The scale of Bitcoin’s (BTC) ongoing downside correction might not be as alarming as it was in 2018, indicates data shared by Glassnode.

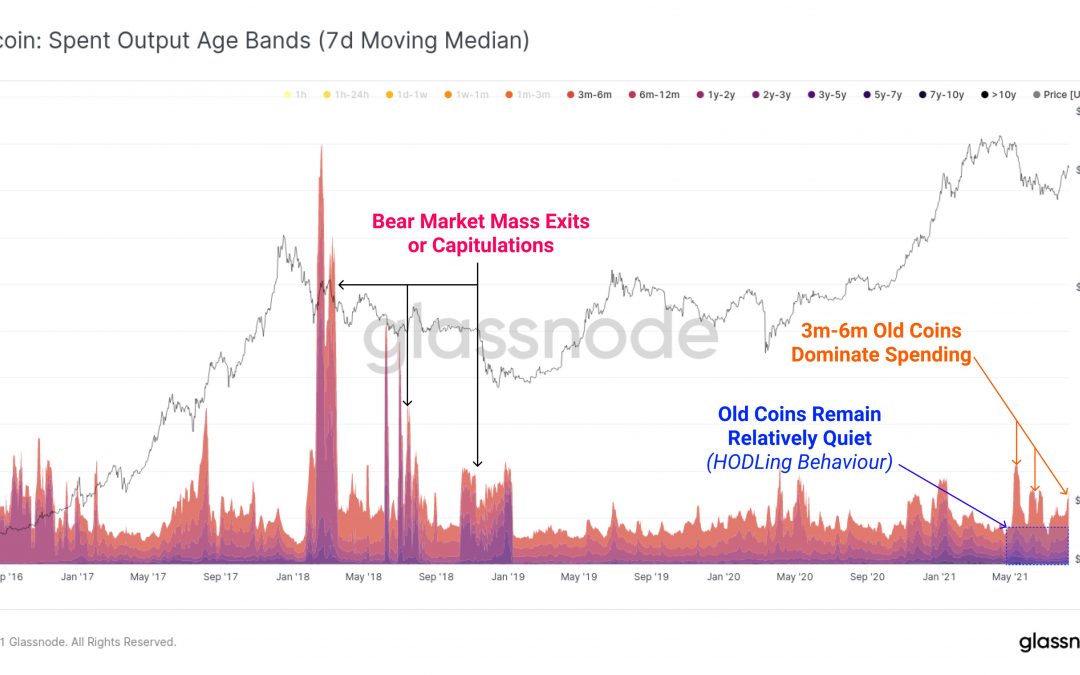

The blockchain analytics firm reported that investors who have held Bitcoin for more than one year showed a lesser interest in liquidating their investments versus those who held the digital asset for three to six months. Its dataset covered the period of Bitcoin’s correction from around $65,000 on April 14 to around $44,000 on Monday.

On the other hand, all investor cohorts were instrumental in crashing the BTC price in 2018 from $19,891 to $3,128.

With a majority of “old coins” not deciding to secure their 275% year-over-year profits even after a 35% downside correction, Glassnode data hinted strong “hodling behavior” that might have Bitcoin escape a 2018-like mass capitulation event.

Glassnode noted:

“Despite a strong rally to $45k, the Bitcoin market still has not seen a significant increase in old coins (>1y) being spent. This is very different to the 2018 bear market where old hands took exit liquidity on most relief rallies.”

Panic selling missing

Excessive valuations led by the initial coin offering frenzy were the main cause behind the 2018 cryptocurrency market crash. Random startups raised billions of dollars to build blockchain platforms, but a majority of them turned out to be either vaporware or scams in the end.

When the bubble finally popped, the cryptocurrency market ended up crashing from $700 billion in January 2018 to $102 billion in December 2018. As a result, Bitcoin, which was one of the currencies of choice during startup fundraisers, fell 85.27% from its then-record high of $19,891.

Nevertheless, 2021’s Bitcoin price rally originated from solid macroeconomic grounds as investors hunted for safe havens against loose monetary policies implemented by central banks worldwide. As a result, central banks’ efforts to guard economies against the financial aftermath of the coronavirus pandemic pushed the global debt to over $281 trillion last year.

Related: $7B investment firm recommends crypto to beat currency debasement

That was 355% of the global gross domestic product. According to the Institute of International Finance, borrowing is expected to have increased by another $10 trillion in 2021.

“People have less wealth and more debt. The devaluation of fiat currencies has made everything more expensive around us,” said Anthony Pompliano, partner at Pomp Investments, in a note to clients, adding:

“The promise of bitcoin is that we will usher in a new era of sound money. The currency is outside the system. No one controls it. People will once again be able to save their way to financial freedom. The money won’t lose value over time. In fact, the purchasing power will increase.”

Short-term investors returning?

Bitcoin’s recent rebound from below $30,000 to over $45,000 also coincided with a modest spike in the percentage of investors who last bought the digital asset three to six months ago.

On July 19, when Bitcoin was wobbling near $30,000, the cryptocurrency’s net unspent transaction output for 3 million–6million investors was 12.84%. That surged to 13.44% on Monday. Bitcoin was trading around $45,130 on the same day, showcasing that weak hands were turning strong.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.