2021 saw NEO reclaim the $100 price level after a downturn in the last couple of years – will June be bullish?

After breaking the psychological $100 barrier, NEO is now trading at around $50 after May’s bear market wiped out over 50% of its value. Dubbed the “Chinese Ethereum”, NEO has often been attractive to investors for its ability to function as a cryptocurrency in heavily regulated countries.

The NEO blockchain functions similarly to the Ethereum network, and its recent successful updates make it a potential investment option for those who are concerned about Ethereum’s protracted transition to Ethereum 2.0.

In this article, we will explore whether today’s price is a bargain or a warning sign, and what to expect from NEO’s price action in June.

NEO Coin Price Analysis

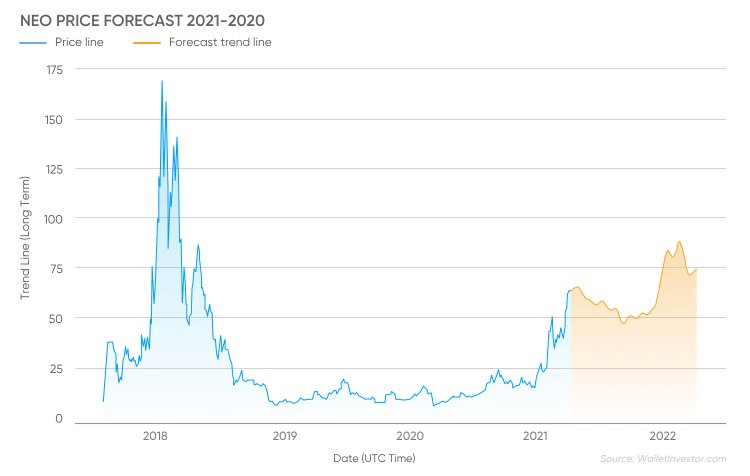

NEO witnessed a major bull run after its launch as it was posed as an attractive alternative to Ethereum, leading to its all-time high of $196.85. However, the market soon underwent a correction and the currency adopted a downward trend that continued throughout 2018 and 2019. In 2020, NEO was heavily affected by the crypto market crash owing to the pandemic and fell to $4 in March.

However, it regained lost ground by September, and joined the 2020/2021 bull market promptly, rallying strongly with the rest of the market. NEO started 2021 at a price level above the $50 price mark, and in April hit the $120 region, a price level not seen since the 2018 bull market. Whether NEO can reclaim its previous heights remains to be seen, but in the short-term, June could potentially be bullish for the coin.

NEO all-time chart. Source: CoinMarketCap

What Could Affect the NEO Price in June?

There are several factors that could affect the price of NEO this month. In this section, we will examine some fundamentals that could be price action drivers.

NEO 3.0

2021 saw NEO reclaim the $100 price level, if only temporarily. This increase in price has been attributed to the launch of NEO 3.0, an upgrade that offers improved consensus protocol, that was launched when Ethereum was suffering capacity issues earlier this year. However, NEO could not consolidate its position above the psychological price level and is currently trading at $52.09, an increase of over 5% in its value in the last 24 hours.

NEO 3.0 is only expected to further drive up the price of the token as it is aimed at raising NEO’s transaction speed and cutting down on the platform’s gas fee, both of which will enable NEO to directly attack Ethereum. NEO 3.0 is also expected to support NFTs in the future. Given the craze for NFTs in the 2021 bull market, this could potentially help NEO to emulate its performance in past years if it can carve out a unique space for itself in the NFT world.

Further, NEO is often regarded as an arm of the Chinese government and said to have the backing of commercial giant Alibaba group. The token’s Asia-centric position gives NEO a massive advantage in the South Asian markets, a key area for cryptocurrencies in the coming decade.

Crypto Market Recovery

NEO’s price movements have often been linked with the rest of the crypto market and its price trajectory has historically been similar to that of Bitcoin. While the crypto market witnessed a crash in light of Elon Musk’s Tesla’s decision to stop accepting payments in Bitcoin, these short-term bearish trends have always been part of the market’s volatile nature.

With the market already in recovery over the last few days, the current time period is attractive for investors as they could gain profits once the market enters a bull run post the recovery period. Thus, going by the crypto market, NEO is an exciting potential prospect for investors in the long run.

NEO Price Forecast

With NEO’s price hitting highs in April and May, the rest of the year looks potentially promising for the token. The price of the token has gone beyond the $50 price level for the last few days and is looking to rally further from this point. In June 2021, the price could fluctuate between $70 and $100. If NEO can overcome the current resistance in the market, it has the potential to go even higher and meet the $120 price range this month.

Source: WalletInvestor

Analysis firm Wallet Investor predicts that the price of NEO will fluctuate between $62 and $120 this month. Long Forecast is more optimistic and believes that the token will witness a bull run post-August and move to a yearly high of $184. InvestingCube, on the other hand, states that the profits of the bull run in April-May might encourage investors to invest further in the token, driving up the price.

