This is an Op-ed article written by Daniel Kelman and Steven F. Muñoz. The opinions expressed in this article are the authors’ own. Bitcoin.com does not endorse nor support views, opinions or conclusions drawn in this post.

The looming shadow the United States federal government casts over the vibrant cryptocurrency industry grew somewhat darker last week. “By and large, the structures of initial coin offerings that I have seen promoted involve the offer and sale of securities and directly implicate the securities registration requirements…”. This remark was published on December 11 by SEC Chairman Jay Clayton as part of a Public Statement on the SEC Website, released concurrently with In the Matter of MUNCHEE INC.

Also Read: Securities Lawyers Say Barry Silbert Tweets Are Red Flags for Regulators

The SEC’s statement was received with shock among crypto media outlets. But the SEC also shed light on several previously vexing questions regarding token sales. Anyone looking to raise funds via a token sale, no matter the utility of their token or the disclaimers in their terms, must pay increased attention to their advertising and social media use.

Tl;dr, touting your organization’s token as an investment for which one would expect profits may subject that token to U.S. securities enforcement.

1. Will My ICO Even Be Regulated by the US?

The SEC’s order noted that the issuer “sold MUN tokens in a general solicitation that included potential investors in the United States.” Note their use of “potential”. The Cease-And-Desist Order does not state that US Persons were investing, only that they may have been. Presumably, Munchee couldn’t prove otherwise. This means that token issuers looking to avoid US jurisdiction may need to do full KYC on all buyers. Blocking US IP addresses may also be insufficient since the “potential” exists that US investors used VPNs to buy-in. Simply operating as a foreign entity may not be sufficient since foreign entities can fall under US jurisdiction where their advertising makes its way into US channels. In the future, promoters of token sales may need to be especially vigilant regarding US customers.

2. Has the SEC Outlawed All ICOs?

SEC Chairman Clayton’s statement reflects that it is possible for ICOs to not qualify as securities and that there are cryptocurrencies that do not appear to be securities. Because Ethereum’s token sale predated the DAO, the SEC could have chosen Ethereum for its first decision. This would have put a stop to all ICOs immediately. Instead, the SEC issued an opinion about the first token-sale conducted on Ethereum, the DAO. The DAO was a clear revenue share, a hedge fund designed to share profits. The SEC had no issue deeming it an unregistered security.

Since then, token issuers proceeded on the assumption that if they structured their token as a pure utility (e.g. no profit share, only a token to use in an ecosystem) that it would not be a security. The SEC’s Order in the Matter of Munchee has proven this assumption wrong. Issuers of bona fide utility tokens need to take other measures to make sure they do not run afoul of US law, especially regarding their messaging.

3. Our ERC 20 Token Is a Utility Token, Are We in the Clear?

First, let’s consider the context of recent token regulation by the SEC. The SEC’s Investigative Report regarding the DAO Token was a clear indication of how the SEC intended to regulate so-called “investment tokens.” In that case, Slock.it provided DAO Tokens with a profit share right built in, coupled with a voting-based investment platform. The SEC faulted the DAO’s curating and control of their platform, which reduced investor participation to less than “managerial” participation and passing the Howey Test to qualify as a security. This meant the DAO Token is an investment contract subject to SEC regulation. On the other hand, the Munchee token is not an investment token with a profit right attached, but a utility token (with no voting rights) that may be used to facilitate an economy of consumer reviews.

In the aftermath of the DAO Report, some commentators advanced the proposition that a utility token may fundamentally not be considered a security by the SEC, a view that is now clearly incorrect. It appears to be the case when a utility token is advertised or touted as a profitable investment opportunity, buying that utility taken may be akin to entering an investment contract. As such, even where the token is not an “investment token” with a profit share, if the token was advertised as a profitable investment opportunity it may still be considered an investment contract.

The SEC set its sights specifically on Munchee for making “public statements or endors[ing] other people’s public statements that touted the opportunity to profit.” They engaged in a top to bottom analysis of Munchee’s messaging that should give pause to all cryptocurrency promoters, from their whitepaper to their website and all advertising and social media use.

