The fall of Bitconnect was as certain as night follows day. A pyramid scheme wrapped inside a Ponzi with a side order of WTF, Bitconnect was as crazy as it was calamitous. The only miracle was that the racket lasted so long. When the ringleaders shut up shop on Wednesday, causing the token to plummet from $290 to $8, that ought to have been the end of the matter. Remarkably though, BCC continues to be actively traded, and has even recovered some of its value. The reason for the mini revival? Bitconnect is launching an ICO.

Also read: Autopsy of the Bitconnect Implosion: Ponzi, Centralization, Governance

Meet the New Boss, Same as the Old Boss

It was no secret, prior to its collapse, that Bitconnect was running an ICO. Its Bitconnect X website has been accepting contributions since January 10. When Bitconnect closed its doors a week later, after its original website had been offline for days, it was assumed that Bitconnect X would follow suit. After all, no one would be gullible enough to get fooled twice, surely. Apparently so. Not only is the Bitconnect ICO going ahead as planned, but investors are actively throwing money at it.

When Bitconnect announced that it was closing its lending platform on Wednesday, $1.5 billion worth of value was wiped off its market cap in less than two hours. Those losses weren’t borne by the company though – it was ordinary investors who were left out of pocket. Bitconnect’s execs were doing just fine, sitting on the stash of bitcoin they’d pocketed from investors in the months prior. But then, as Twitter traders eagerly watched to see the first altcoin drop to zero in real time, something strange happened. BCC stopped falling and started to climb.

The Ponzi Scheme That Just Won’t Die

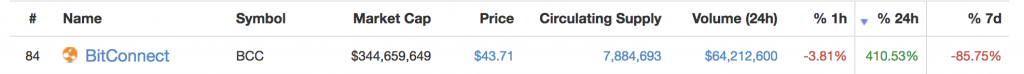

On January 17, BCC was the worst performing cryptocurrency on Coinmarketcap. Incredibly, 24 hours later, it was the best performing coin on the site, up 410% in 24 hours to reach $43 a token. This revival will have been of little consolation to investors, who were still heavily in the red. Nevertheless, it showed that against all reason, people were still buying the coin. In the past 24 hours, $18 million of BCC has been traded and a coin that was written off as being utterly worthless is now changing hands for $28.

The reason for this is BCC can be used to purchase BCCX, the new Bitconnect token that’s being launched via an ICO. Each BCCX is priced at $50. To reiterate then: Bitconnect duped thousands of investors, selling them BCC coins at up to $290 apiece. It then crashed the market, and is now encouraging the same investors to exchange their BCC for BCCX at a ratio of 2:1 in an event that ought to be dubbed The Halvening.

Lambs to the Slaughter

By late 2017, it was apparent to Bitconnect that the Ponzi scheme they had constructed was on the verge of toppling. Not content with riding off into the sunset with their ill-gotten gains, they decided to have another bite of the cherry. The Bitconnectx.co domain was registered on the penultimate day of 2017, and the crowdsale commenced less than two weeks later. The company is seeking to sell 11.76 million BCCX, which will earn it $588 million. It will also retain another $145 million in coins, bringing its total assets to $733 million.

The new-look Bitconnect X platform, for the record, “allows you to earn interest for helping maintain security on the network by holding BCCX in a Qt Desktop wallet that is attached to the network and allowing transactions to flow through it”. Which sounds suspiciously like Bitconnect mk I.

The new-look Bitconnect X platform, for the record, “allows you to earn interest for helping maintain security on the network by holding BCCX in a Qt Desktop wallet that is attached to the network and allowing transactions to flow through it”. Which sounds suspiciously like Bitconnect mk I.

One of the first tasks on the Bitconnect X roadmap is to attain a listing on Coinmarketcap, which shouldn’t be a problem, as the site had no qualms about heavily promoting the previous scam. After that it will spend the summer performing vague tasks such as “adding more security layers in Exchange platform”, presumably while Bitconnect execs put as much distance between themselves and their creditors as possible.

Bitconnect Keeps Playing While the Titanic Sinks

In the days after the collapse of Bitconnect, the company’s social media account continued glibly tweeting bitcoin news, as if nothing had happened. Each new story it posted was met with hundreds of thunderous replies, until the account finally broke its silence to audaciously issue the following claim:

Before cryptocurrency was invented, gullible individuals were defrauded via Nigerian bank scams. After the mark had lost almost everything, and the princes’ fortune they’d been promised had failed to materialize, the scammer would go in for one last trick. They’d “come clean” with the victim and confess that they too had been duped. For a small fee, they could get the mark’s money back, and set everything right.

Amazingly, many victims, out of desperation, would take them up on this offer. The majority of Bitconnect X’s investors will be the same souls who lost thousands in Bitconnect. Despite all the warning signs, they’re willing to go for broke and pray that this time they can get out before the pyramid collapses. In the words of Winston Churchill, never was so much owed by so many to so few.

Amazingly, many victims, out of desperation, would take them up on this offer. The majority of Bitconnect X’s investors will be the same souls who lost thousands in Bitconnect. Despite all the warning signs, they’re willing to go for broke and pray that this time they can get out before the pyramid collapses. In the words of Winston Churchill, never was so much owed by so many to so few.

How long do you think Bitconnect X will last? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

The post Not Content Scamming $1.5 Billion, Bitconnect Wants Another $500 Million for ICO appeared first on Bitcoin News.