Neo price was trading more than 1,500% up when it touched intraday highs of $133

Neo (NEO) price has gained more than 40% in 24 hours to see it trade at its highest level since February 2018. In reaching intraday highs of $133, Neo’s value against the US dollar was a mouth-watering 1,534% up since mid-April 2020.

Selling has seen the coin pare some of its gains to trade around $115 as of writing. Despite this, Neo’s price remains nearly 90% up over the week and about 500% higher year to date.

What contributed to Neo’s price gains?

Neo has been in an uptrend for much of the past year thanks to strong demand as it moves towards a network upgrade. The blockchain network is also one of the few open-source projects that enjoys massive support in China; with the latest upside coming on the back of reports that China had given a nod to Bitcoin and other cryptocurrencies as investment tools.

Apart from Neo (NEO), another cryptocurrency that has gained from the news is VeChain (VET). The 13th ranked VET has soared 17% in the past 24 hours to trade above $0.25.

Neo price analysis

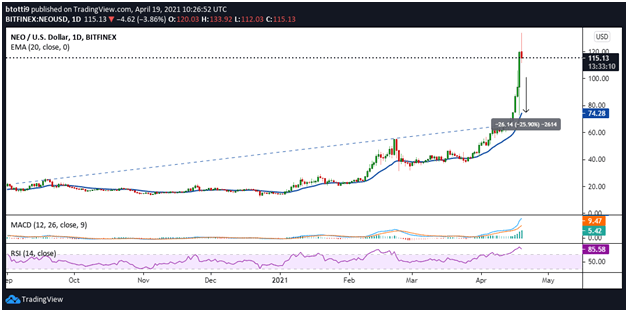

NEO/USD has been in parabolic mode since breaching resistance at $68 on 14 April. After forming a cup and handle pattern, Neo broke upward and posted five consecutive green candles through to 18 April. The daily chart shows bulls managed to buy the sell-off, although bears still hover around as indicated by the red candlestick.

While the MACD is increasing in the bullish zone, the daily RSI has begun to flip downwards. Sustained profit booking might see sellers take advantage and seek to push prices lower. This scenario puts the immediate target at $100, while 25% pullback points to the 20-day EMA ($74).

However, as the overall picture remains bullish for NEO/USD, another leg up is likely. If this happens, it is possible bulls could target a retest of $133 before pushing for short-term goals of $150-$180.

The post NEO price analysis: What’s next after massive surge to $133? appeared first on Coin Journal.