins are sufficient to support healthy company operations. Until the low-margin fallacy is corrected, margin recovery is impossible and the industry’s focus will remain dangerously askew. To be clear, gross margin supports the entire company from logistics through marketing and administration through R&D and including everyone’s salaries, health care and other benefits.

The belief that a 15 percent gross margin is sufficient to run a manufacturing company is almost impossible to overcome simply because people need to believe and so will continue to seek evidence to support their closely held beliefs while eschewing all conflicting information. A skittish race horse may wear blinders so that it can successfully compete relying on the jockey to avoid being blindsided. An industry that wears blinders to avoid uncomfortable facts will, and often is, blindsided.

Salaries and benefits could also be considered soft costs and it is worth remembering that behind these soft costs are people trying to make a living and to increase their personal margins. The cost of labor increases, and it should; the only controlling factor is to limit how much of it you use. In this regard, the industry needs to decide whether limiting labor is really in its long term best interests.

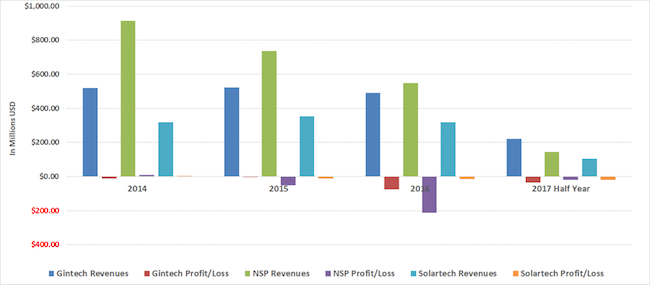

The drastic price drops at the end of 2016 affected all cell/module manufacturers. Gintech, Solartech and NSP reported losses for several years and though the price drops certainly did not help, there were problems before the crash.

Despite the triumvirate’s announced optimism in their new (not-so-new) direction, there is no reason to think that this merger will result in an economic improvement for them. After all, the overriding industry metrics remain the same.

Figure 1 offers several years of revenues and profit/losses for Gintech, NSP and Solartech.

Figure 1: Gintech, NSP and Solartech Revenues and Profit/Loss 2014 through Half Year 2017

Lead image credit: depositphotos.com