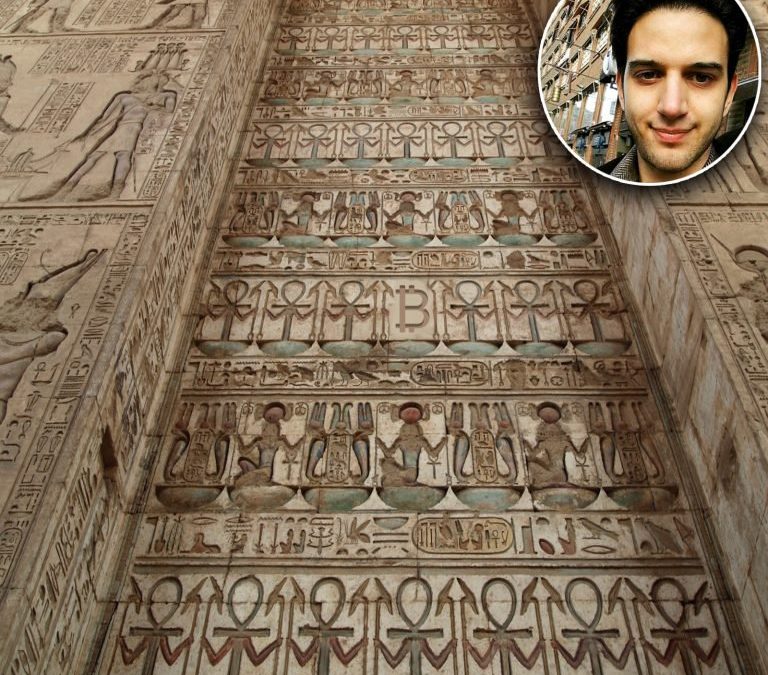

This post is the first in a weekly trading tips series called ’Writing On The Wall’, in which our game theory guide Eric Wall tries to decipher those writings.

The retail market forces in cryptocurrencies are governed by a mishmash of various ideas and concepts. The longer trends in which these are prevalent are sometimes referred to as fundamentals, which for bitcoin are things such as financial sovereignty, inflation immunity, and un-correlatability. The shorter trends are governed by what can be thought of as a multitude of competing memes, where the most prevailing meme for a given week will be the dominating factor in dictating that week’s price movements.

See also: Markets Update: Bitcoin Bulls Push the Price Above $8600

Understanding Market Dynamics

For the intra-week bitcoin trader, correctly identifying the current landscape of these memes is crucial. Whether the trader agrees with the reasoning behind a certain meme is of no importance; the trader needs only to measure its potency through the eyes of the market. Here’s a list of what I consider to have been the most prevailing memes during this past month:

- Get in before the SegWit2x fork to get free shitcoins! (Oct 28 to Nov 8, $5,700 → 7,500)

- No free SegWit2x coin? Back in to alts! (Nov 8 to Nov 9, $7,500 → $7,000)

- The Cashening?! (Nov 9 to Nov 12, $7,000 → $5,400)

- No Cashening? (Nov 12 to Nov 14, $5,400 → $6,500)

- Get in before Wall Street! (Nov 14 to Nov 22, $6,500 → $8,200)

I contend that there often are clues by which the savvy trader can estimate or predict these memes. For instance, the potency of the “Get in before the split to get free shitcoins!”-meme could have been predicted by giving afterthought to market participants sweetened tooth from the combined value increase of Bitcoin and Bitcoin Cash following the Aug 1st hardfork.

I contend that there often are clues by which the savvy trader can estimate or predict these memes. For instance, the potency of the “Get in before the split to get free shitcoins!”-meme could have been predicted by giving afterthought to market participants sweetened tooth from the combined value increase of Bitcoin and Bitcoin Cash following the Aug 1st hardfork.

Even if a trader fails to identify a meme prior to the event, they can still profit during the event if they can correctly estimate whether a certain market reaction is indicative of an overreaction — which is usually the norm — whether it’s China banning bitcoin, Jamie Dimon getting upset on television or Tether getting hacked (or as Kraken would put it, “non-redeemable tokens almost being not redeemed”). Typically, by applying a simple BTFD scheme to such events, I contend that traders have been able to outperform virtually any TA-based strategy, regardless of whether the indicators are of the Tone Vaysian or Sachsian flavour.

