The drop in the price of Ether (ETH) is failing to shake out the long-term holders, while the decentralized finance (DeFi) sector is also providing opportunities for investors.

So suggests a new Glassnode report that noted many long-term Ether holders (>155 days) are sitting atop profits despite ETH/USD’s 55% decline from its peak level above $4,300. In comparison, the short-term Ether holders (

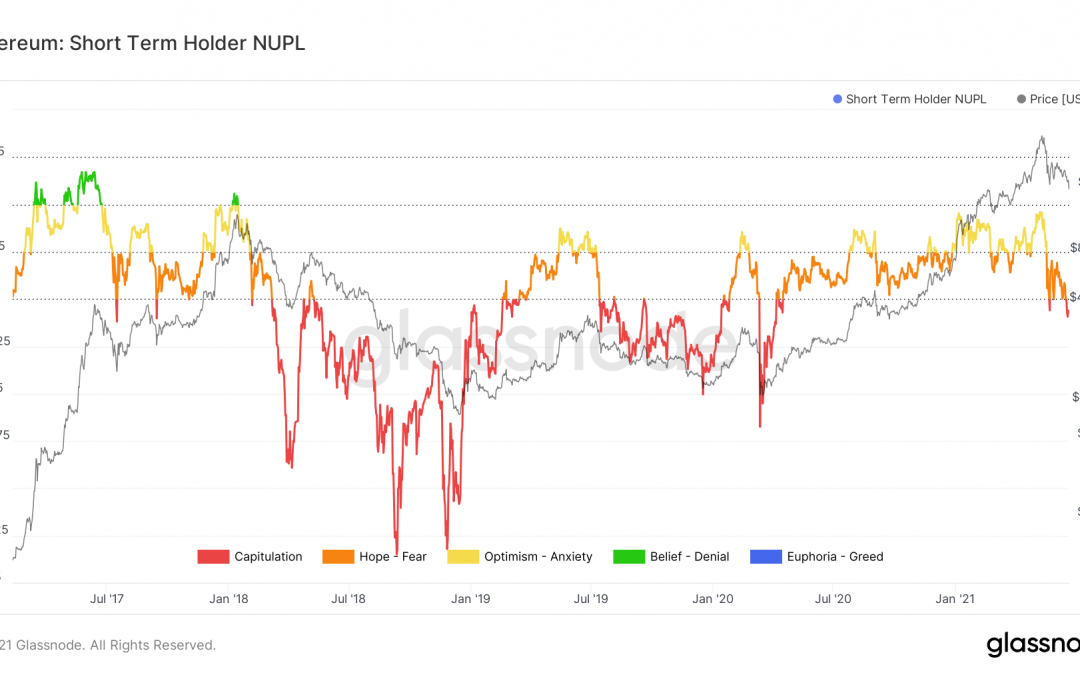

“After almost hitting 46% of the market cap in unrealized gain, short-term holders are now holding an aggregate paper loss of -25% of the market cap,” Glassnode wrote. “Conversely, long-term holders remain firmly in profit, holding paper gains equivalent to around 80% of the market cap.”

Those in losses have a higher probability of liquidating their ETH holdings, added Glassnode while citing its proprietary STH-NUPL (short-term holders’ net unrealized profits-losses) indicator, which fell below zero.

The net unrealized profit/loss (NUPL) looks at the difference between unrealized profit and unrealized loss to determine whether the network as a whole is currently in a state of profit or loss.

Glassnode further noted that LTH-NUPL, an indicator that measures long-term holders’ net unrealized profits-losses, went flat during the Ether’s downside correction. Thus, per the data analytics service, a flat LTH-NUPL showed holders’ intention to assume downside risks in the Ether market.

DeFi to limit Ether declines?

The last LTH-NUPL readings above 1 were during the 2017–2018 bull run, wherein the Ether prices surged 20,217%. Nonetheless, the massive move uphill followed up with an equally strong sell-off — ETH/USD wiped almost 95% of those gains.

The voluminous declines showed that long-term holders panic-sold their ETH holdings after witnessing their paper profits disappear.

But then, the year 2018 did not have a DeFi sector that could take those holders’ ETH and return them with annualized yields like a government bond. Glassnode noted:

“Unlike previous times of capitulation, many of these long-term holders can now deploy their assets in DeFi. ETH is widely deposited in lending protocols like Aave and Compound, where it currently sees over $4B outstanding deposits.”

Long-term holders get to borrow stablecoins — United States dollar-pegged tokens — by keeping their ETH as collateral with Aave and Compound protocols. As a result, the strategy allows depositors to garner attractive risk-off yields or speculate on token prices.

“These holders can accumulate governance tokens, grow their stablecoin balances, or buy into large dips, all while keeping the exposure they have to ETH as long-term lenders,” the Glassnode report added. “Deposits and borrow in Aave and Compound remain strong.”

Borrowing unstable assets remain a riskier alternative, nonetheless. For instance, governance tokens have dipped by more than 60% from their peaks during the latest downturn. DeFi participants, especially those who are long-term Ether holders, therefore, look to risk-off yield farming opportunities to survive downside volatility.

With liquidity still strong among DeFi platforms, a little over $100 billion according to data provided by Glassnode, and Ether holders’ willingness not to liquidate their assets, it’s likely that ETH can avoid a 2018-like downside correction in 2021.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.