The market for solar PV design software has opened up significantly in the past five years. New offerings have taken off in that time, and they range from fully integrated systems offering one-stop functionality, to niche services that are hyper-focused on one segment of the design process.

Yet a huge amount of growth is still to come for these software systems and much of that growth will hinge on which systems users are choosing today, how they choose those systems, and the delivery mechanism for software options in the future.

Lead image: Solar design software. Credit: Chris Hipp with input from Paul Grana, Folsom Labs.

Growth with an Integrated Approach

Some of the most robust solar design software offerings used by developers — across residential, commercial and industrial (C&I), and utility-scale sectors — make it easier to sell and install solar. With an address and an electric utility bill, developers can quickly present a wealth of information — from financial analyses to engineering layouts to shading analyses — to help customers choose solar.

Independent software provider Aurora Solar says users of its software can produce a complete system design for a residential homeowner in about 15 minutes. Aurora was founded in 2013 and launched its software in early 2015. Co-founder Christopher Hopper says that in 2016, the company’s software was being use to design 1,000 projects per week. In 2017, that number jumped to 10,000.

According to Hopper, the company’s progress over the past two years stems from a few basic concepts that he and Co-founder Samuel Adeyemo agreed upon at the start.

They chose to build an independent software company that was not tied to a specific manufacturer, financing provider, or other entity.

“We thought it was important that the industry be able to make data-driven decisions,” Hopper said.

They also focused on integration.

“We realized there was a strong need for having an integrated design process that goes from A to Z — from an address to a finished proposal — and not break that process up into different steps across different software,” Hopper said. “Designing a solar system is a complex problem that touches a lot of different aspects, and we felt that integrating all those into one clear and streamlined software solution would provide a lot of value.”

Finally, they decided that providing software that enables remote design was critical for developers to grow.

“We felt that as the industry scales, it’s important to accurately design systems remotely,” Hopper said. “We wanted sales people to be able to accurately quote systems remotely without having to travel to the site and go through all the cumbersome and manual design steps.”

With updates to the software released every two weeks, Adeyemo said there have been hundreds of improvements to the system since its launch. Among those improvements are LIDAR mapping and a function called AutoDesigner, which allows users to enter parameters — the percentage of energy to offset or amount of bill savings — and the system will generate the best design to meet those objectives.

“We have a feature where you can use Google Street View to pull up information like the slope of roofs and the height of buildings,” Adeyemo said. “And we have another feature where you can automatically detect all the obstructions on a commercial building roof surface. We don’t want our clients to travel to a site until they have a paying customer, and those are the kind of features that allow us to continue pushing the envelope.”

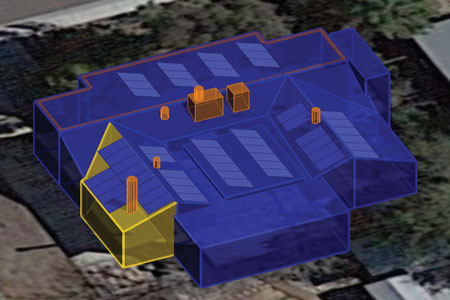

3D residential solar design in Helioscope. Credit: Folsom Labs.

The Path to Interoperability

Other solar design software providers take a similar approach to Aurora, offering a functioning suite that delivers ease of use to employees across an organization.

Folsom Labs, which has been offering its integrated design software HelioScope since 2014, says its product shortens the learning curve for solar PV system design and opens up the bottleneck that can occur when, i.e., one engineer drives the entire design process.

“When the sales person can own the design experience, it’s the single biggest driver of ROI for Folsom’s customers – it’s pure ease of use,” Folsom Labs Co-founder Paul Grana said.

But at Folsom Labs, an integrated system is not the sole approach to software services. The company also is looking at how customers choose software and services today to think about the future.

The company has agreements with other niche software providers that allow interoperability between HelioScope and other systems. Folsom Labs, for example, recently reached interoperating agreements with Energy Toolbase and EcoTiza. The software systems remain independent of one another, and users have separate sign-ins for each, but the systems play together seamlessly. These agreements are just the “tip of the iceberg” according to Grana.

“We’ve provided our API documentation, which is basically all that is necessary [for interoperating], to over 100 different companies,” Grana said. “We’re huge believers in that kind of product tie-in so that people can get the best of as many worlds as possible.”

Grana cites as an example the way users today choose IT systems. They are not necessarily brand loyal across the IT spectrum. A user may buy a PC with a Microsoft operating system, but may choose to use Google Gmail over Microsoft Outlook for business email. So, too, a user may choose to use Dropbox over Google Drive for cloud storage, and so on.

In that context, Grana said, there are going to be some users who want HelioScope for design, financial optimization, proposals and CRM, and there will be others who want HelioScope for design, Energy Toolbase for finances and Salesforce for CRM.

“We want to have other products — Folsom Labs is going to have a CRM, and a pricing/proposal tool, but we also 100 percent want people to choose what they want,” Grana said. “It’s all good.”

Digging Deeper into Customer Choice

Customer choice, it appears, could matter more and more as the solar design software market grows. Grana says Folsom is looking into the future at a potential “share of wallet” approach, where they can capture a portion of a customer’s wallet by being a facilitator of sorts for additional tools.

This approach can happen in one of two ways.