4. We Have Targeted Crypto Investors Rather Than Utility Users in Our Messaging, Should We Worry?

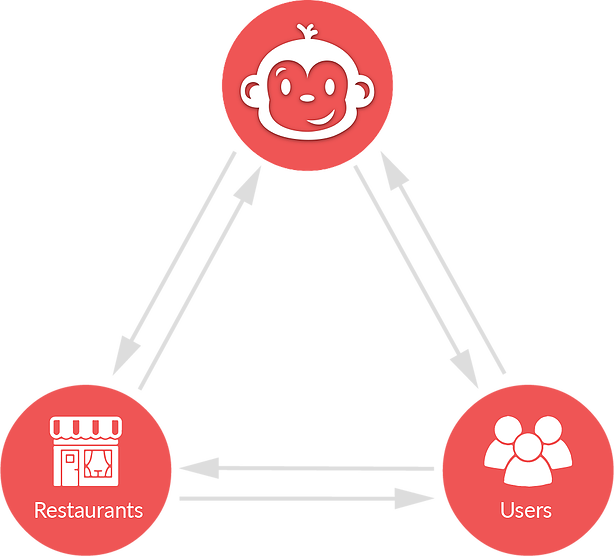

Promotion of a utility token should target utility users rather than just crypto investors. The SEC specifically pointed out that Munchee and its agent directed their marketing towards investors in cryptocurrency rather that users of the Munchee app or restaurant industry participants. Despite the MUN Token’s utility function, this looked to the SEC like MUN was priming expectations of security-like profits. Moving forward, token promoters should take care not to specifically advertise their token sale to investors seeking profits only without interest in a token’s utility.

5. How Should We Talk About Liquidity, Return on Investment, and Value Increases in Our Messaging?

As little as possible. The SEC considered Munchee’s stated plan to increase the value of MUN, cause appreciation, and support secondary markets to be significant entrepreneurial and managerial efforts creating investors profits. A graphic including MUN value increases as part of Munchee’s economic model was included to show how they created a reasonable expectation of profits. Promotion of a utility token should be about the use of that token rather than the ability to flip it for a profit down the road.

6. We Want to Retweet an Awesome Youtube Video About Our Token, Is That Ok?

The SEC specifically mentioned in its Order that Munchee had linked to a third-party Youtube video review of Munchee’s investment profitability, commenting “199% GAINS on MUN token at ICO price! Sign up for PRE-SALE NOW!” This was considered part of creating a reasonable expectation of profits in the investor in the SEC’s Howey Analysis of Munchee. Promoters of token sales must be very careful when choosing to retweet or adopt other statements in social media, because they may reflect the type of touting that was frowned upon in this case.

Conclusion

Moving forward, it appears that even promoters of utility token sales have their work cut out for them. They may want to KYC all their customers to root out American citizens. They must carefully examine every element of their messaging, from whitepaper to Facebook account. They must consider who is being targeted by the messaging, discussion of any profitability or token appreciation, and whether utility or profits is being highlighted. Promoters of token sales must not tout their token as a profitable investment opportunity.

This means many token sales will have to make a radical change to their marketing strategy and perhaps their business model in order not to run afoul of the SEC. Of course, participants in the cryptocurrency industry must remember that the Howey Test is based upon a case-by-case analysis, and no one factor is dispositive in determining whether or not a token is a security. Token promoters should be careful to receive professional analysis and advice when deciding how to proceed with a sale that may be regulated by the US federal government.

Written by Daniel Kelman and Steven F. Muñoz.

Daniel Kelman is general counsel to Bitcoin.com and GSR Markets. He is also a co-founder of Bitocean Japan and an advisor to Vechain’s steering committee. He is the managing partner of Kelman PLLC which operates Crypto.law offering legal advisory services to token issuers conducting ICOs.

Steven Muñoz works with Daniel assisting token issuers and ICOs at Crypto.law. He is a lecturer on US law at Jimei University School of Law in Xiamen, China. Steven has passed the New York Bar and is presently awaiting admission.

What do you think of the SEC’s response to the six token sale questions? Do you think most of the ICO’s today violate the SEC guidelines? Let us know in the comments below.

Images courtesy of Shutterstock, Munchee

This is an Op-ed article. The opinions expressed in this article are the author’s own. Bitcoin.com does not endorse nor support views, opinions or conclusions drawn in this post. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the Op-ed article. Readers should do their own due diligence before taking any actions related to the content. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any information in this Op-ed article.

Keep track of the bitcoin exchange rate in real-time.

The post No Tout: Six Token Sale Questions Clarified by the SEC appeared first on Bitcoin News.