Brian Frye, a conceptual artist, film maker and law professor, encourages people to plagiarize everything he’s ever created or said.

“I’m the legal academy’s leading plagiarism advocate. I’m also the legal academy’s only plagiarism advocate, which makes it very easy to be number one,” the bespectacled Frye said in a video call yesterday. Well, professor, I’m stealing that joke.

This article is part of CoinDesk’s Policy Week, a forum for discussing how regulators are reckoning with crypto (and vice versa). A version of it published first in The Node newsletter, which you can subscribe to here.

This pro-plagiarism stance is part of Frye’s continuing campaign against copyright, the legal instantiation of the idea that ideas can and should be owned. Over the past decade and a half, Frye has written countless legal reviews and op-eds discussing how copyright is antiquated in a world where the internet eliminates the costs associated with reproduction and distribution.

“Ideas are non-rival,” he told CoinDesk. “You don’t need to value them because there’s no scarcity, so they should be valueless.”

This contrarian opinion has brought him to the world of non-fungible tokens (NFT), the blockchain-based technology often credited with bringing “scarcity” to digital goods. It’s an idea for which lots of people are willing to pay big bucks.

A representative example: Ether Rocks is a series of virtual pet rocks that “live” on the Ethereum blockchain. There are 100 unique tokens – each corresponding to a near-identical cartoon JPEG – that even the creators say serve “NO PURPOSE” beyond speculation. Though the original image was a royalty-free piece of clip art, some people have spent millions of dollars on these tokens.

But, as Frye notes, what people are buying when they buy any NFT is “worthless.” By and large, NFTs do not represent ownership of the digital goods to which they supposedly correspond, do not confer copyright and may, in fact, one day be classified as securities. “So the owner of the NFT gets nothing other than the right to claim ownership of the NFT,” he wrote in August.

That’s not nothing. In fact, Frye is learning NFTs have a lot going for them. For one, there’s a sort of community-wide acceptance that people can sell even things they don’t possess. He sold an NFT of the Brooklyn Bridge for $500 – stealing the idea from an infamous scam artist.

NFTs are the “reductio ad absurdum” of contemporary art markets, meaning they reduce the “concept of ownership to its purest essence, it’s the ownership of ownership,” he said, and of art to pure market functions. Art, he said, has always been more about status than anything, and the blockchain just makes this pecking order more visible and open.

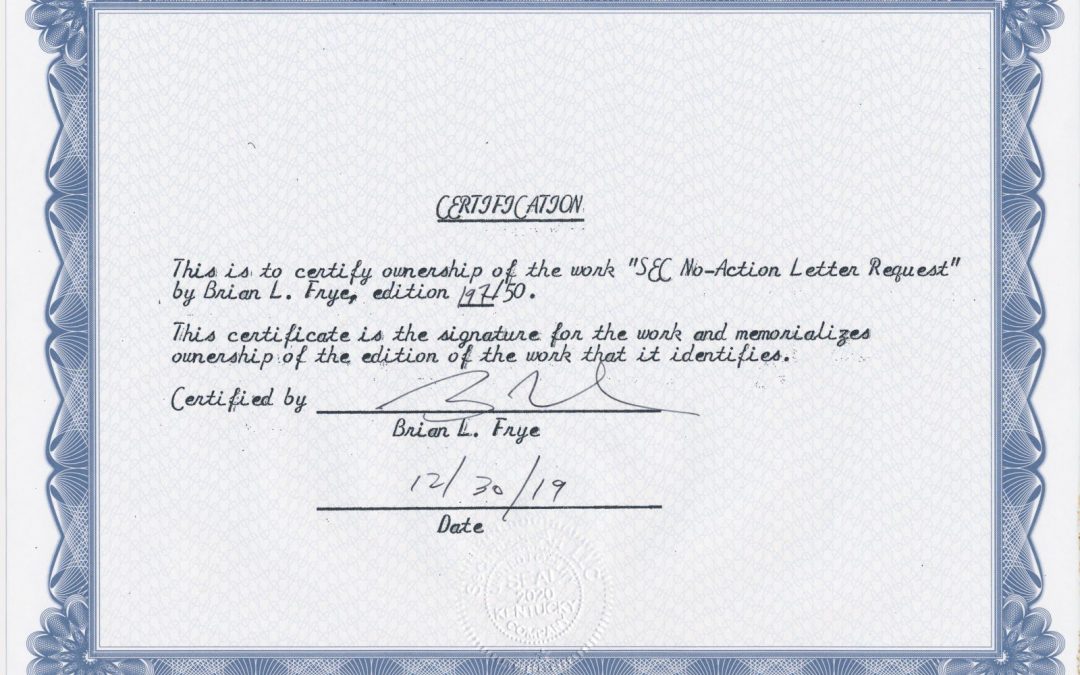

Further, NFTs are a sort of blunt instrument to wield against legacy institutions. In September, Frye minted a series of NFTs tied to a paper he wrote called “SEC No-Action Letter Request,” which raised the question of whether selling shares of ownership in the paper is an illegal unregistered security.