First, Grana said, Folsom can begin to build interfaces to logical operations that users might want. A user, for example, could use an interface to see what the company’s project pipeline looks like, or analyze how a sales team is doing.

Second, Folsom sees an opportunity to become a provider much like the Apple App Store. In the app buying process, Apple is a facilitator; it is an important part of the process, while letting other products, brands or companies maintain a direct relationship with the customer.

“That’s what we’re going to see with a bunch of other third-party products in the solar design software sector,” Grana said.

Users, for example, could buy — within HelioScope — imagery from a provider, such as EagleView Pictometry or Nearmap.

“When that transaction hits the user’s credit card, it will say Folsom Labs, but they will know it’s not Folsom Labs delivering the product — it will be Pictometry or Nearmap,” Grana said. “It’s totally transparent who is delivering the value, but we just facilitate that.”

The upside, according to Grana, is that Folsom Labs can provide third parties access to a long list of developers that they would never have access to otherwise — small and local companies with highly sophisticated operations.

Those third-party providers — imagery, weather data, financing — “have a direct feed to the top 100 solar developers, but for the 101-5,000, those are our people,” Grana said.

Taking a Niche Focus

While providers, such as Folsom Labs and Aurora, are working on the A-to-Z paradigm, others are focusing on one part of the solar PV design process. Energy Toolbase, for example, is deeply focused on utility rate and avoided-cost analysis.

HelioScope and Aurora also offer that same functionality. Energy Toolbase already interoperates with HelioScope, and according to Adeyemo, it also could interoperate with Aurora.

Depending on their needs, users can choose which system they prefer for those analyses.

“There’s no question that the software landscape is evolving pretty fast, and I think there’s room for multiple winners,” Energy Toolbase Chief Operating Office Adam Gerza said. “We’re just looking at this concept of stacking software because across our user base, it is incredible how different and unique all these various organizations are and which tools they choose to leverage.”

Gerza says Energy Toolbase differentiates its product by delivering analyses that are constantly evolving with the complexities of the financial piece of the design puzzle.

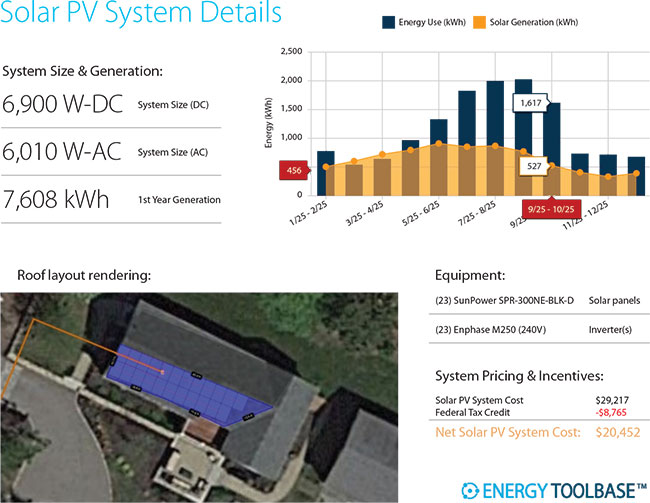

Proposal output. Credit: Energy Toolbase.

On the residential side, “you are seeing a lot more rate switching scenarios, where you have a customer with a unique load profile; maybe they’re on a flat rate and proposing to switch to a time-of-use rate; maybe they’re getting forced onto some set of net metering 2.0 assumptions; or maybe they are also looking at an option pairing energy storage with solar,” Gerza said. On the commercial side, he added, there are many more layered sets of use cases.

The company is taking its product to the next level by expanding its analyses functionality for energy storage.

“Users have been able to model energy storage in our tool for the last two-and-a-half years, but we’re pushing out some really significant game-changing new features,” Gerza said. “It’s the same approach we take on the solar side, only it’s a robust tool to do accurate objective and transparent analysis and optimization for storage projects.”

He added that the company’s guiding product philosophy is to be objective and unbiased.

“There are a lot of energy storage providers out there — Tesla, Stem, Sonnen, LG,” Gerza said. “When a sales person is trying to figure out the savings of any type of hardware, any type of battery chemistry, any type of solar technology, whatever their chosen production modeling tool is, we’re treating everything on an equal playing field and coming up with an objective, transparent savings answer.”

Gerza expects that in 18-24 months residential installers may need to look holistically at a project – potentially installing solar and storage, and maybe also some energy efficiency retrofits or demand-response opportunities — and figure out the best solution. Gerza says the company wants to focus on providing a best-in-class financial tool to handle the complexities of those choices.

Today’s Market Realities

With all the growth potential envisioned by companies in the solar design software space, Folsom Labs’ Grana provides some sobering statistics.

He said that in a recent survey, the company learned that most of the current marketshare is still in Excel, PowerPoint and Word.

“There’s still so much growth just in terms of converting people from basically using Google Earth, Microsoft Word and Excel to using software tools,” he said. “We’re talking 70-90 percent penetration for those products.”

Aurora’s Adeyemo believes that that user conversion is critical for the solar market.

“It’s imperative that people have some sort of software solution; simply because the demands are getting higher in terms of the level of accuracy, the level of precision and the level of efficiency you have to have with running a business in order to scale effectively,” Adeyemo said. “It’s a tough business.”