But perhaps all that is coming to an end now.

The Last Meme

Of the items on the list, the last item is special for several reasons. Not only is it special because it is still transpiring in the market. It is also special because when it matures, it may fundamentally change the market dynamics of bitcoin for good.

The perception of bitcoin as an uncorrelated asset may be the most important driver in why Wall Street wants to get in to bitcoin, but ironically, the very fact that Wall Street hasn’t gotten in yet may simultaneously be a key factor in why bitcoin still is an uncorrelated asset in the first place. Indeed, as institutional capital flows into bitcoin, the current meme-driven intra-week market dynamics dominated by retail investors may instead transition into being more tightly coupled with the real economy.

It Came From the East

As Chris Burniske has been known to say, if bitcoin is held by institutional investors as a part of larger portfolios, portfolio managers may need to offload bitcoin to the market as a means of rebalancing in the event of a stock market downturn, which would increase the correlation between bitcoin and the stock market. As such, Wall Street may destroy the very property they hope to extract from bitcoin by adopting it.

Traders will need to anticipate the turn of the tides before it happens and modify their strategies accordingly. However, meme-driven analysts may find some respite thanks to the recent South Korean infusion. As long as Bithumb with its ~$2.5bn daily trading volume remains the cryptocurrency powerhouse worldwide, Twitter and Reddit are the Bloomberg Terminals of Bitcoin.

Sell Bitcoin Gold (BTG)

Anyone who was a bitcoin holder at Bitcoin block height 491,407 received an equal amount of Bitcoin Gold (BTG). They are currently accessible to the users of exchanges that list them and users of hardware wallets such as Ledger Nano S and Trezor. Bitfinex BTG deposits are open where it is currently trading at ~$390.

Anyone who was a bitcoin holder at Bitcoin block height 491,407 received an equal amount of Bitcoin Gold (BTG). They are currently accessible to the users of exchanges that list them and users of hardware wallets such as Ledger Nano S and Trezor. Bitfinex BTG deposits are open where it is currently trading at ~$390.

In this post I’ll argue why I think this is an excellent BTG selling opportunity.

The free float for BTG is currently severely limited due to a number factors:

Exchanges: Most big exchanges (e.g. Coinbase, Bitstamp, Kraken) are not supporting it, although this may change in the future.

Wallets: Most smartphone wallets are not supporting it; users must manually extract their private keys and run a Bitcoin Gold client in order to access the coins, which is both relatively complicated and risky. The same complexity and risks exist for private keys stored elsewhere, e.g. in Bitcoin Core or in cold storage paper wallets. We can assume this will take some time for most users, while some may even avoid it altogether.

The suppressed float, combined with the fact that BTG was listed on Bithumb earlier today has provided ideal conditions for a price rally. Some facts about Bithumb:

- Largest cryptocurrency exchange by trading volume (~$2.5bn/daily)

- Based in South Korea

- Rumored to have been joined by Chinese speculators since the Chinese regulatory shut down of several cryptocurrency exchanges in September

- Supports a limited number of cryptocurrencies, where Bitcoin Gold is the 11th addition

The reason why I think the Bitcoin Gold price is overpriced at ~$390 is because Bitcoin Gold has virtually zero community backing, no-name developers and a completely outrageous 100,000 BTG premine. I believe that the price is driven by Bithumb (responsible for ~50% of total BTG trading volume), and that Bithumb speculators are unable to sanely price the asset (currently buying at a market cap valuation of >$6bn).

Forked Coins and Forked Tongues

My theory is that there is a language barrier between South Korea and the West which prevents South Koreans from accessing information that is easily accessible to Western traders. Furthermore, the South Koreans are nascent to the cryptocurrency market and the average speculator is unlikely to possess a mature framework for valuating coins. Finally, I believe South Koreans have a larger appetite for risk than Western traders, and trade in a pattern that more closely resembles gambling.

The BTG free float is likely to be diluted over the coming weeks and months as more users gain access to their coins. When that happens, I suspect that the South Koreans will be unable to sustain the current price level for very long.

Do you think bitcoin gold has a future? And do you believe forked coins should be welcomed or avoided? Let us know in the comments section below.

Disclaimer: Bitcoin price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

The post New Trading Tip Column `Writing On The Wall´ says “Sell Bitcoin Gold” appeared first on Bitcoin News.