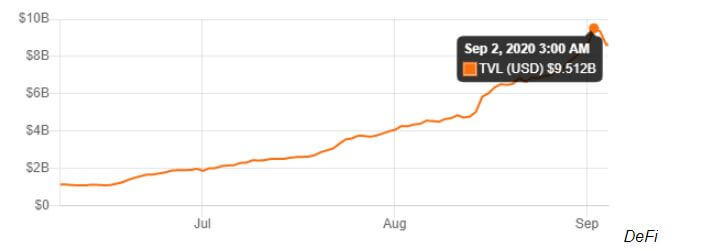

Value locked in DeFi smart contracts is now around $8.6 billion, down from $9.5 billion on September 2.

Early this week, the total value locked in decentralized finance smart contracts peaked at an all-time high of $9.51 billion.

With yield farming on the upside, the value locked in DeFi protocols had surpassed the $9 billion mark on September 2, largely driven by increased liquidity from centralized exchanges and the monstrous rally in unaudited protocol Sushiswap.

However, the last 24 hours have seen a meltdown in the cryptocurrency market to contribute to the massive decline in the metric.

According to data from DeFi tracking platform DeFi Pulse, the TVL (USD) now stands at around $8.6 billion. It means that the last 24 hours have seen more than $900 million in total value locked wiped off the space.

Uniswap accounts for the most value locked in protocols at $1.68 billion, while stablecoin mint protocol Maker is second with about $1.47 billion in locked value. Aave now accounts for $1.38 billion and Curve Finance has over $1.17 billion worth of assets locked.

But the four leading DeFi protocols have all seen a dip in the TVL metric, with 6.38%, 7.01% and 7.2% for the top three respectively. Curve Finance has the least decline percentage among the four at 0.76% as of writing.

Decentralized finance tokens have seen massive rallies over the year, with listings on platforms like Coinbase, Binance and OKEx contributing to the spike from $500 million in TVL early this year to over $9.5 billion this week.

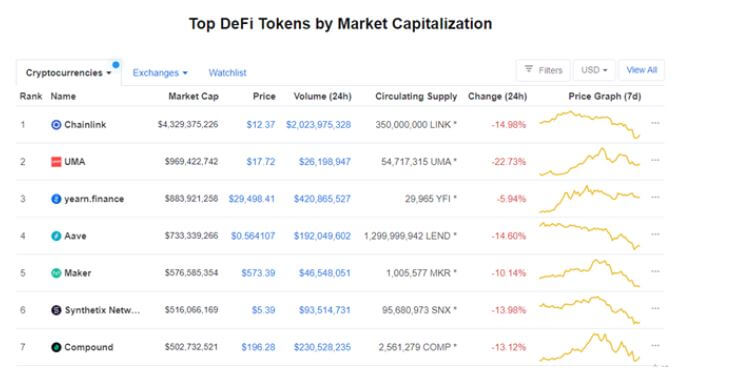

According to CoinMarketCap, all the top 7 DeFi tokens by market cap have traded -5.9% to -23% in the past 24 hours.

ChainLink has dropped 14.98% as of writing to trade around $12.37 and UMA is changing hands nearly 23% lower at $17.72. The rest of the top 7 are Aave (-14.60%), yearn.finance (-5.94%), Maker (-10.14%), Synthetix Network (-13.98%) and Compound (-13.12%).

TRX/USD defies sell-off

It’s a bad week for Bitcoin that has seen its price drop from highs of $12,000 to lows of $10,000. The decline has also been registered in the altcoin market, with Ethereum sliding 12.6% from highs of $450 to around $375 and XRP losing about 8% to trade at $0.25.

But while the market bled on Wednesday and Thursday, TRON remained bullish to defy the overall rot.

The 11th-ranked cryptocurrency is the only one among the top 20 by market cap in the green over the past 24 hours.

TRX/USD is up 8.7% on the day and more than 74% in weekly gains. Early this week, TRON announced support for DeFi and its price jumped 23% to hit $0.037. As of writing, the TRX/USD pair is trading around $0.041.

The post Nearly $1B wiped off DeFi TVL amid crypto market sell-off appeared first on Coin Journal.