There was the implicit promise of income, which, to his surprise, actually came through. He brought in tens of thousands of dollars worth of ETH in the sale. This proved his thesis: The project called into question standing securities law, which Frye thinks is overly-broad in covering “any investment in a common enterprise that generates profit from the efforts of others,” and lays out a possible argument the SEC could use against him.

Read more: Some NFTs Are Probably Illegal. Does the SEC Care?

It’s easy to call everything meaningless: Art, securities rules, copyright. As part of a series we’ve called “Gensler for a Day,” which is asking informed and influential people to give their ideal crypto policies, CoinDesk reached out to see if Frye has any concrete plans, not just concepts. It’s not too far out there: Frye did once run for public office.

What follows is a condensed version of our conversation, covering NFTs, the SEC and the merits of writing while taking a bath. You can read a full version on CoinDesk.com. And feel free to steal his ideas.

“Break a contemporary museum into pieces with the means you have chosen, collect the pieces and put them together again with glue.” [That’s a line from Yoko Ono’s poetry book “Grapefruit,” which Frye has cited as inspiration.] Does that mean anything to you?

The idea is to just give people something to think about when they think about what they’re doing and why they’re doing it, you know, and also to do it by kind of ostentatiously plagiarizing someone else at the same time. All my good ideas are stolen from someone else.

Is that what you’re doing with NFTs?I mean, I think so. I’m not sure what I’m doing in NFTs, yet. When the NFT thing first hit the public consciousness over the summer, somebody called me from Business Insider and wanted me to talk about what was going on. The first thing I said to her was, “I have no idea what’s happening, but I love it.” That’s still true, I have no idea what’s happening. I don’t think anyone has any idea what’s happening, but something is happening. I’m just trying to do my best to be open to whatever it is that’s taking place enough to help me see even though I can’t figure out what it is.

Are you purposefully goading the SEC to make a determination?

They won’t talk to me, they don’t want to talk to me, they’re terrified of what I’m asking them. This is existential for the SEC.

What do you mean by that?

OK, look, everyone asks the wrong question. People keep saying, “is it a security?” If the SEC wants to regulate it – that’s the only real question. The SEC transforms things into securities by the magic of regulation. Anything can be a security as long as the SEC decides to characterize it as a security because the definition is overinclusive, it means everything.

I don’t mean I’m agnostic as to how we should go about doing this. Maybe a probationary regime of securities regulation is what we want. Maybe we do want a kind of SEC exercising discretion about what it regulates. But the problem is the SEC. The people there are morons. They have no idea what they’re doing and they don’t actually realize that the term “security” is meaningless.

So this is a problem for them because all of a sudden they’re confronted with something that is terribly, existentially terrifying to them because they don’t know what to do with it.

You’re doing the work for them. They can plagiarize it if they want.

A friend of mine said to me when I did the SEC “No Action” letter requests as a work of conceptual art – the conceptual art consisted of me sending the “No Action” letter request to the SEC asking them to “regulate me baby.” I explained to them, this is a security according to your definition, therefore you should prohibit me from selling it. My friend said this is probably the first ever “Action” letter request. Because nobody sends a letter to the SEC, saying, “I want to do something illegal, please stop me.”

You’ve received broad acceptance from the NFT community, from the media – Business Insider, Bloomberg, CoinDesk. But it seems like your true audience – the SEC – has rejected your work. (They could also just move slowly.) How does that make you feel?

I love it. If the SEC had it in them to respond to what I’m doing I think it would make the art less fun. The whole point is to be trolling the government. The SEC is basically nerd cops. They want to be in the business of being in charge. The one thing you’re not used to is people punking them. No one does this.

Except for Elon Musk.

Fair. He’s got balls of steel to punk the SEC while having something actually on the line. No one questions whether or not it falls within the sphere of securities regulation. He’s playing chicken with them. In my case, there’s no risk. What are they going to do to me? It would be too humiliating for them to prosecute me. Bringing an action against me would be like throwing me in the briar patch.

You said that a lot of people suddenly wanted to spend a lot of money to buy nothing, because that’s what an NFT is – nothing. Are your ideas worth less than nothing?

I mean, ideas are valueless because they don’t need to have a value. Ideas are non-rival. You don’t need to value them because there’s no scarcity, so they should be valueless. What I find most interesting about NFTs is that they sort of are the reductio ad absurdum of the art world in a really beautiful way.

Everyone talks about Walter Benjamin and the “aura of authenticity of the work of art.” You know, God bless him, I think he was actually onto something, but he was totally wrong but it wasn’t his fault that in 100 years there’d be the internet, let alone cryptocurrency or NFTs. The problem is he saw the aura as being attached to the authentic object; but what he missed, I think, was that the aura is really all about ownership. The concept of ownership. The peculiar thing about NFTs is that they reduce the concept of ownership to its purest essence, it’s the ownership of ownership, and that’s it.

Right. You don’t own the object, you own a token that may correspond to an object.

