Whatever your feelings on initial exchange offerings (IEOs), there’s been no avoiding them this year. Nurtured under the wing of cryptocurrency exchanges before being unleashed onto liquid secondary markets, many tokens have mooned, while a few have fizzled out like damp squibs. To gauge the current market sentiment toward IEOs, news.Bitcoin.com has calculated the return on investment (ROI) for the first wave of initial exchange offerings.

Also read: How Traditional Stock Markets Can Help Mainstream Cryptocurrency

A Breakdown of 2019’s Leading IEOs

When it comes to fundraising, there’s only been one acronym on everyone’s lips this year and it hasn’t been “STO.” Rather, the cryptoconomy has fixated on the IEO, which has become the talk of Telegram trading groups, crypto Twitter, subreddits, image boards, and every other hub for digital asset discussion. As Priority Token’s Artur Boytsov points out, the first IEOs actually took place in 2017 with the likes of Bread and Gifto, but the trend didn’t really catch on until the beginning of 2019. He notes “at least 15 exchanges which have either started supporting IEOs or announced that they are developing an IEO concept.”

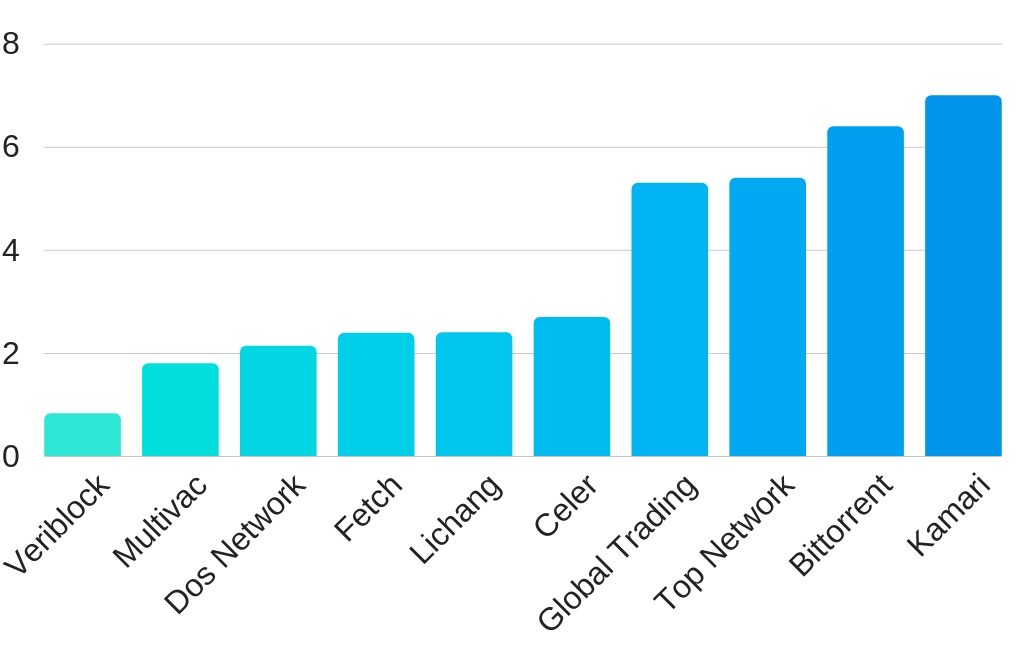

Platforms such as Binance, Kucoin, Huobi, and ZBG have become synonymous with hosting initial exchange offerings, though participating platforms are proliferating so fast it’s impossible to list them all. Having analyzed the performance of the first wave of IEOs, news.Bitcoin.com can provide detailed figures regarding the ROI and all-time high (ATH) of 10 of this year’s most popular initial exchange offerings. The results show significant variance between exchanges in terms of the profit realized by investors.

ZGB Launchpad and Binance Launchpad Lead the Charge

Because IEOs are still a relatively new phenomenon, the number of completed token sales per exchange is low. As a result, it is too early to draw any definitive conclusions, although two exchanges have established an early lead: ZGB and Binance boast the first and second most successful IEOs to date respectively, with the former also claiming the number four spot. At the time of publication, kamari (KAM), which was issued on ZGB Launchpad, has performed a 7x in USD terms, followed by Binance’s bittorrent (BTT) at 6.4x. In third place is the Huobi Prime-issued TOP (5.4x), followed by Global Trading System (5.3x), again on ZGB.

While the majority of these first-gen IEOs are currently in the green, some exchanges have gotten off to an inauspicious start. Bittrex International had to cancel its first IEO, for Raid, at the last minute after concerns emerged about the legitimacy of the project’s partnerships. Its second token sale, for Veriblock, sold out in just 10 seconds, but investors who managed to snap up VBK tokens have come to rue their seeming good fortune: it’s currently the only IEO profiled here to be underwater, with an ROI of just 0.83x. Be it through luck or judicious vetting of projects, some exchanges have produced a string of winners, while a handful have yet to strike gold.

What are your thoughts on initial exchange offerings? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

The post Moon Landing or Misfire? 2019’s Biggest Initial Exchange Offerings Analyzed appeared first on Bitcoin News.