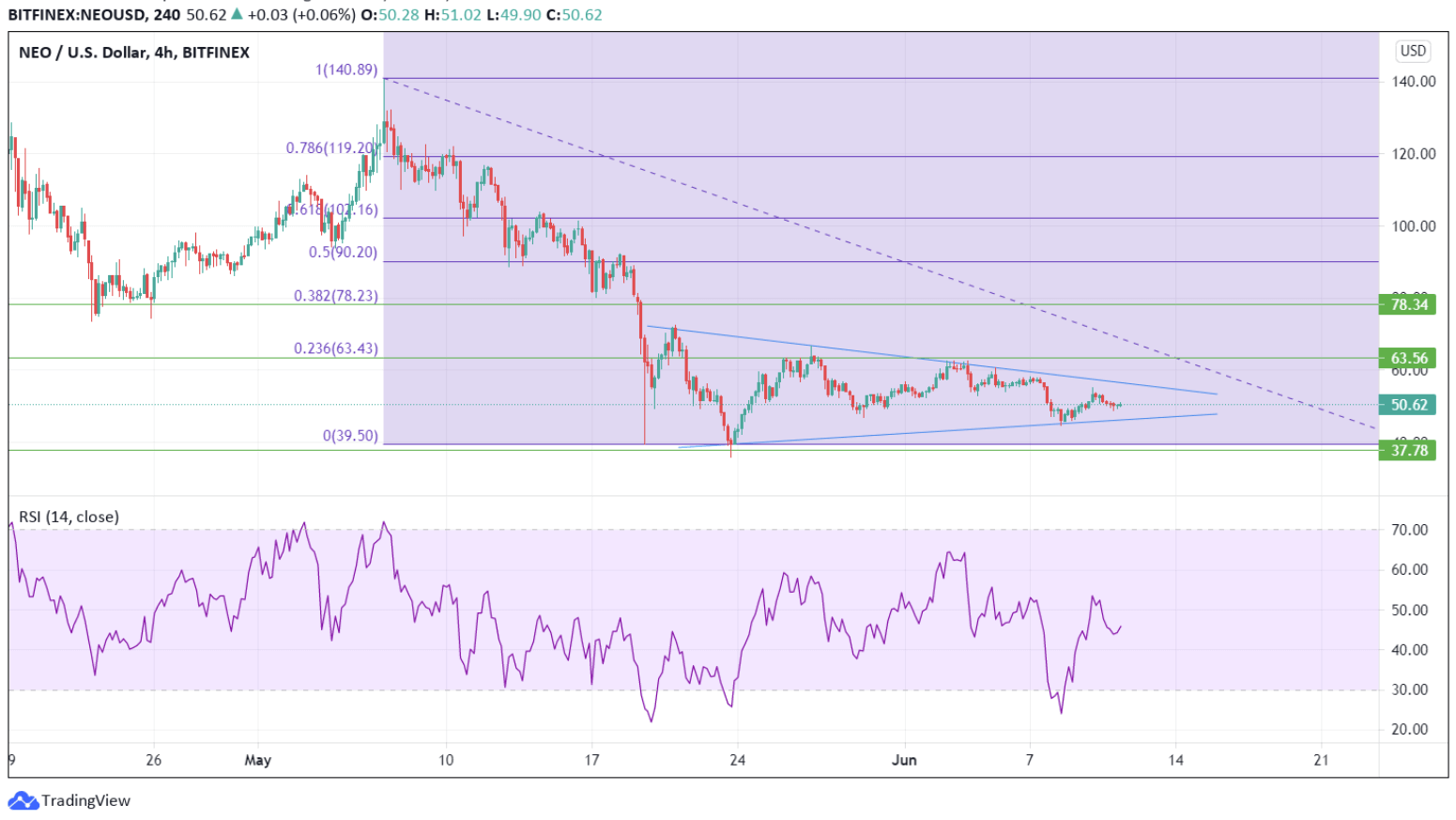

Source: TradingView

The 4-hour chart shows NEO being squeezed between converging diagonal support and resistance lines. If market sentiment continues to improve, a bullish breakout could see NEO hit the Fibonacci targets of $64 and $78 by the month’s end. Alternatively, a downside move would meet fairly staunch resistance just below $40.

Despite Ethereum boasting greater market control and a larger developer community, the recent NEO upgrade and the network’s ambitions in the DeFi and NFT spaces are a direct challenge to Ethereum. If NEO 3.0 is a success and manages to convince developers and investors to shift to NEO, prices higher than the ones forecasted above is also possible.

Please note, the details provided above are entirely a personal opinion of the writer, derived from the relevant market data. None of these are meant to be taken as direct investment advice.

The post NEO Price Prediction for June 2021 appeared first on Coin Journal.