You own a token that the relevant people are willing to accept as corresponding to ownership of something valuable. Something that they care about, that matters, is meaningful. It’s all about status, really, it’s about other people’s recognition. When you buy art, what you’re buying is a spot in some artist’s catalog or resume – sometimes a dirty piece of cloth or a lumpy rock comes along with it.

See also: It’s Time to Talk About NFTs and Intellectual Property Law

You’re sometimes credited, but not always, with the idea that copyright holders are like landlords. Insisting that an idea has value and then charging a type of tithe for people to use it. Who fixes the drain when something is clogged in this analogy?

No one! That’s part of the problem. Corporate owners are the worst landlords because they don’t do any maintenance and they think they’re God’s gift. Regular landlords at least have a bit of humility. The whole point is not to say that there’s anything wrong with landlords, it’s just to say that there is something wrong with idolizing copyright owners and authors by association with their ideas. There’s nothing special about collecting rent and that’s all you’re doing when you assert copyright ownership.

Do you have thoughts about the idea of copyright in NFTs?

The beautiful thing about NFTs is that they might actually solve a problem, at least some of the problems that arise in that landlord scenario. What we’ve done with this technology and various other kinds of internet-based platforms has eliminated entirely all the costs associated with reproducing and distributing works of authorship. That used to be the most expensive part of getting culture out to the public. The whole reason that copyright came into existence in the first place was that the cost of reproduction and distribution had come down slightly when the printing press was invented. When the cost came down a little bit – from manuscripts to printed books – copyright made sense.

The problem is that now the cost of reproduction and distribution is zero. It’s zero. The only cost is associated with producing the work in the first place but we’re stuck with the same mechanism designed for a world where transaction costs associated with reproduction and distribution were significant.

My hope is that NFTs have the potential to actually compensate authors without having to have copyright at all. Imagine two different potential worlds: You can have one world where you own the right to control the use of the works of authorship you create – you can tell people what they can and can’t do with whatever it is that you produce. But you don’t really get any money if no one really cares or wants to give you money for it. In the other world you don’t own anything. You have no right to control how people use the work of authorship that you created, but somebody is willing to give you 100 grand for it. Which do you prefer?

I’m greedy. I want the money, upfront. I don’t give a [care] about control. We don’t need control anymore as long as you can get paid up front. And, to my mind, NFTs might make that possible. A lot of people are still stuck in this controlling mindset.

What are the concrete policy considerations you want to throw on the table? Eliminate copyright?

I think it has to happen on its own. I’m not delusional enough to think anyone gives a [hoot] what I think. All I can do is throw ideas out there and see what sticks. The landlord thing was great: I put it out there, Mike Masnick picked it up, people ran with it, nobody attributes it to me but they use it all the time and I love it. It was viral. No one’s going to listen to me to make copyright policy or any other kind of policy, but if we can shift the window a little bit and help people see that this is something actually positive and potentially liberatory that’s going to give people an opportunity to get outside of our regime of ownership that is not productive.

So plagiarism is productive?

I think creators are very narcissistic and they should get over themselves. I like to say I’m the legal academy’s leading plagiarism advocate. I’m also the legal academy’s only plagiarism advocate, which makes it very easy to be number one.

Why do you write in a bathtub?

It’s comfortable. It’s relaxing. It gives me a little bit of time off. Alan Greenspan used to do it.

A little Randian in the tub.

I like to think he would be horrified by everything I stand for.

Do you still think NFTs have the ability to collapse the traditional art market by siphoning off capital?

I think yes. I mean, ideally, yes. But I would put it a little bit differently. I think NFTs have the potential to make the traditional art market irrelevant, which will be a wonderful thing because I think that there’s a fetishization of objects that I think is unhealthy. Taking the money away lets us think about the art more. Art is a consumer good that consumers don’t understand. Consumers understand money – that’s why we talk about art in terms of money, because that helps people understand it. We talk about law schools in the same way, in rankings. We have stock markets – someone won a Nobel Prize for telling us that price is just a way of communicating information.

[Laughs, Googles Joseph E. Stiglitz, cries.]

The art market is a way of communicating information about consumer preferences. The problem is consumers don’t actually know what they want to buy. All they know is what the price tells them about what they’re supposed to buy. What they’re ultimately buying isn’t the object, it’s the status associated with the object. NFTs make the work available to everyone on the same terms, and make it very clear that what you’re buying and what you’re trading is just the status associated with being the owner.

See also: Nobel Laureate Thinks Bitcoin is an “Amazing” Bubble

Some notable art critics have said there’s little aesthetic value in NFT art.

Most art critics are idiots. I’m in the process of trolling Chris Knight right now – the least-deserving Pulitzer Prize winner in the history of Pulitzer Prizes. I will concede that what people are trading is in many respects not to my aesthetic preferences. But I don’t think that matters. Who cares what my aesthetic preferences are? If people like it, who’s to say?

I also think that it’s too early to really know what people are going to ultimately value and find worthwhile and why they’re going to value it and find it worthwhile. The wonderful thing about NFTs is we don’t actually need them – they’re a technical solution to a problem that never actually existed, but we need to figure out how to solve anyway.