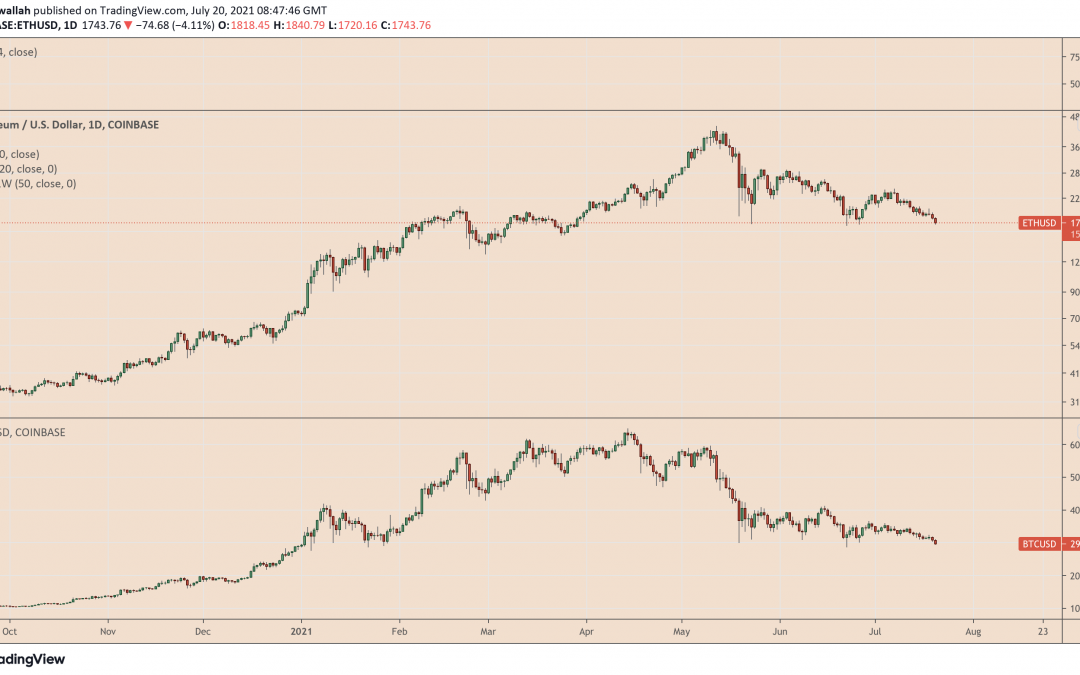

Ether (ETH) prices slid on Tuesday in tandem with Bitcoin’s (BTC) drop below $30,000.

The ETH/USD exchange rate dropped 5.41% to an intraday low of $1,720 — or roughly $400 above its 2018 all-time high price — which should serve as an important psychological support level.

The pair’s bid had climbed to as high as $1,994 on the Coinbase exchange on Sunday. Meanwhile, its price action looked strikingly similar to Bitcoin’s, the flagship cryptocurrency that topped at $32,450 on Sunday but later corrected to as low as $29,507 during the Tuesday session.

The plunge also followed the Ethereum network’s co-founder Anthony Di Iorio’s exit from the cryptocurrency industry partially because of personal safety concerns. Di Iorio, who’s likely a large Ether holder, hinted to Bloomberg in an exclusive interview that he would liquidate his entire crypto-related holdings, without specifically mentioning the Ethereum blockchain’s native token.

“[Crypto is] really a small percentage of what the world needs,” he said, adding that he wants “to diversify to not being a crypto guy, but being a guy tackling complex problems.”

Hard fork FOMO snubbed?

The latest bout of sell-off surfaced despite Ethereum’s upcoming network upgrade. Dubbed as the London hard fork, the major code update is another step toward turning Ethereum into a speedier and scalable proof-of-stake network from an energy-intensive proof-of-work one.

But the most talked-about feature in the upcoming hard fork is deflation. The upgrade expects to burn a portion of the base fee paid to miners, thereby reducing the supply of Ether. Crypto education platform CoinMonk noted in March that the London hard fork upgrade could ideally burn 1 million ETH in 365 days, which is almost 1% of the network.

Grayscale, a New York-based digital asset investment firm, also wrote in a report in February that deflationary dynamics would prove extremely bullish for Ether prices. ETH/USD surged by almost 180% to its record high of $4,385 after the report came out.

The latest downturn in Ether markets has flashed serious concerns about the London hard fork’s ability to withhold bullish bias. For instance, analysts at TradingView said in their timeline updates that inflationary pressures from United States markets might have boosted ETH/USD’s downside sentiment.

In detail, the U.S. Labor Department last week released June’s Consumer Price Index (CPI) report. The latest data showed that inflation in the U.S. rose 0.9% in June to 5.4%, the fastest just before the 2008 financial crisis. Bitcoin and Ether prices dropped after the report was released.

“Typically, cryptocurrency has been seen by digital asset investors as a hedge against inflation,” TradingView analysts wrote, adding:

“However, in this case, the data itself matters less than what the Federal Reserve might do in response to that data. Traders began selling off cryptos like Ethereum and Bitcoin on fears that continuously rising inflation would prompt the Fed to take back its quantitative easing policies.”

Bullish all the way

But not everyone is bearish. For instance, Konstantin Anissimov, executive director of CEX.IO exchange, anticipates Ether prices to reach $3,000 following the London hard fork.

“As things stand, the Federal Reserve has increased the size of its balance sheet from early 2020 to more than $8 trillion — a substantial rise,” he said, adding that the reduced prices in the cryptocurrency markets are an opportunity for investors against beaten-down safe-havens in traditional markets.

“Market investors could accumulate the coins at a discount while trusting in their abilities to serve as the right hedge against the inherent inflation. Both coins with the renewed buy ups are likely to retest new price levels at $45,000, and $3,000 respectively.”

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.